How Investors Are Reacting To Prosperity Bancshares (PB) Earnings Beat And Insider Stock Sales

- Earlier this week, Prosperity Bancshares reported third-quarter 2025 earnings per share of US$1.45, an 8.2% year-over-year increase that exceeded expectations, while director Ned S. Holmes sold US$77,096 of company stock in several transactions.

- Beyond the insider sales, the earnings call highlighted management’s focus on growth initiatives and a constructive outlook, which has drawn renewed attention from analysts and investors.

- Now we’ll examine how Prosperity Bancshares’ better-than-expected quarterly results and confident outlook may influence its existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Prosperity Bancshares Investment Narrative Recap

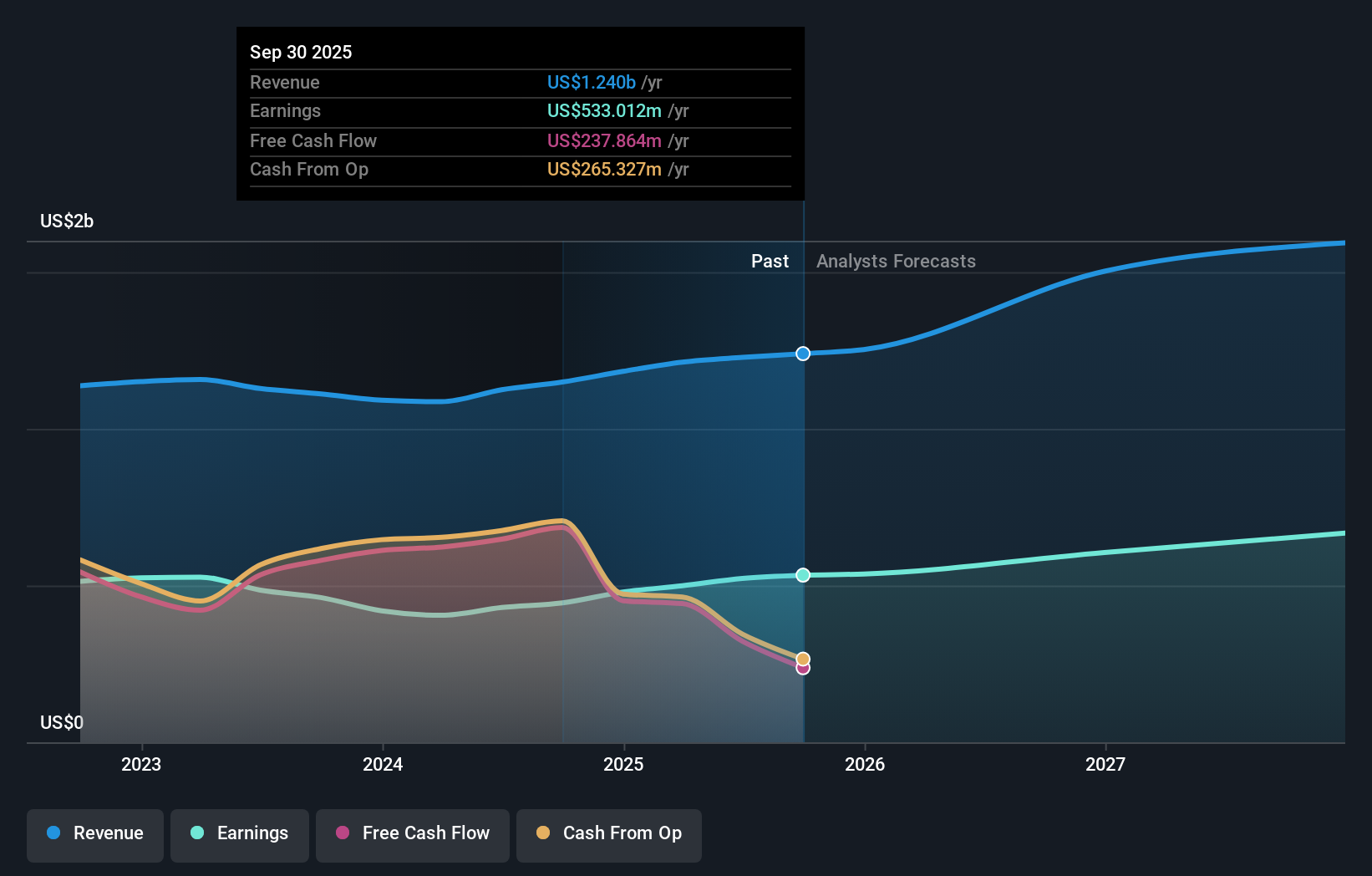

To own Prosperity Bancshares, you need to be comfortable with a regional bank that is leaning into growth while managing real credit and funding risks. The strong Q3 2025 beat and constructive outlook support the case for earnings resilience, but they do not fully resolve concerns around loan growth, deposit trends and asset quality, which remain the key near term catalyst and the most important risk.

The most relevant recent development is the Q3 2025 earnings release, where EPS rose 8.2% year over year to US$1.45, modestly ahead of expectations. Management used the call to reiterate growth initiatives and a positive stance despite pressure points in loan growth and nonperforming assets, tying the earnings surprise directly to the ongoing story of expanding in Texas markets and improving profitability.

Yet, even with improving earnings, investors should be aware that rising nonperforming assets could still...

Read the full narrative on Prosperity Bancshares (it's free!)

Prosperity Bancshares' narrative projects $1.7 billion revenue and $731.7 million earnings by 2028. This requires 11.0% yearly revenue growth and a roughly $209 million earnings increase from $522.7 million today.

Uncover how Prosperity Bancshares' forecasts yield a $78.47 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$70 to US$78 per share, underscoring how much private investors can disagree. Against that backdrop, recent concerns about rising nonperforming assets may carry very different weight for you depending on how you think they will influence Prosperity’s earnings resilience and growth potential over time.

Explore 2 other fair value estimates on Prosperity Bancshares - why the stock might be worth just $70.36!

Build Your Own Prosperity Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prosperity Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Prosperity Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prosperity Bancshares' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal