Is Masco Now a Value Opportunity After Recent Share Price Slide?

- Wondering if Masco is quietly turning into a value opportunity after a rough patch? This breakdown will help you decide whether the current price just looks cheap or truly is.

- Even though the stock is down about 11.8% year to date and roughly 20.5% over the last year, longer term holders are still sitting on gains of 35.4% over 3 years and 27.3% over 5 years, which hints that the recent weakness may be more of a reset than a collapse in the story.

- Recently, Masco has been in the spotlight as investors reassess housing and remodeling demand alongside shifting interest rate expectations, which directly shape sentiment toward building products names like this. There is also growing focus on how the company is positioning its portfolio and capital allocation to navigate a slower macro backdrop and still drive shareholder returns.

- On our framework, Masco scores a 4/6 valuation check rating, suggesting it looks undervalued on several key metrics. Next, we will walk through those different valuation approaches before ending with a more nuanced way to think about what the market might really be pricing in.

Find out why Masco's -20.5% return over the last year is lagging behind its peers.

Approach 1: Masco Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Masco is expected to generate in the future, then discounts those projections back into today’s dollars to estimate what the business is worth now.

Masco currently produces around $815 Million in free cash flow, and analyst forecasts plus Simply Wall St extrapolations suggest this could rise to roughly $1.11 Billion by 2035. In other words, the model assumes steady but not explosive growth in cash generation over the coming decade, using a 2 Stage Free Cash Flow to Equity framework that blends near term analyst estimates with longer term trend assumptions.

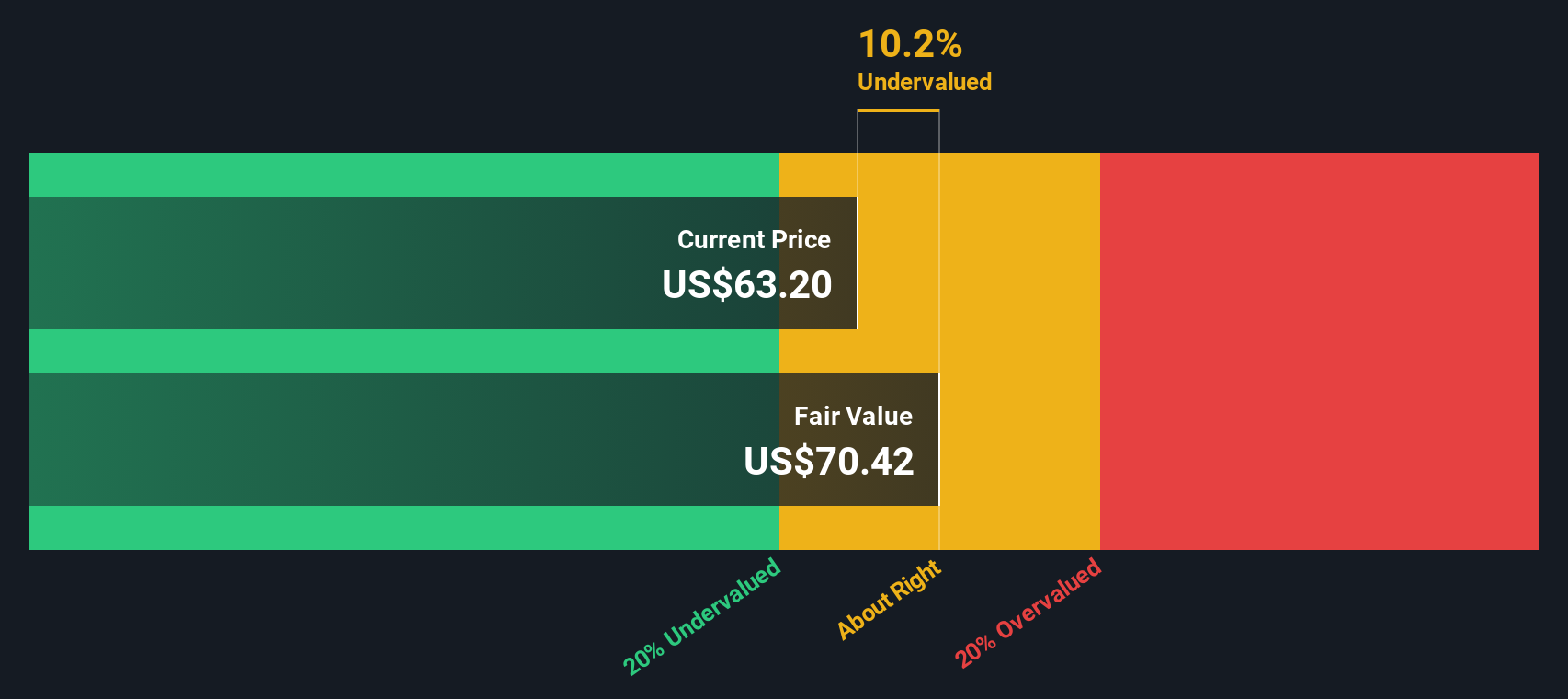

When those projected cash flows are discounted back, the intrinsic value comes out at about $70.57 per share. Compared with the current market price, this indicates the stock is trading at roughly a 10.4% discount, which suggests a modest but meaningful margin of safety for long term investors who are comfortable with the cash flow assumptions used in the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Masco is undervalued by 10.4%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Masco Price vs Earnings

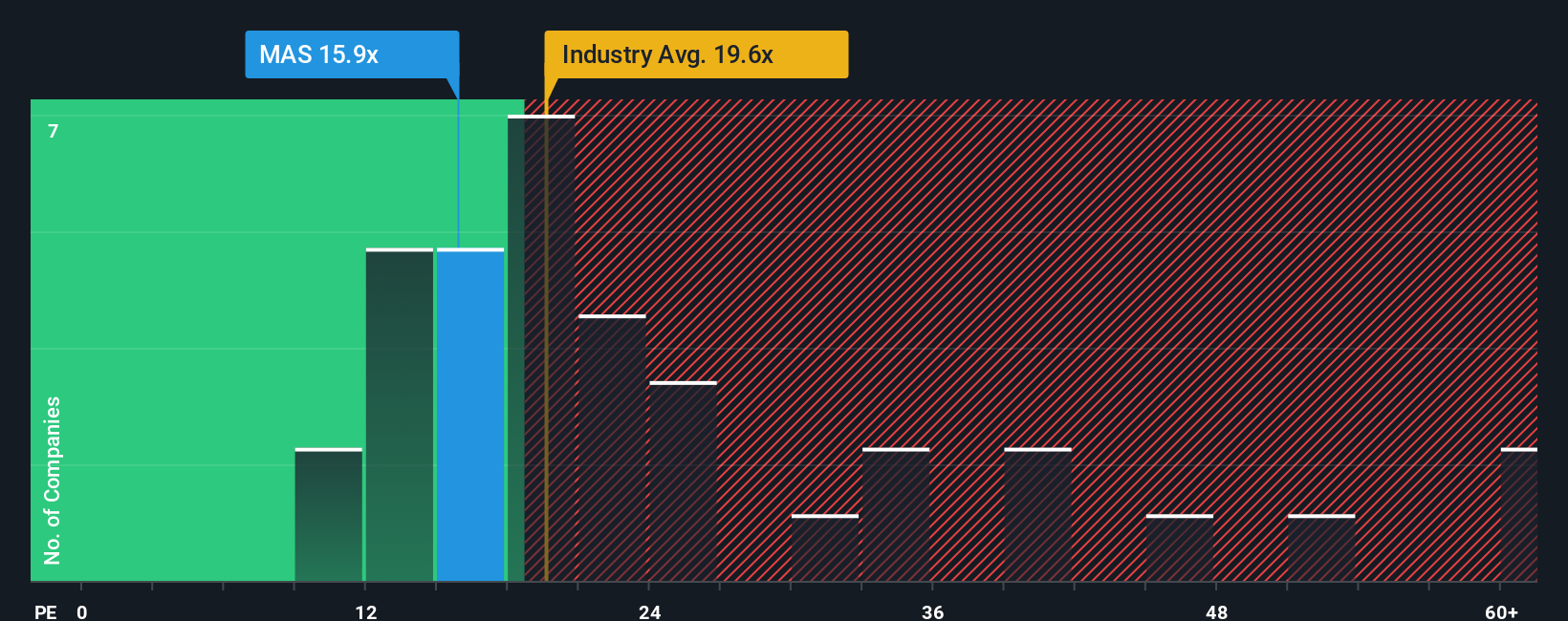

For established, profitable companies like Masco, the price to earnings ratio is a useful yardstick because it directly links what investors pay today to the profits the business is currently generating. In general, faster expected earnings growth and lower perceived risk justify a higher, or more generous, PE multiple, while slower growth or higher uncertainty usually pulls that “normal” range down.

Masco currently trades on about 15.9x earnings, which is below both the broader Building industry average of roughly 19.6x and the peer group average around 21.2x. Simply Wall St also calculates a proprietary Fair Ratio of 23.3x for Masco, which reflects what the PE might reasonably be given its earnings growth profile, margins, industry position, size and risk factors. This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for Masco specific fundamentals instead of assuming all Building names deserve the same multiple.

Set against that 23.3x Fair Ratio, Masco’s current 15.9x PE suggests the shares are trading at a noticeable discount to what its fundamentals might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

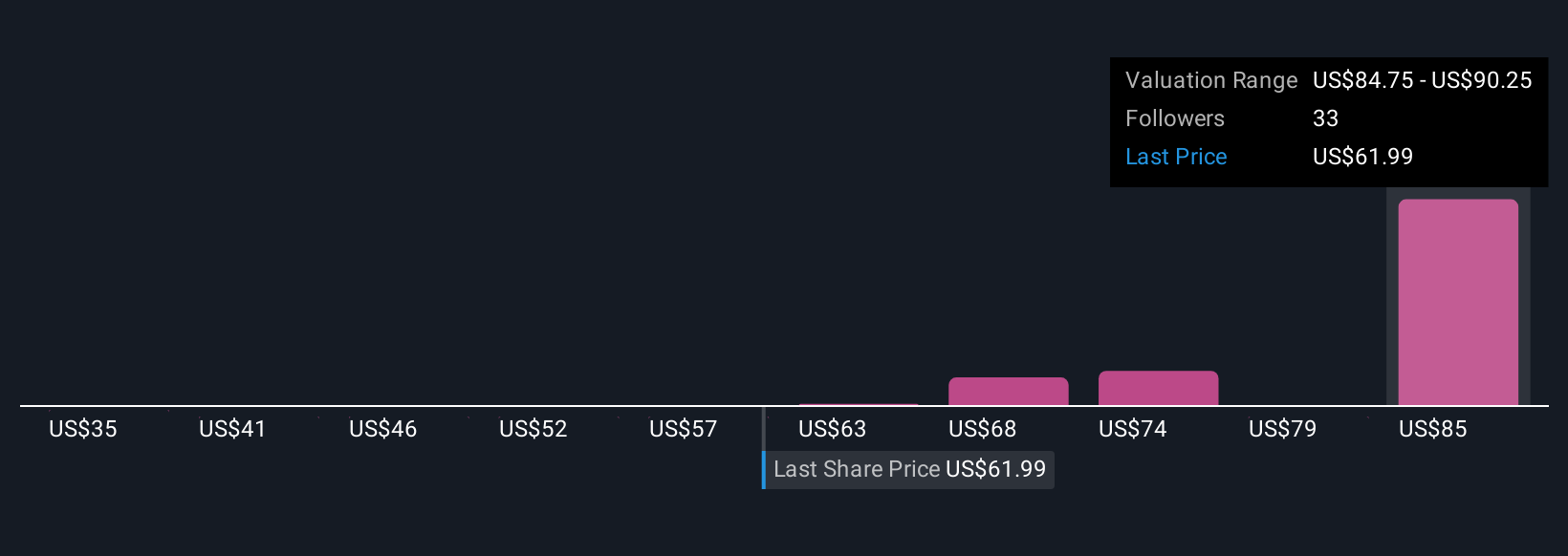

Upgrade Your Decision Making: Choose your Masco Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Masco’s story with the numbers behind it. A Narrative is your own explanation of what you think will drive Masco’s future, translated into assumptions about revenue growth, margins and earnings, which then roll up into a Fair Value estimate. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to link a company’s story to a forecast and then to a valuation, so they can compare that Fair Value against today’s share price and decide whether to buy, hold or sell. Narratives are updated dynamically as new earnings, news and guidance come in, so your view can evolve without rebuilding a model from scratch. For example, one Masco Narrative might lean into long term remodeling tailwinds and product innovation to arrive at a Fair Value near $90 per share, while another might stress affordability risks and competition to justify a Fair Value closer to $65 per share.

Do you think there's more to the story for Masco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal