Reassessing Dana (DAN) After an 86% Year-to-Date Surge: Is the Valuation Getting Ahead of Earnings?

Dana (DAN) has quietly turned into a strong performer this year, with the stock up roughly 86% year to date despite softer annual revenue, as improving profitability reshapes how investors are valuing the business.

See our latest analysis for Dana.

That surge has come with some bumps, and the latest 1 day and 7 day share price returns of negative 4.15% and negative 6.29% suggest a breather after big gains. At the same time, a 72.72% 1 year total shareholder return still points to strong, improving sentiment around Dana’s earnings power.

If Dana’s rebound has you rethinking the auto space, it could be worth scanning other auto manufacturers that are showing similar shifts in growth and profitability expectations.

With Dana’s shares already up sharply and trading about 24% below the average analyst target but near some estimates of intrinsic value, the key question is whether this rally still leaves upside or if future growth is fully priced in.

Most Popular Narrative: 19.7% Undervalued

With Dana last closing at $21 and the most followed narrative pointing to fair value near $26, the current gap centers on future earnings power and capital returns.

The strategic redeployment of Off Highway sale proceeds to reduce leverage to <1x EBITDA and an accelerated, below intrinsic value share buyback (~25% reduction in share count), directly boost future earnings per share (EPS) and position Dana for stronger capital returns.

Curious how shrinking revenues and rising margins can still support a higher valuation? This narrative leans on bold EPS compounding and a future earnings multiple that looks more like a quality compounder than a cyclical auto name. Want to see how those moving pieces come together in the model?

Result: Fair Value of $26.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a few North American light vehicle customers and execution risk on deeper cost cuts could easily derail this optimistic earnings path.

Find out about the key risks to this Dana narrative.

Another View, Rich on Earnings

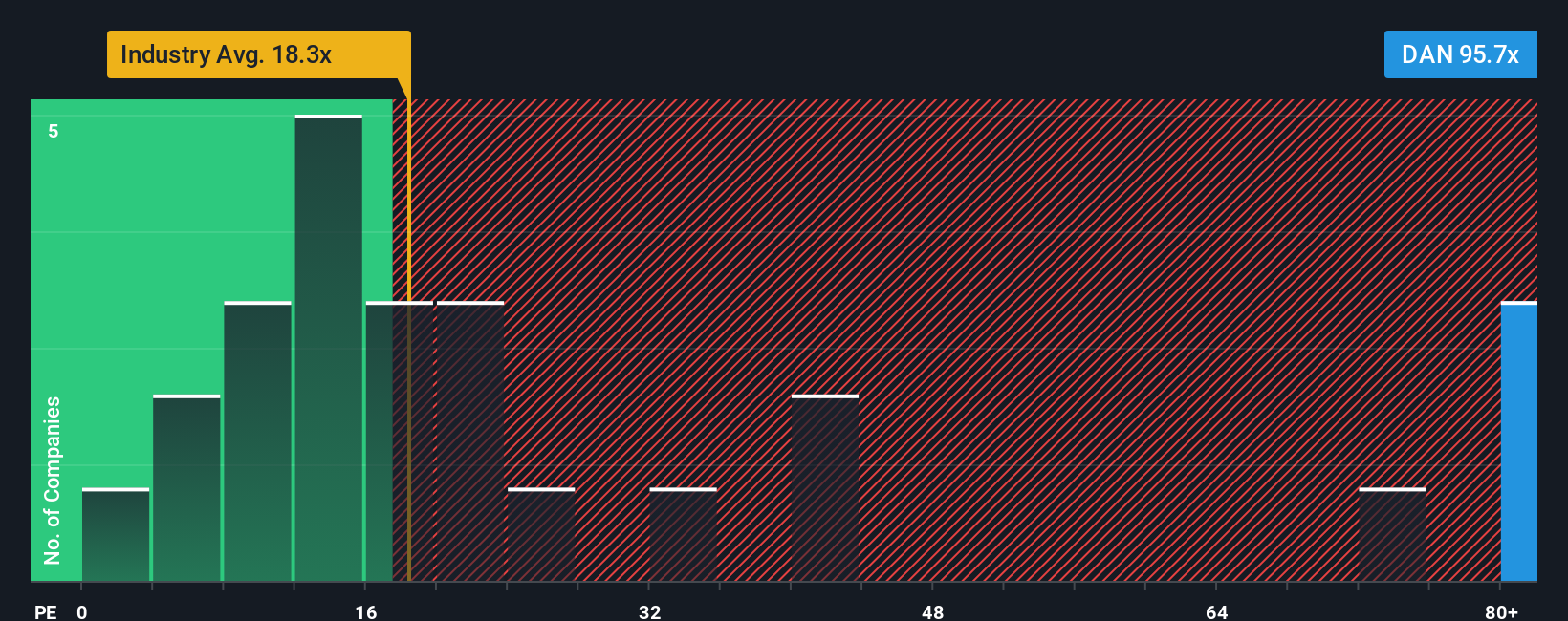

While the narrative suggests upside to $26, the current price near $21 already implies a steep 37.7x price to earnings ratio versus 18.8x for the US Auto Components industry and a 24.8x fair ratio. That premium signals valuation risk and not a clear bargain, if earnings stumble.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dana Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a full narrative in minutes: Do it your way.

A great starting point for your Dana research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener now to uncover fresh opportunities across sectors and themes, so you never feel stuck on a single stock story.

- Target steady income by reviewing these 15 dividend stocks with yields > 3% that can help anchor your portfolio with cash returns.

- Capitalize on cutting edge innovation by scanning these 26 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence.

- Strengthen your value strategy by focusing on these 906 undervalued stocks based on cash flows that may offer attractive upside based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal