Does Star Bulk Carriers’ (SBLK) Ongoing Buyback Activity Reveal a Deeper Capital Allocation Play?

- From August 6 to October 31, 2025, Star Bulk Carriers completed a share repurchase of 462,476 shares, about 0.4% of its stock, for US$8.6 million under its previously announced buyback program.

- This latest tranche underlines management’s continued use of buybacks alongside dividends and debt reduction to reshape the capital structure and support per-share metrics.

- Next, we’ll examine how this completed buyback tranche fits into Star Bulk’s broader investment narrative around capital allocation and earnings power.

Find companies with promising cash flow potential yet trading below their fair value.

Star Bulk Carriers Investment Narrative Recap

To own Star Bulk Carriers, you need to believe that tight vessel supply and disciplined capital allocation can offset choppy dry bulk demand and earnings volatility. The latest US$8.6 million buyback tranche is small in scale and does not materially change the near term earnings recovery story or key risk around weak trade growth and freight rate sensitivity.

The recent dividend increase to US$0.11 per share is the clearest parallel to the buyback, as both illustrate how Star Bulk is returning cash while also reshaping its capital structure. Together with the ongoing repurchase program, these moves sit alongside lower leverage as potential supports for per share outcomes if the freight market cooperates.

Yet while capital returns are appealing, investors should also be aware of the pressure that a nearly flat dry bulk trade outlook could place on...

Read the full narrative on Star Bulk Carriers (it's free!)

Star Bulk Carriers' narrative projects $1.0 billion revenue and $521.3 million earnings by 2028. This implies revenue declining by 3.8% per year and an earnings increase of about $397 million from $124.2 million today.

Uncover how Star Bulk Carriers' forecasts yield a $22.78 fair value, a 11% upside to its current price.

Exploring Other Perspectives

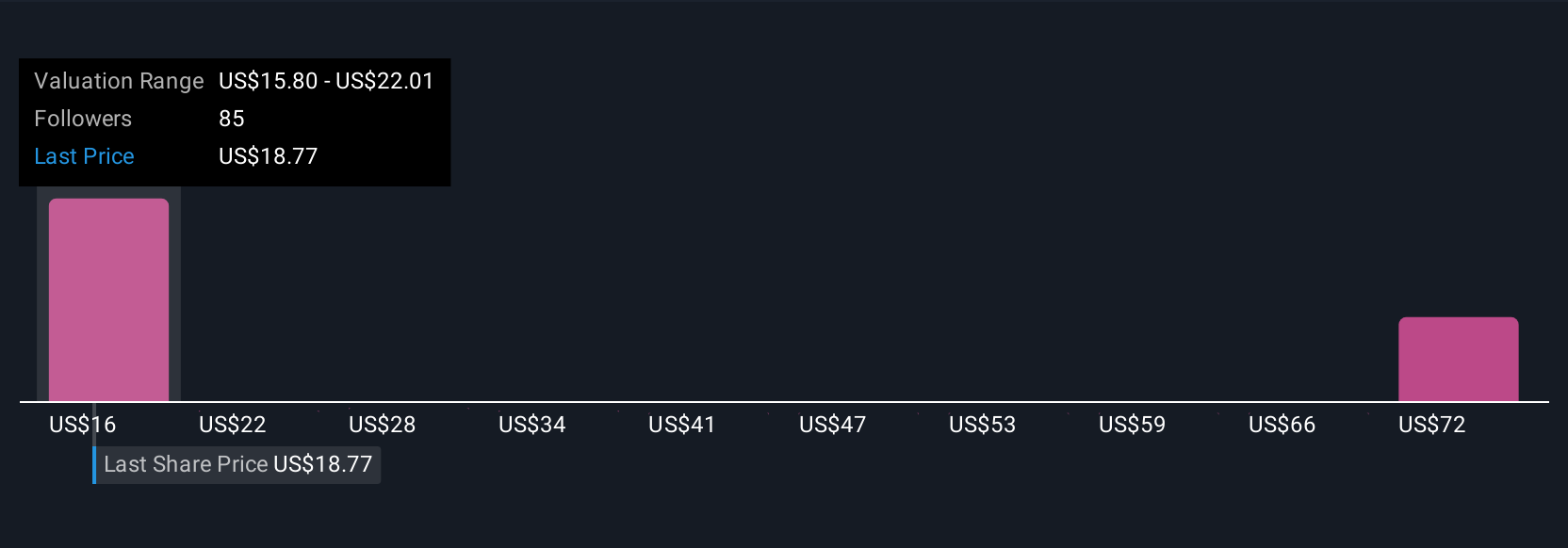

Eight fair value estimates from the Simply Wall St Community span roughly US$22 to US$111.57, so you are seeing very different views of upside. Against that wide range, the risk of structurally weak dry bulk trade growth could be a critical swing factor for Star Bulk’s longer term cash generation.

Explore 8 other fair value estimates on Star Bulk Carriers - why the stock might be worth just $22.00!

Build Your Own Star Bulk Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Star Bulk Carriers research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Star Bulk Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Star Bulk Carriers' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal