Assessing M&T Bank’s Valuation After Recent Regional Banking Sector Headlines

- Wondering if M&T Bank at around $195 a share is quietly trading below what it is really worth? You are not alone. This article is written for investors asking exactly that question.

- The stock is up 2.6% over the last week and 6.4% over the past month. Yet it is only up 3.4% year to date and still about 4.8% lower than it was a year ago, despite gaining 42.7% over 3 years and 81.7% over 5 years.

- Recent headlines have focused on regional banks adjusting their balance sheets and capital plans in response to shifting interest rate expectations, and M&T Bank has been part of that broader regional banking narrative. At the same time, investors have been watching regulatory developments and loan quality trends across the sector, which helps explain some of the push and pull behind the share price.

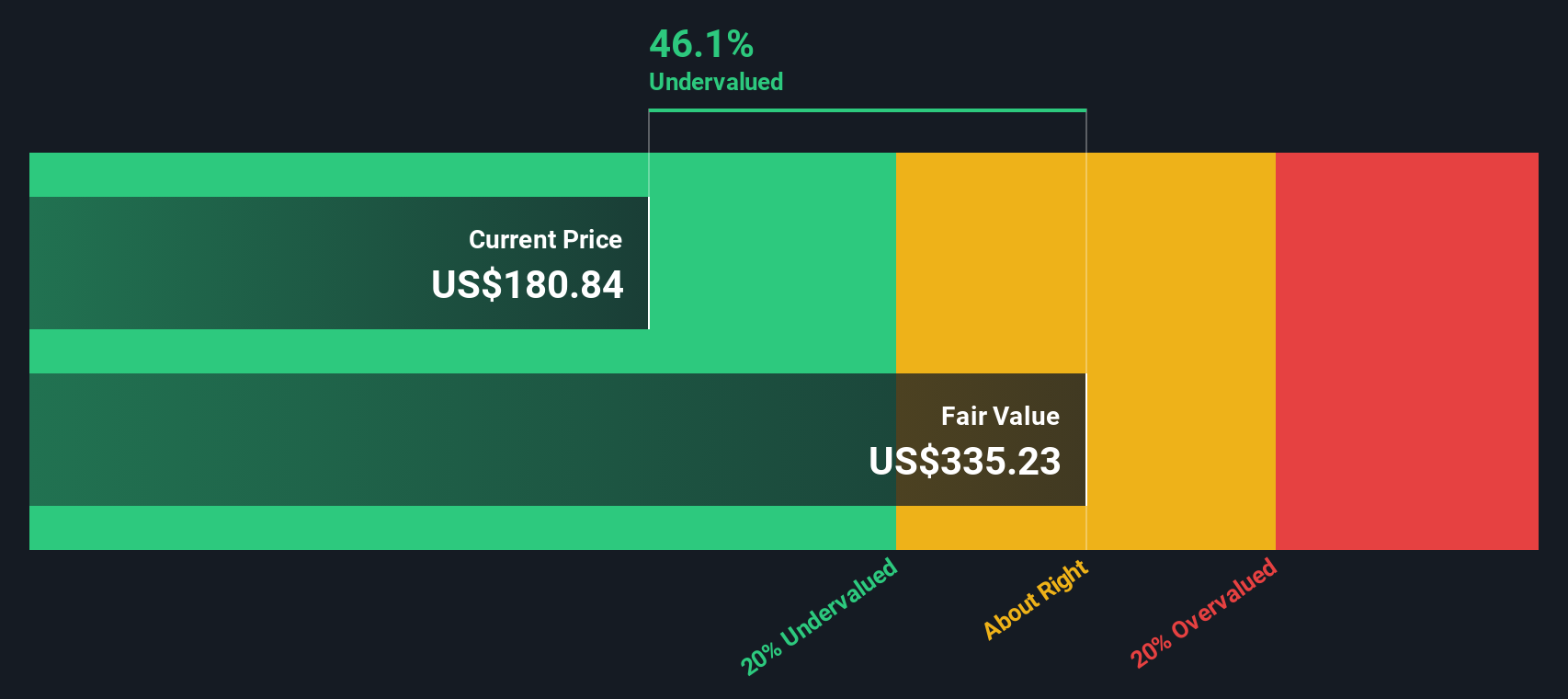

- On our valuation checks, M&T Bank scores a strong 5/6, suggesting the market may still be underestimating parts of the story. Next, we will walk through the main valuation approaches, before ending with a more holistic way to think about what the stock is really worth.

Find out why M&T Bank's -4.8% return over the last year is lagging behind its peers.

Approach 1: M&T Bank Excess Returns Analysis

The Excess Returns model asks a simple question: how much value can M&T Bank create above the return investors demand on its equity, and for how long can it keep doing that? Instead of focusing on cash flows, it looks at returns on equity relative to the cost of equity and builds an intrinsic value from those excess profits.

For M&T Bank, book value sits at about $170.44 per share, with an average return on equity of 10.36%. Analysts expect stable earnings of roughly $19.12 per share, supported by a stable book value forecast of $184.51 per share, based on future estimates from 10 to 13 analysts. Against a cost of equity of $13.12 per share, this implies an excess return of around $5.99 per share that can be generated for shareholders.

When these excess returns are projected and capitalised, the model points to an intrinsic value of about $340 per share, which is roughly 42.6% above the current price near $195. On this framework, the stock screens as meaningfully undervalued rather than just slightly cheap.

Result: UNDERVALUED

Our Excess Returns analysis suggests M&T Bank is undervalued by 42.6%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

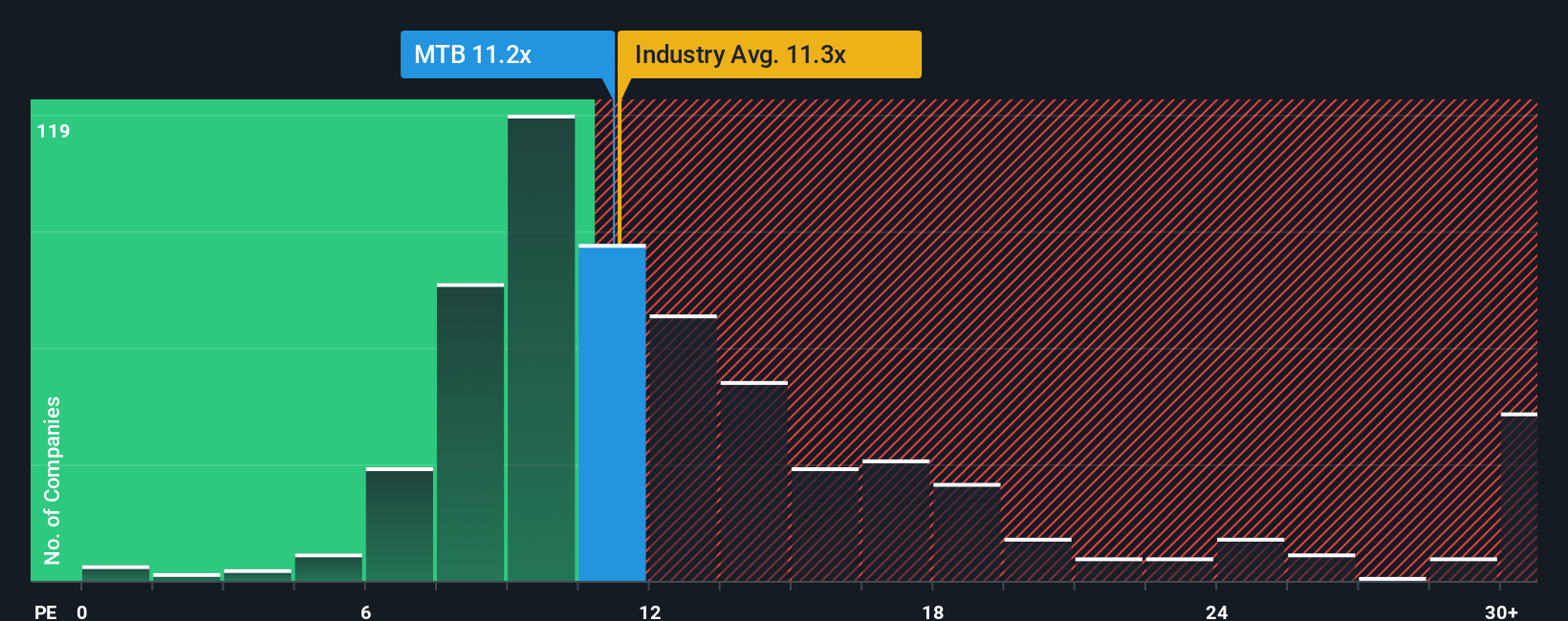

Approach 2: M&T Bank Price vs Earnings

For a consistently profitable bank like M&T, the price to earnings ratio is a practical way to gauge what investors are willing to pay for each dollar of earnings. It neatly captures expectations about future profitability, making it a useful cross check against more complex intrinsic value models.

In general, companies with stronger growth prospects and lower perceived risk tend to have a higher normal PE ratio, while slower growing or riskier names tend to trade on a lower multiple. M&T currently trades on about 11.4x earnings, which sits slightly below both the Banks industry average of roughly 11.7x and the peer group average near 12.8x. That discount suggests that the market is applying a modestly cautious view to the stock.

Simply Wall St’s Fair Ratio of about 12.7x is a proprietary estimate of what M&T’s PE could be, given its earnings growth outlook, profitability, risk profile, industry, and size. Because it blends these company specific factors, it offers a more tailored benchmark than simple peer or industry comparisons. With the Fair Ratio sitting meaningfully above the current 11.4x, this PE based lens suggests that M&T is trading at an attractive discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

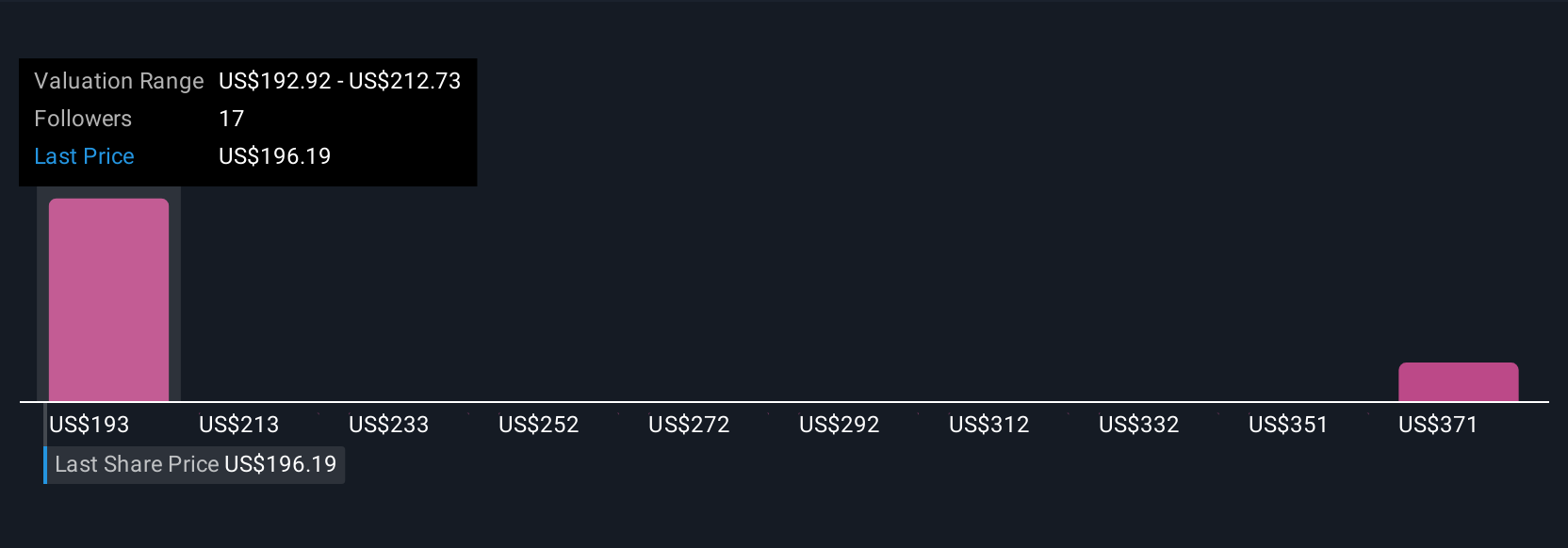

Upgrade Your Decision Making: Choose your M&T Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple way to attach your own story about M&T Bank to the numbers by linking your view of its future revenue, earnings and margins to a financial forecast and then to a fair value estimate. You can do this all within Simply Wall St’s Community page, where millions of investors can easily create and compare these dynamic Narratives as they update with new news or earnings, and use them to decide when to buy or sell by comparing their Fair Value to today’s Price. That could mean a more optimistic view that M&T’s capital strength, fee income growth and buybacks justify something closer to the bullish 240 dollar target, or a more cautious stance that deposit risk, higher expenses and regulation keep it nearer the bearish 175 dollar target.

Do you think there's more to the story for M&T Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal