Is Serve Robotics (SERV) Quietly Building a Defensible Urban Delivery Network With Fort Lauderdale Expansion?

- Serve Robotics recently expanded its AI-powered sidewalk delivery service into Fort Lauderdale, building on its existing Miami operations and partnering with Uber Eats to offer autonomous restaurant deliveries in key neighborhoods like Downtown and Las Olas Boulevard.

- This move not only extends Serve’s South Florida footprint but also positions the company to benefit from policy momentum around U.S. robotics promotion and growing urban demand for sustainable last-mile delivery.

- With this expansion into Fort Lauderdale, we’ll explore how Serve Robotics’ role in autonomous urban delivery is shaping its broader investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Serve Robotics' Investment Narrative?

For Serve Robotics, you have to believe that autonomous delivery can evolve from pilot novelty to a scaled, everyday utility, and that Serve’s tight integrations with Uber Eats, DoorDash and national chains like Shake Shack and Little Caesars can translate into sustainable unit economics rather than just headline growth. The Fort Lauderdale launch fits squarely into the near term catalyst story: expanding the South Florida network, supporting the company’s goal of deploying 2,000 robots by year end, and reinforcing the policy tailwind from a federal push to promote robotics. At the same time, it does little to change the core risk profile: very small revenue base, heavy losses of over US$80,000,000, ongoing dilution, volatile share price and high expectations already reflected in a premium price to book. Short term, sentiment may improve more than fundamentals.

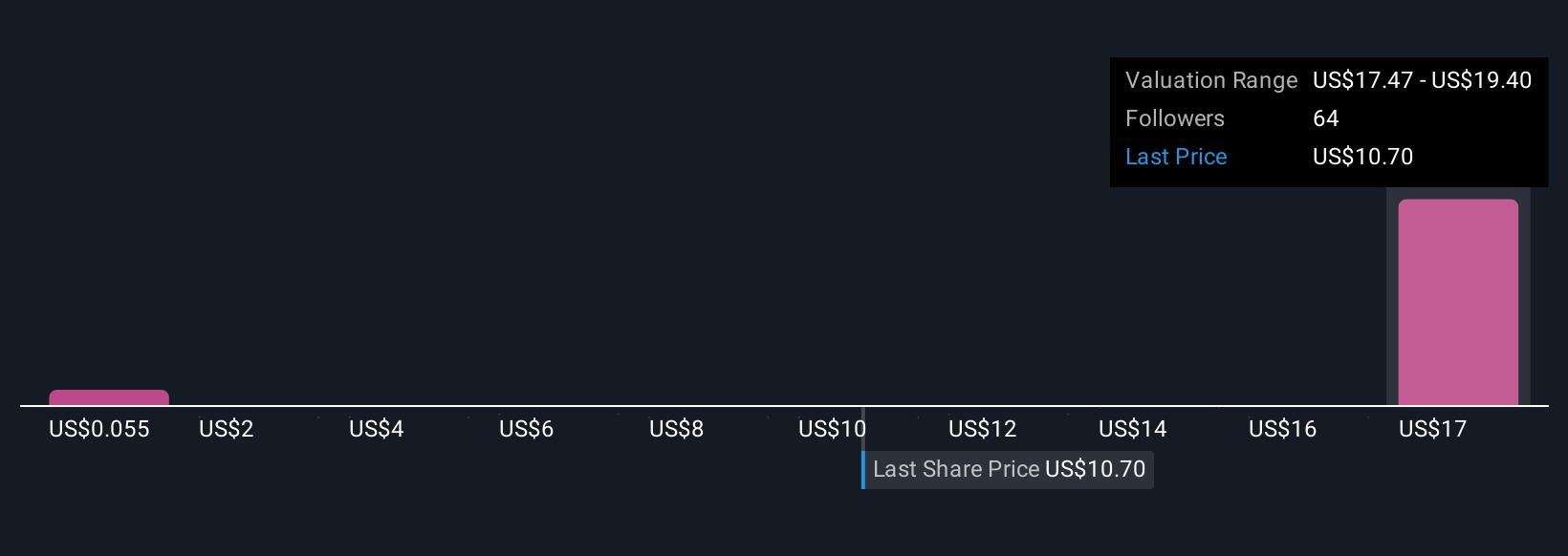

But behind the growth story sits a funding and dilution risk that investors should understand. The analysis detailed in our Serve Robotics valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 13 other fair value estimates on Serve Robotics - why the stock might be worth less than half the current price!

Build Your Own Serve Robotics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Serve Robotics research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Serve Robotics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Serve Robotics' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal