Does Uranium Energy (UEC) Earnings Timing Hint At Confidence In Its Uranium Expansion Strategy?

- Uranium Energy Corp recently announced it will release its fiscal 2026 first-quarter operating and financial results on December 10, 2025, followed by a conference call and webinar the same day.

- This update comes as the company advances in-situ recovery uranium projects in the U.S. and high-grade conventional assets in Canada, positioning its platform within the broader shift toward cleaner, secure energy.

- We’ll examine how the upcoming results release and progress at Christensen Ranch shape Uranium Energy’s investment narrative for uranium exposure.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Uranium Energy's Investment Narrative?

For Uranium Energy, the big-picture belief is that nuclear power will remain central to cleaner, secure energy, and that a U.S.-centric, in-situ recovery platform can translate that theme into cash flow over time. The upcoming fiscal 2026 first-quarter release on December 10 sits alongside several existing catalysts: the ramp-up at Christensen Ranch, the UF6/HALEU refining initiative, and the company’s ability to put its fully permitted capacity to work. Given the strong share price run this year and recent equity raises, the main questions are now about execution and capital discipline rather than balance sheet access. The new earnings date itself is not a material shift, but the market’s reaction to any update on production, costs and refinement plans could reset how investors weigh those upside drivers against persistent losses and dilution risk.

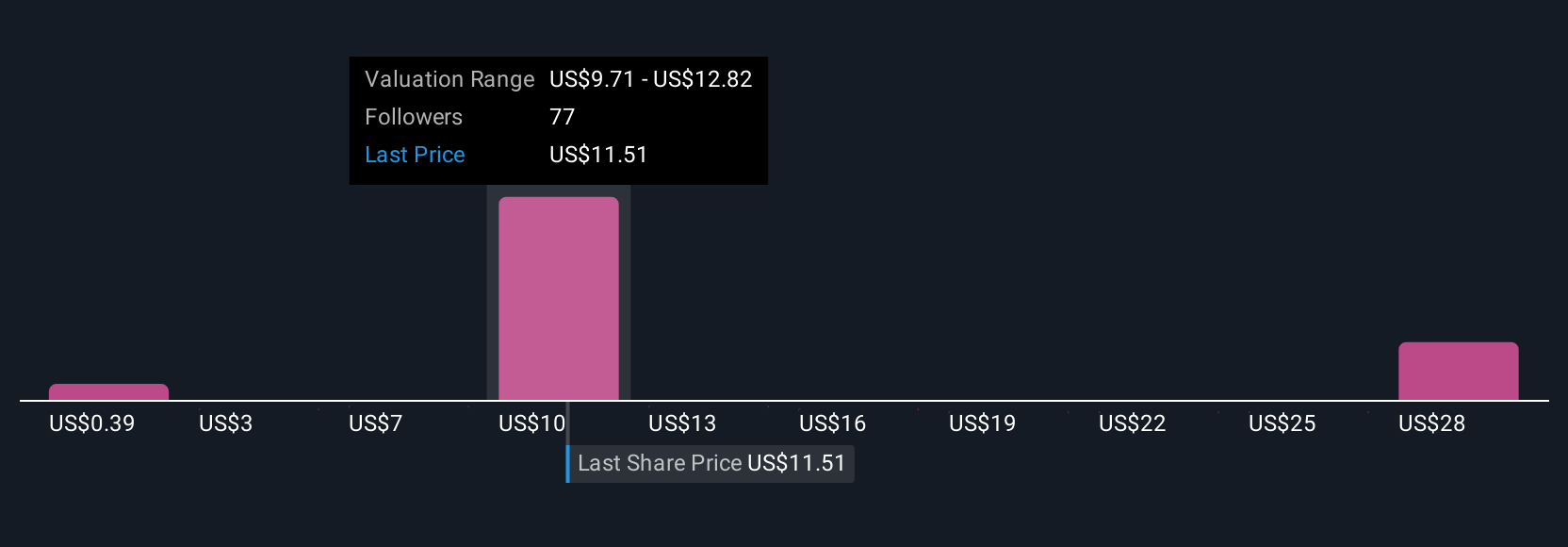

However, investors should be aware of how ongoing losses and equity issuance could affect future returns. Uranium Energy's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 28 other fair value estimates on Uranium Energy - why the stock might be worth as much as 21% more than the current price!

Build Your Own Uranium Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uranium Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Uranium Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uranium Energy's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal