Ubiquiti (UI) valuation check after board loss and temporary NYSE audit non‑compliance concerns

Board loss puts a spotlight on Ubiquiti governance

Ubiquiti (UI) is navigating a difficult moment after longtime director Ronald A. Sege passed away, leaving his Class II board seat vacant and temporarily shrinking the audit and governance framework he helped oversee.

See our latest analysis for Ubiquiti.

Despite the governance setback, investors have largely stayed focused on fundamentals, with a year to date share price return of 71.45% and a three year total shareholder return of 111.98%. This suggests longer term momentum remains intact even after a sharp 30 day pullback.

If this governance shake up has you rethinking concentration risk, it might be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

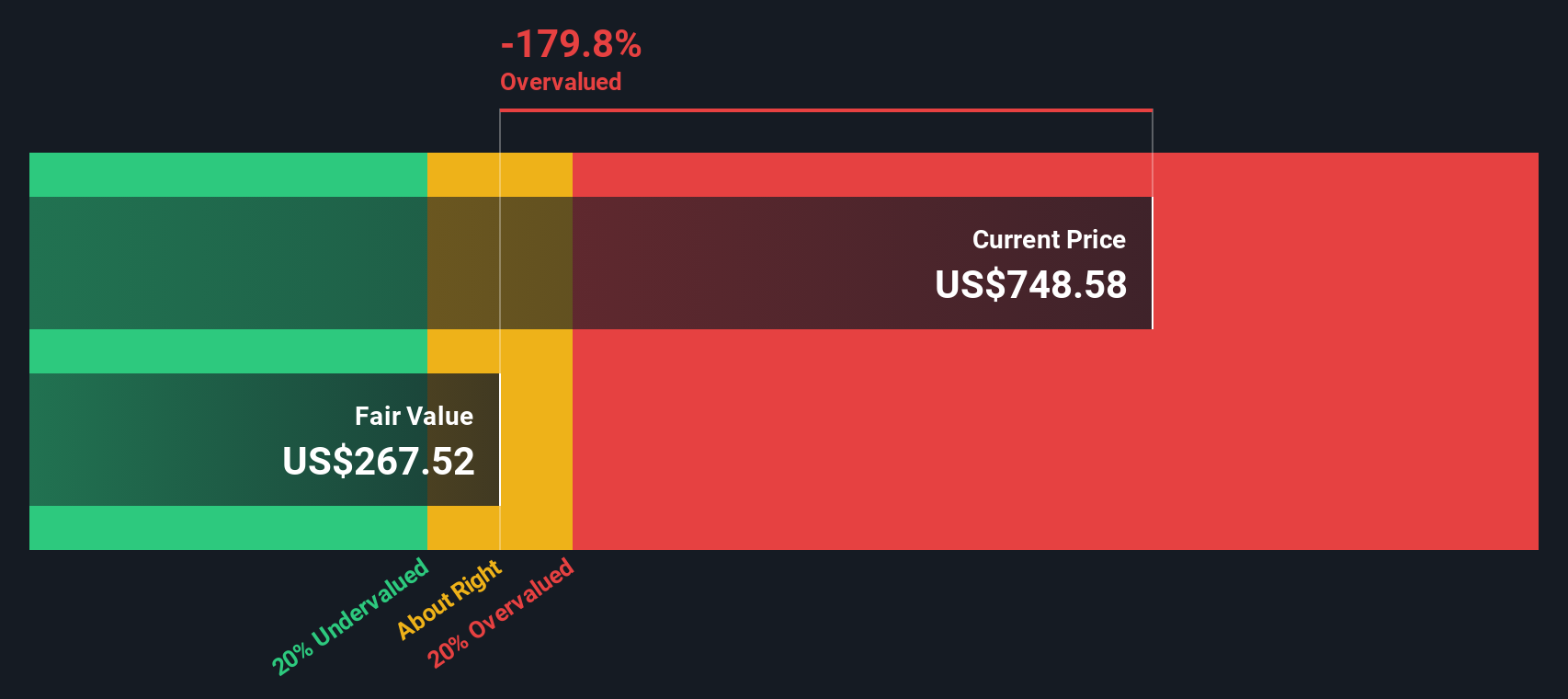

With revenue and earnings still growing double digits but the share price sitting just below analyst targets and trading at a slight premium to intrinsic value estimates, is Ubiquiti a buy today or already discounting future growth?

Price to earnings of 44.2x: Is it justified?

Ubiquiti’s current share price of $577.92 reflects a rich price to earnings multiple of 44.2 times, pointing to a clear valuation premium versus peers.

The price to earnings ratio compares what investors pay today to each dollar of current earnings, and is a key signal for profitable, mature tech and communications companies. At 44.2 times earnings, the market is effectively baking in robust profit durability and ongoing growth, not just a one off rebound.

However, that optimism goes well beyond both Ubiquiti’s own fair value signal and its broader sector yardsticks. The stock trades above the estimated fair price to earnings ratio of 35.9 times, a level the market could revert toward if expectations cool. It also sits meaningfully higher than the US communications industry average of 31.9 times and the peer group average of 32.1 times, underscoring how stretched the current pricing looks.

Explore the SWS fair ratio for Ubiquiti

Result: Price to earnings of 44.2x (OVERVALUED)

However, concentration in networking hardware and any slowdown in double digit growth could quickly challenge both the premium valuation and the recent share price momentum.

Find out about the key risks to this Ubiquiti narrative.

Another look at value

While the current price to earnings ratio paints Ubiquiti as expensive versus peers and its own fair ratio, our DCF model goes even further, suggesting fair value around $142.20, well below the $577.92 share price. If both signals are right, an important question is how long this premium can last.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ubiquiti for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ubiquiti Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Ubiquiti research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scouting a few more targeted opportunities that could balance Ubiquiti’s risk profile and sharpen your strategy.

- Explore early stage potential with these 3576 penny stocks with strong financials that pair low share prices with robust fundamentals and room for significant upside.

- Focus on powerful secular trends by targeting these 26 AI penny stocks positioned at the intersection of automation, data and scalable digital business models.

- Look for ways to turn volatility into opportunity by reviewing these 81 cryptocurrency and blockchain stocks that provide equity exposure to the infrastructure behind digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal