Hugo Boss (XTRA:BOSS) Is Down 7.4% After 2026 Reset Plan And Governance Scrutiny - Has The Bull Case Changed?

- In late November 2025, Hugo Boss unveiled its CLAIM 5 TOUCHDOWN overhaul, warning of a mid- to high-single-digit sales decline and EBIT of €300–€350 million in 2026 as it realigns brands, tightens distribution, and invests in growth areas like footwear, accessories, and a new dedicated womenswear unit from January 2026.

- At the same time, ownership and governance came into sharper focus, with Bank of America disclosing control of about 12.98% of voting rights and fresh criticism resurfacing over Hugo Boss’s under-integrated Nazi-era history, both raising questions about how the group balances financial ambition with accountability and corporate responsibility.

- We’ll now examine how this planned 2026 reset, especially the dedicated womenswear unit, could reshape Hugo Boss’s investment narrative through 2028.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Hugo Boss Investment Narrative Recap

To own Hugo Boss today, you need to believe CLAIM 5 TOUCHDOWN can turn a deliberate 2026 earnings dip into a healthier, more focused business by 2028, with womenswear, footwear, accessories and direct to consumer as core pillars. The near term catalyst is whether this reset stabilizes weakening demand in Europe and Asia without eroding brand equity, while the biggest risk now is that planned price discipline and store/channel pruning collide with already muted consumer sentiment.

The most relevant update is management’s guidance for 2026, with sales expected to fall mid to high single digits and EBIT guided to €300–€350 million as assortments and distribution are overhauled. This “reset year” directly tests one of the key bullish pillars for the stock: that investments in higher margin categories and digital channels can more than offset pressure from weaker store traffic and the drag from underperforming womenswear by 2027–2028.

Yet behind this reset, investors should be aware of questions around how Hugo Boss handles its historical legacy and what that could mean for...

Read the full narrative on Hugo Boss (it's free!)

Hugo Boss' narrative projects €4.6 billion revenue and €287.5 million earnings by 2028. This requires 2.8% yearly revenue growth and a €67 million earnings increase from €220.5 million today.

Uncover how Hugo Boss' forecasts yield a €40.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

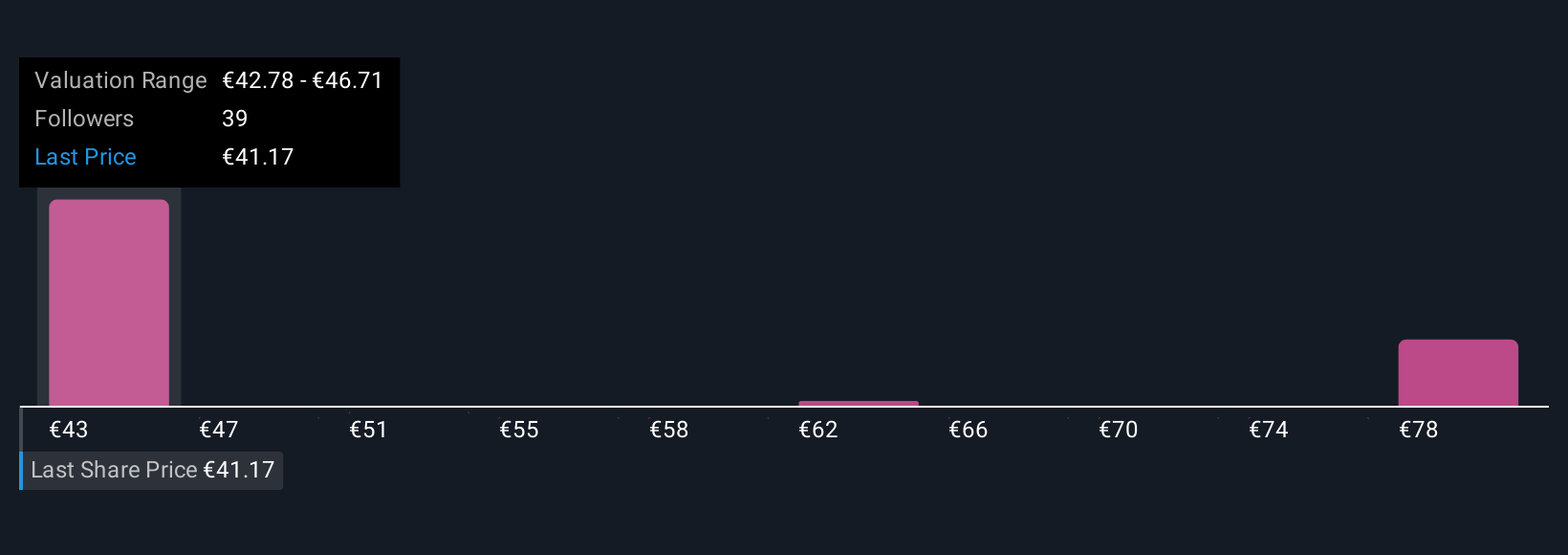

Four Simply Wall St Community valuations for Hugo Boss span roughly €40 to €70 per share, underlining how differently private investors see its potential. As you weigh those views, it is worth setting them against the company’s plan to accept a guided revenue and EBIT step down in 2026 in order to refocus brands, which could matter a lot for how quickly performance improves afterward.

Explore 4 other fair value estimates on Hugo Boss - why the stock might be worth as much as 98% more than the current price!

Build Your Own Hugo Boss Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hugo Boss research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hugo Boss research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hugo Boss' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal