Carrier Global (CARR): Evaluating Valuation After Dividend Hike, Buyback Launch and Confident HVAC Outlook

Carrier Global (CARR) just gave income focused investors something to consider: a higher quarterly dividend, supported by a new share buyback plan and confidence in its commercial HVAC business.

See our latest analysis for Carrier Global.

Despite the richer dividend and $5 billion buyback plan, Carrier Global’s recent share price return has been weak, with a 30 day share price return of minus 4.5 percent and a year to date share price return of minus 20.6 percent. However, the five year total shareholder return of 56.4 percent shows that long term holders have still been rewarded, suggesting short term momentum is fading even as management signals confidence in the business.

If Carrier’s mix of steady cash returns and cyclical exposure appeals to you, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

With earnings still growing, a richer dividend, and shares trading at a discount to analyst targets, is Carrier quietly setting up a value entry point, or is the market already discounting its next leg of growth?

Most Popular Narrative: 25.3% Undervalued

With Carrier Global’s shares last closing at $54.29 against a narrative fair value near the low $70s, the current price implies a substantial valuation gap.

The company's efforts in operational efficiency, such as using Carrier Excellence to enhance productivity and mitigate tariff impacts through cost containment and supply chain adjustments, are likely to support margin expansion and improved earnings per share.

Want to know what powers that higher fair value? The narrative focuses on accelerating earnings, expanding margins, and a future profit multiple that is typically associated with top-tier compounders. Curious which assumptions really move the needle? Click through to unpack the full storyline behind this valuation view.

Result: Fair Value of $72.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer U.S. HVAC demand and lingering tariff and cost pressures could easily delay the earnings inflection that underpins this undervalued narrative.

Find out about the key risks to this Carrier Global narrative.

Another Angle on Valuation

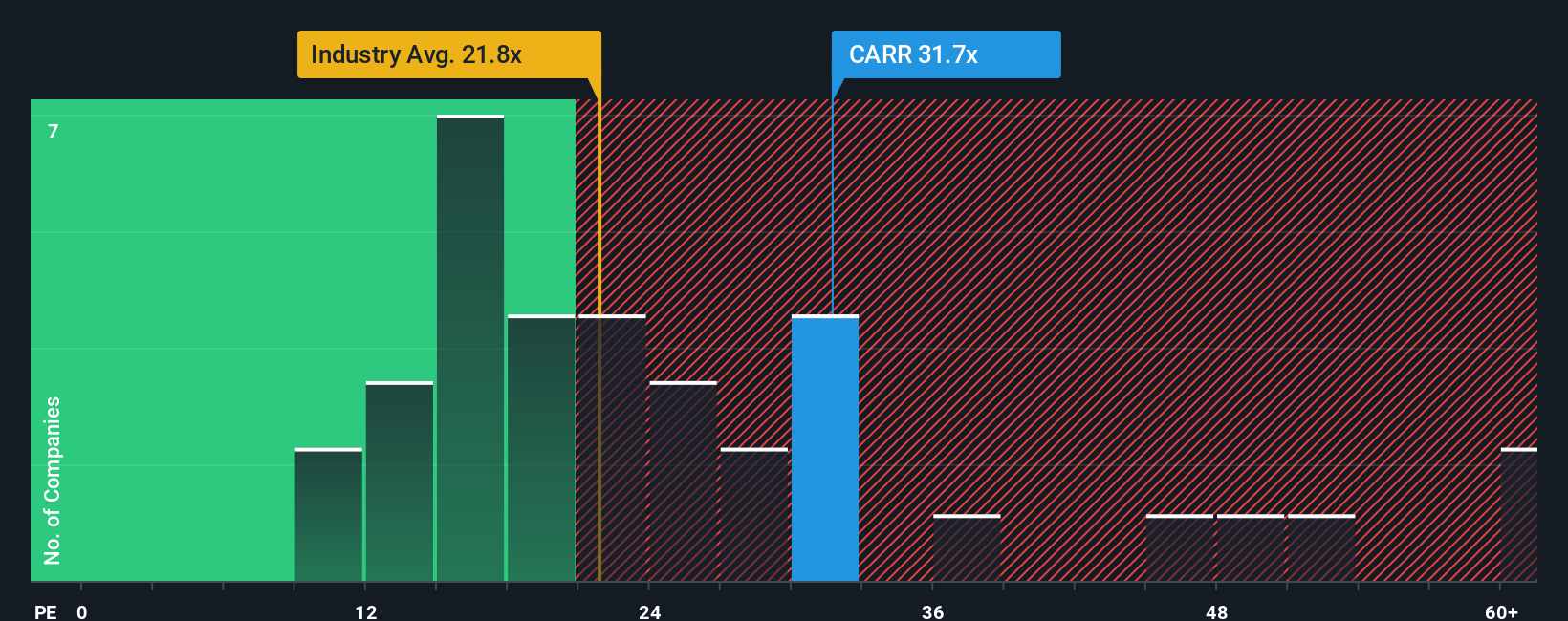

On earnings, Carrier Global does not look obviously cheap. Its price to earnings ratio around 33 times sits well above the US Building industry at 19.5 times and peers at 28.4 times, even though our fair ratio points higher at 38.8 times. Is the market overpaying for growth that has yet to show up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carrier Global Narrative

If you see the story differently, or simply prefer digging into the numbers yourself, you can craft a custom view in minutes: Do it your way

A great starting point for your Carrier Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You have already done the hard part by digging into Carrier. Now lock in the advantage by lining up your next set of potential winners with our screeners.

- Capitalize on mispriced opportunities by scanning these 906 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations.

- Ride powerful technology trends by targeting these 26 AI penny stocks positioned at the intersection of automation, data and intelligent software.

- Strengthen your income strategy by filtering for these 15 dividend stocks with yields > 3% that can potentially boost portfolio yield without sacrificing quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal