Will Cameco’s (TSX:CCO) Nuclear Platform Push at Resourcing Tomorrow Change Its Investment Narrative?

- Cameco Corporation recently presented at the Mines and Money @ Resourcing Tomorrow conference in London, with Global Managing Director Dominic Kieran outlining the company’s role across uranium supply, fuel services, and Westinghouse-linked technologies.

- This appearance highlighted how Cameco is increasingly positioned as a multi-layered nuclear energy supplier, tying together long-duration reactor demand, fuel security, and value-added services within one integrated platform.

- We’ll now explore how Cameco’s expanding role across uranium, fuel services, and Westinghouse exposure could reshape its existing investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cameco Investment Narrative Recap

To own Cameco, you need to believe nuclear power will remain central to long term energy plans and that utilities will keep prioritizing secure Western fuel supply. The London Mines and Money presentation reinforces Cameco’s role across uranium, fuel services and Westinghouse, but does not materially change the near term picture, where the key catalyst is renewed long term utility contracting and the biggest risk remains delays or cancellations in new reactor final investment decisions.

Among recent announcements, the 5 November 2025 update on uranium and fuel services production feels most relevant here, because it shows how Cameco’s integrated platform is already translating into multiple operating “legs.” While nine month uranium volumes were lower year over year, fuel services output edged higher, underlining how a broader nuclear services mix could help soften the impact of any timing-related swings in uranium demand or pricing as the contracting cycle evolves.

Yet even with this broader footprint, investors should be aware that project delays and slower reactor approvals could still...

Read the full narrative on Cameco (it's free!)

Cameco’s narrative projects CA$3.9 billion revenue and CA$1.2 billion earnings by 2028. This requires 2.6% yearly revenue growth and an earnings increase of about CA$666 million from CA$533.6 million today.

Uncover how Cameco's forecasts yield a CA$151.75 fair value, a 20% upside to its current price.

Exploring Other Perspectives

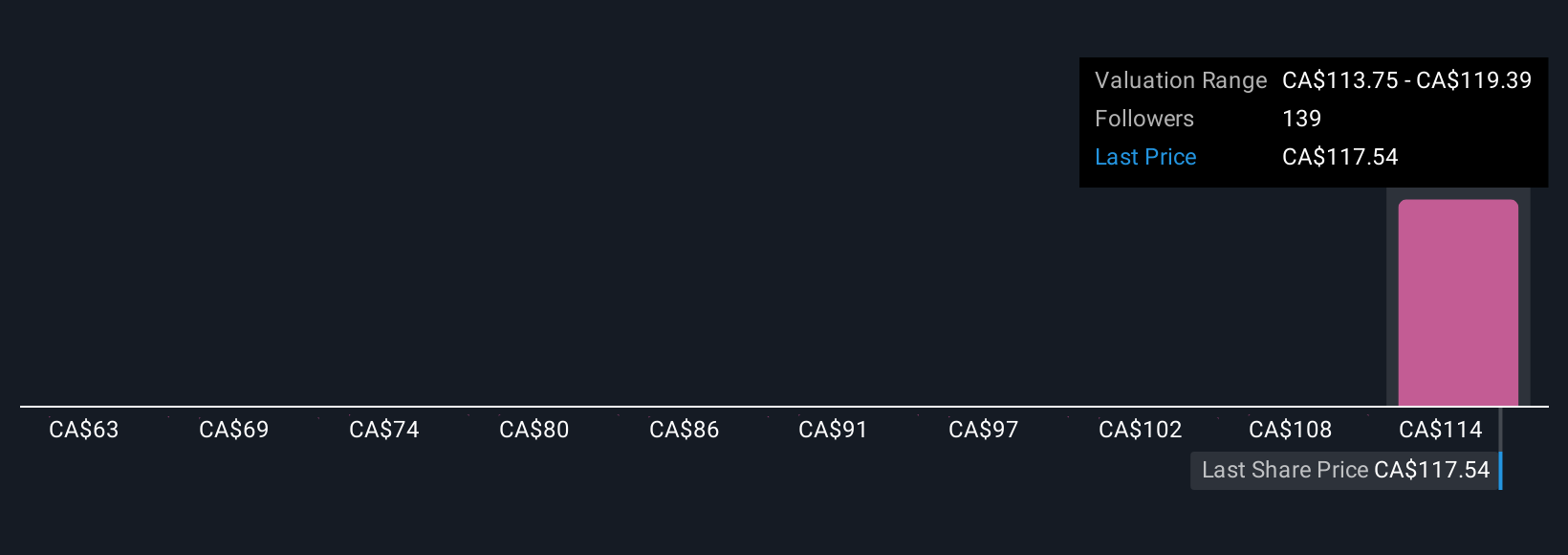

Fourteen fair value estimates from the Simply Wall St Community span roughly CA$50.81 to CA$151.75, showing how widely individual views can differ. Against that backdrop, the big swing factor many of these community members are weighing is whether delayed nuclear reactor FIDs eventually convert into firm projects, or keep revenue and earnings under pressure for longer.

Explore 14 other fair value estimates on Cameco - why the stock might be worth as much as 20% more than the current price!

Build Your Own Cameco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cameco research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cameco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cameco's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal