Why Atlassian (TEAM) Is Up 6.6% After Listing Core Cloud Apps on AWS Marketplace

- In early December 2025, Atlassian Corporation announced that its core cloud apps, Jira, Confluence, and Jira Service Management, are now publicly listed on AWS Marketplace, enabling enterprises in more than 150 countries and over 15 currencies to procure and manage these tools directly through their AWS accounts.

- This expansion deepens Atlassian’s multi-year collaboration with AWS, aiming to speed up complex cloud migrations and unlock AI and security features that are only available in Atlassian Cloud for large, global customers.

- We’ll now examine how Atlassian’s AWS Marketplace listing, which streamlines enterprise cloud procurement, may influence the company’s existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Atlassian Investment Narrative Recap

To own Atlassian, you need to believe its move from Data Center to Cloud can translate a large, sticky user base into durable, higher quality subscription revenue, while AI features deepen usage. The AWS Marketplace listing supports this by simplifying procurement for complex enterprises, but does not remove the execution risk around large, late-stage migrations or the market’s concern about how quickly new AI capabilities can translate into earnings growth.

The AWS news also sits alongside Atlassian’s ongoing share repurchase program of up to US$2,500 million of Class A stock, which has already retired more than 5.2 million shares. While buybacks can support per-share metrics, the more immediate fundamental catalyst still depends on whether cloud momentum, helped by AWS Marketplace distribution, can offset concerns about slower free cash flow conversion during the migration phase.

Yet while cloud distribution keeps improving, investors should also be aware that the toughest, most complex enterprise migrations are still ahead and...

Read the full narrative on Atlassian (it's free!)

Atlassian's narrative projects $8.7 billion revenue and $310.2 million earnings by 2028. This requires 18.7% yearly revenue growth and a $566.9 million earnings increase from -$256.7 million today.

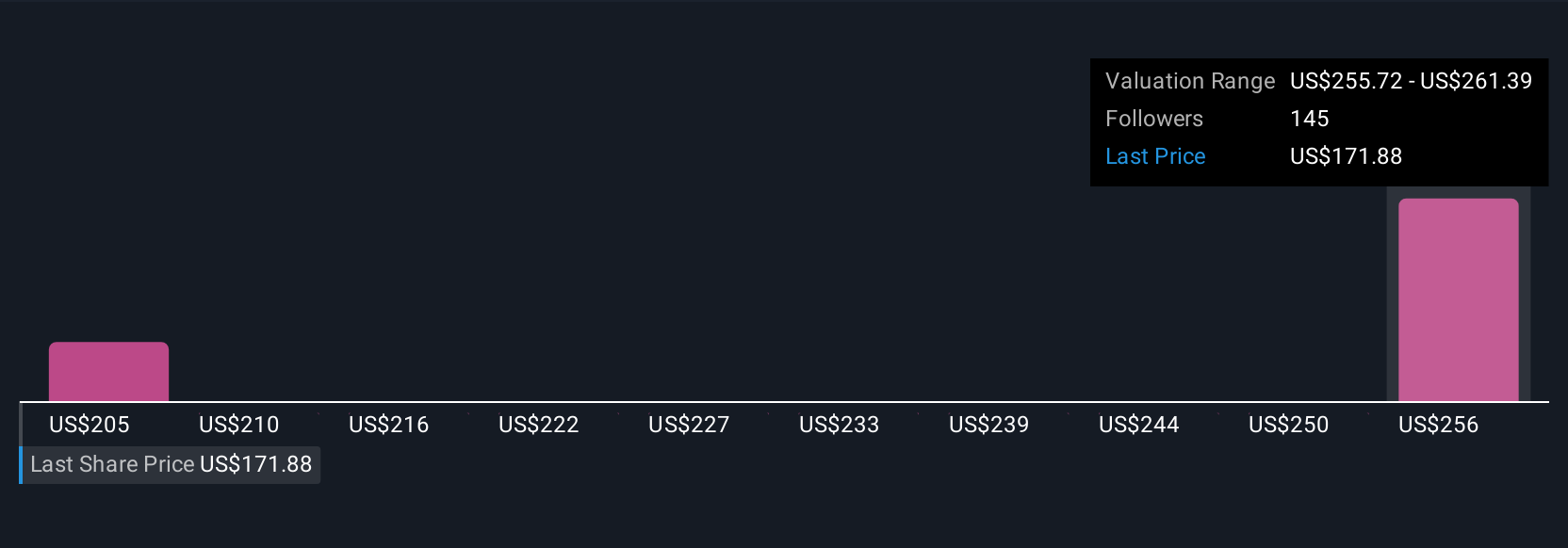

Uncover how Atlassian's forecasts yield a $245.24 fair value, a 54% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently estimate Atlassian’s fair value in a tight US$201 to US$247 range, reflecting varied expectations. You can weigh those against the AWS-driven cloud catalyst, which could affect how quickly enterprise migrations translate into the earnings progress many shareholders are watching.

Explore 7 other fair value estimates on Atlassian - why the stock might be worth just $201.40!

Build Your Own Atlassian Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlassian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atlassian research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlassian's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal