Should Li Auto’s Weaker Q4 Outlook and BEV Pivot Require Action From Li Auto (LI) Investors?

- Li Auto Inc. reported that it delivered 33,181 vehicles in November 2025, bringing cumulative deliveries to 1,495,969 as it works through a period of softer demand and rising costs.

- Amid its first quarterly loss in years and weaker fourth-quarter guidance, the company is pushing new BEV models, software upgrades, and AI accessories to revive growth and reposition its brand.

- We’ll now examine how Li Auto’s weaker fourth-quarter delivery outlook and renewed focus on technology and BEVs affects its broader investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Li Auto Investment Narrative Recap

To own Li Auto today, you need to believe its pivot toward BEVs, software, and AI can offset softer demand, higher costs, and intensifying EV competition. November’s 33,181 deliveries and sharply weaker Q4 guidance reinforce that the key near term catalyst is successful ramp up of new BEV models, while the biggest risk is profitability pressure from elevated R&D and capex if volumes do not recover. The latest numbers materially increase focus on execution quality in 2026.

The company’s Q4 2025 outlook, calling for a 37% to 30.7% year over year drop in deliveries and a 40.1% to 34.2% decline in revenue, is the clearest recent data point shaping this catalyst. It directly tests whether Li Auto’s heavy investment in AI, intelligent driving and new BEV launches can eventually support margins after the first quarterly loss in years, or whether rising competition and incentives keep squeezing returns.

Yet behind Li Auto’s technology story, investors should be aware that sustained negative free cash flow and large AI spending could still...

Read the full narrative on Li Auto (it's free!)

Li Auto's narrative projects CN¥232.1 billion revenue and CN¥15.2 billion earnings by 2028. This requires 17.4% yearly revenue growth and a CN¥7.1 billion earnings increase from CN¥8.1 billion today.

Uncover how Li Auto's forecasts yield a $28.09 fair value, a 58% upside to its current price.

Exploring Other Perspectives

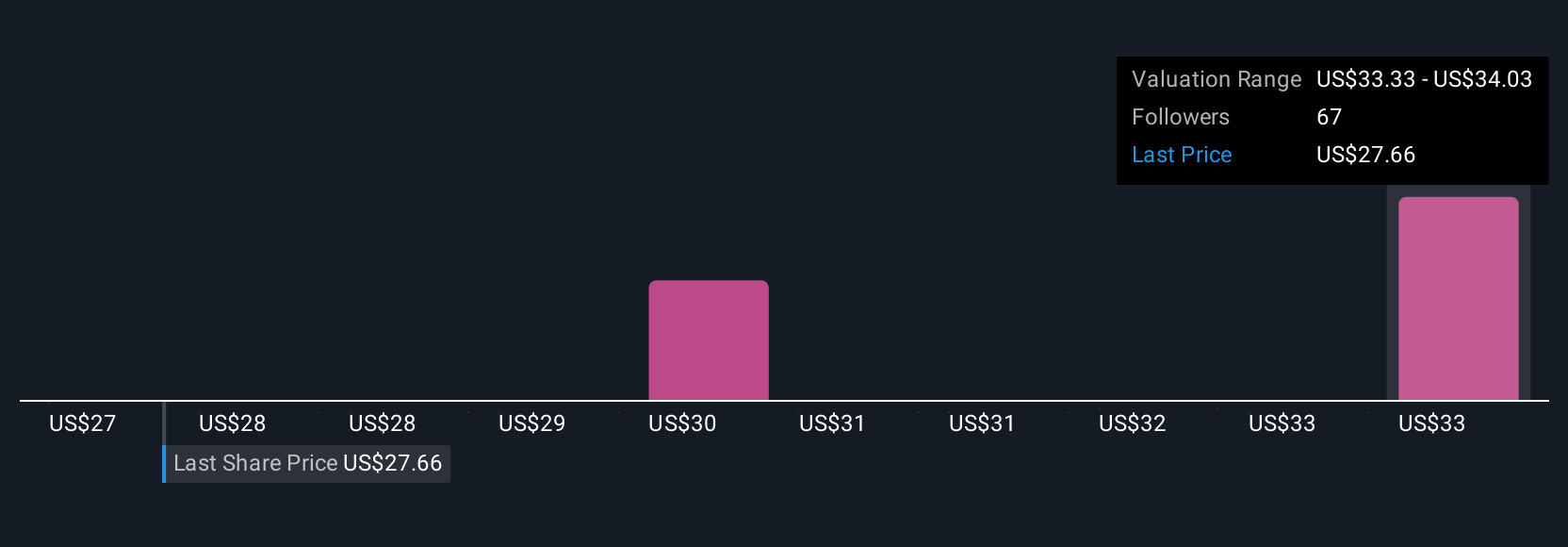

Five fair value estimates from the Simply Wall St Community span roughly US$24.68 to US$36.75 per share, reflecting wide disagreement on upside. Against this spread, Li Auto’s weaker Q4 delivery and revenue guidance raises fresh questions about how quickly its BEV and AI investments can translate into scale and more resilient profitability, so it is worth weighing several different views before deciding how the stock fits in your portfolio.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth over 2x more than the current price!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal