Assessing IDEXX Laboratories (IDXX) Valuation After Its Strong Year-To-Date Share Price Surge

IDEXX Laboratories (IDXX) has quietly turned into one of the market’s steadier healthcare compounders, with the stock gaining about 64% over the past year as earnings and revenue continue to climb.

See our latest analysis for IDEXX Laboratories.

That strength has not come in a straight line, with the latest 7 day share price return of minus 5.15% and a relatively flat 30 day move, but the roughly 75% year to date share price return and strong multi year total shareholder returns suggest momentum is still very much intact.

If IDEXX’s run has you rethinking your watchlist, this is a good moment to explore other resilient healthcare stocks that might be setting up for their next leg higher.

With double digit profit growth but an already rich valuation and a share price hovering just below analyst targets, is IDEXX still trading below its true potential, or is the market already pricing in years of future expansion?

Most Popular Narrative Narrative: 5.4% Undervalued

With IDEXX Laboratories last closing at $714.10 against a narrative fair value near $755, the current share price implies a modest valuation gap that hinges on sustained growth and resilient margins.

Analysts expect earnings to reach $1.3 billion (and earnings per share of $16.93) by about September 2028, up from $985.7 million today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.5x on those 2028 earnings, down from 53.2x today.

Curious how mid single digit revenue growth expectations, rising margins and a still premium earnings multiple can all coexist in one story? Want to see which assumptions carry the most weight in that fair value, and how much future upside is riding on them? The full narrative lays out the blueprint.

Result: Fair Value of $754.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could easily crack if U.S. vet visit growth stays weak or if instrument placement momentum cools faster than expected.

Find out about the key risks to this IDEXX Laboratories narrative.

Another Way to Look at Value

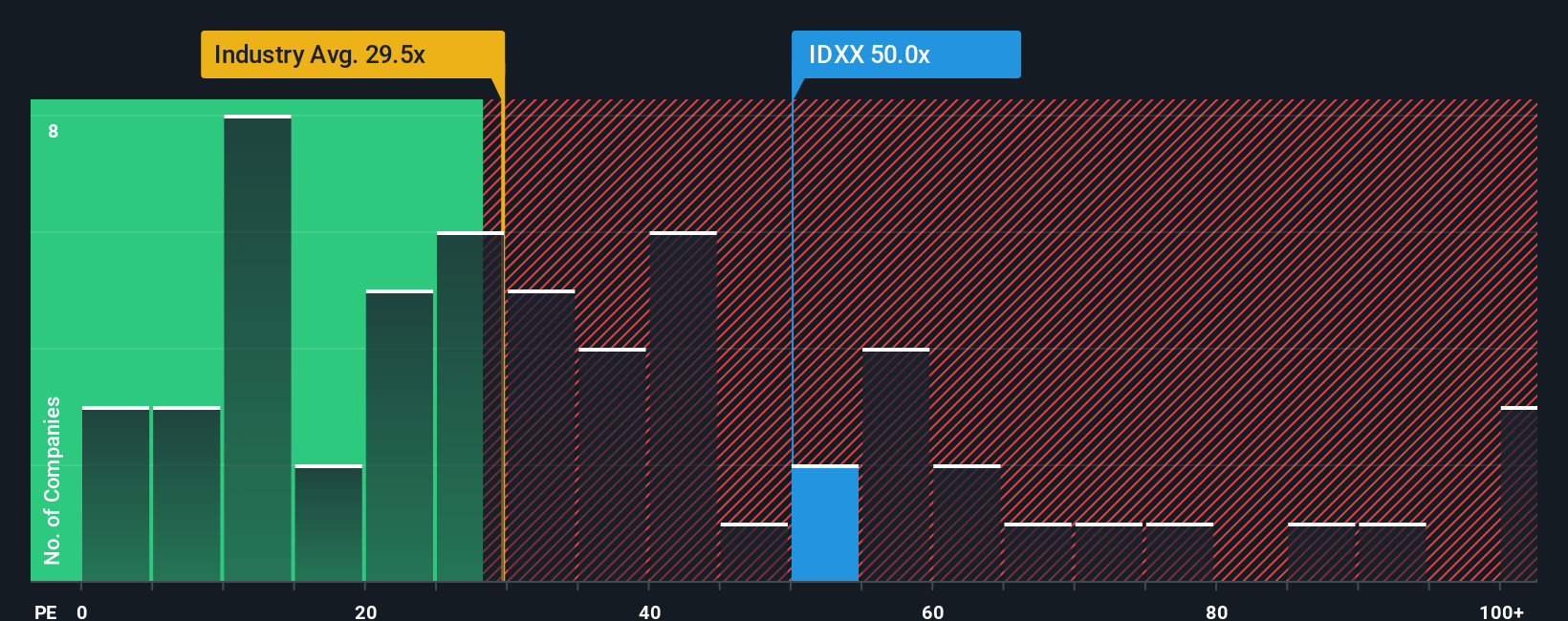

While the narrative model sees IDEXX as about 5% undervalued, a simple earnings comparison tells a very different story. The stock trades on a P/E of 55.5x versus 28.9x for the US medical equipment industry and a fair ratio near 31.7x, which implies meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDEXX Laboratories Narrative

If this view does not fully align with your own, or you prefer digging into the numbers yourself, you can craft a personalized narrative in just a few minutes, Do it your way.

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next smart idea?

Before you move on, lock in an edge by using the Simply Wall Street Screener to uncover targeted opportunities that most investors are still overlooking.

- Capture potential multi baggers early by scanning these 3576 penny stocks with strong financials that already show financial strength instead of speculation alone.

- Position yourself at the heart of the AI revolution by tracking these 26 AI penny stocks shaping everything from automation to intelligent software.

- Secure a growing income stream by focusing on these 15 dividend stocks with yields > 3% that can support compounding returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal