Should UAMY’s New Finance Chair and Defense-Focused Board Refresh Prompt a Rethink of Its Capital Strategy?

- On November 24, 2025, United States Antimony appointed veteran dealmaker Jon R. Marinelli to its expanded seven-member board and named him chair of a newly formed Finance Committee.

- His deep capital-markets background, including advisory work on more than US$285 billion of transactions, could be important as the company manages its new multiyear defense and industrial supply commitments.

- We’ll now examine how the Pentagon supply agreement and expanded industrial contracts may reshape United States Antimony’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

United States Antimony Investment Narrative Recap

To own United States Antimony today, you need to believe the company can convert its new Pentagon and industrial supply contracts into sustainable, profitable growth despite current losses and regulatory and supply-chain risks. Marinelli’s appointment and the new Finance Committee look most relevant to near term funding and execution of these commitments, but do not remove the key risk that heavy upfront investment and potential permitting delays could still leave the business with underutilized assets and volatile cash flows.

The five year, up to US$245 million Pentagon supply agreement sits at the center of this new phase, because it underpins US Antimony’s push to expand mining and processing capacity while justifying recent equity raises. In my view, this defense demand visibility is now one of the main catalysts for the stock, but it also raises the stakes if the company encounters permitting setbacks at its Alaska and Ontario projects or struggles to secure reliable ore supply at scale.

Yet for all this new contract momentum, investors still need to be aware of how permitting delays could...

Read the full narrative on United States Antimony (it's free!)

United States Antimony's narrative projects $208.1 million revenue and $82.5 million earnings by 2028. This requires 100.7% yearly revenue growth and an $83.4 million earnings increase from -$889.8 thousand today.

Uncover how United States Antimony's forecasts yield a $9.67 fair value, a 52% upside to its current price.

Exploring Other Perspectives

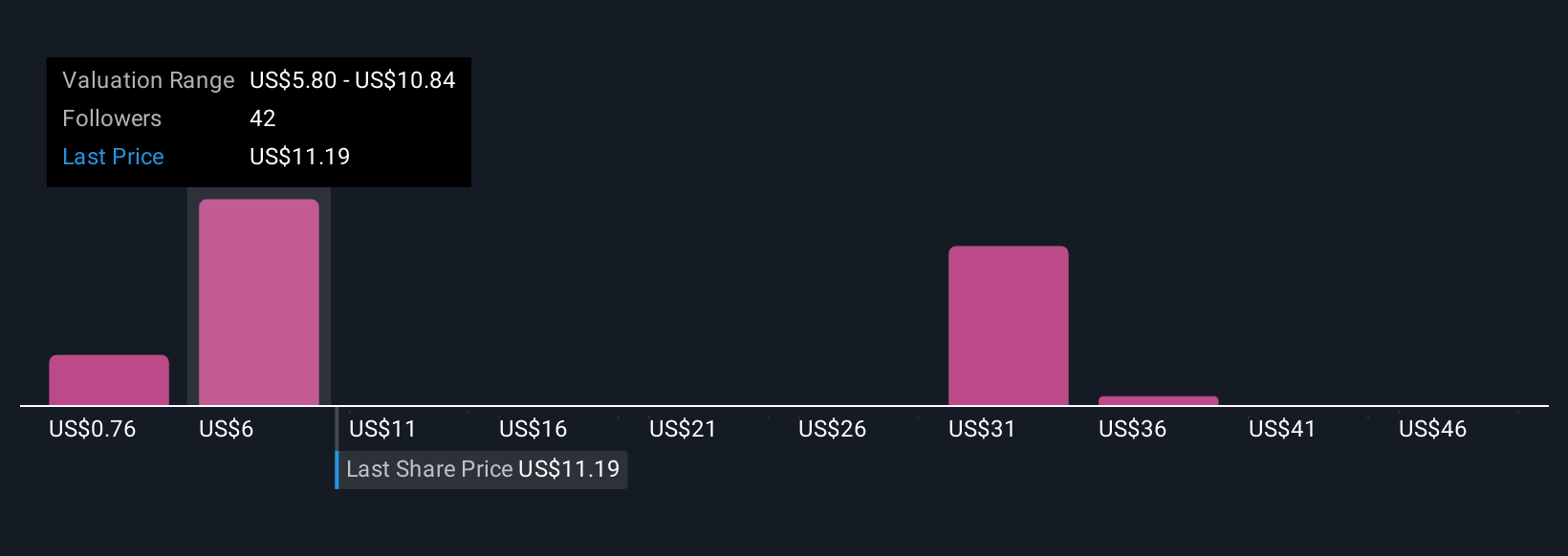

Nineteen members of the Simply Wall St Community value US Antimony between US$1.31 and US$41, underscoring how far apart individual views can be. Set those wide opinions against the company’s continued permitting and execution risks, and it becomes even more important to compare several perspectives before deciding how this growth story might play out.

Explore 19 other fair value estimates on United States Antimony - why the stock might be worth less than half the current price!

Build Your Own United States Antimony Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Antimony research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United States Antimony research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Antimony's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal