Why Sezzle (SEZL) Is Up 10.8% After Strong Holiday BNPL Forecasts Among Younger Shoppers

- Earlier this month, Sezzle was lifted by industry reports forecasting a strong holiday season for Buy Now, Pay Later services, with Adobe Analytics projecting US$20.20 billion of BNPL spending, an 11% year-on-year increase.

- The growing use of BNPL among younger shoppers during peak spending periods highlights how Sezzle’s core customer base aligns closely with these industry trends.

- We’ll now examine how this upbeat holiday BNPL outlook, especially among younger consumers, interacts with Sezzle’s existing investment narrative and risks.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Sezzle Investment Narrative Recap

To own Sezzle, you need to believe BNPL can keep deepening its role in everyday spending, particularly with younger consumers, while Sezzle turns that usage into durable, profitable growth. The upbeat holiday BNPL outlook supports the near term revenue momentum catalyst but does little to change the biggest immediate risk, which remains rising credit losses as Sezzle stretches further into first time and higher risk users.

The most relevant recent update here is Sezzle’s raised 2025 net income guidance to US$125.0 million, reaffirming strong growth expectations even before this latest holiday boost to BNPL demand. Together, the guidance and seasonal tailwind put more focus on whether Sezzle’s underwriting and loss provisions can keep pace with higher transaction volumes without eroding the company’s improving profitability profile.

Yet behind the strong holiday headlines, investors should be aware of Sezzle’s rising provision for credit losses and what that means for...

Read the full narrative on Sezzle (it's free!)

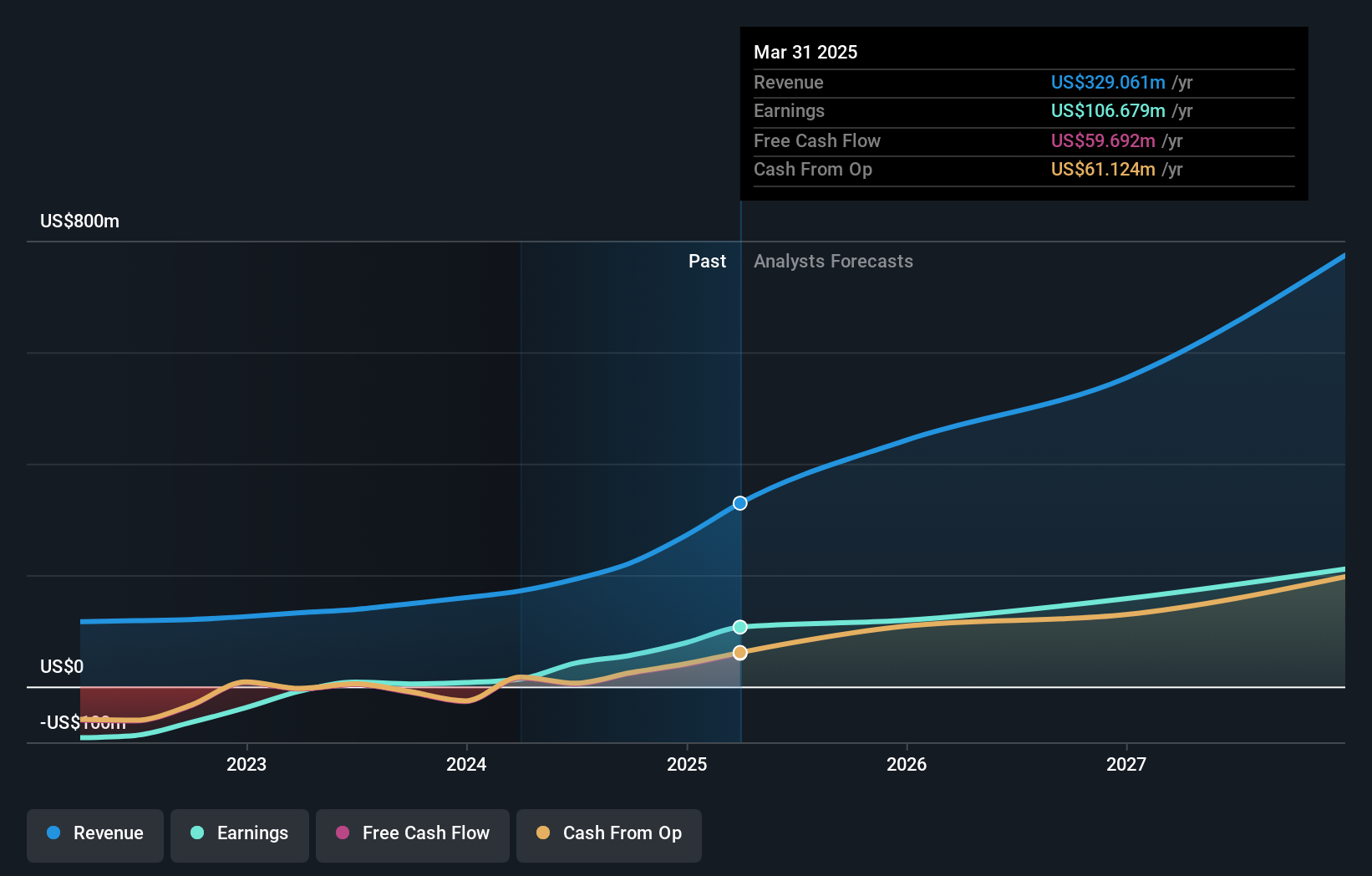

Sezzle’s narrative projects $885.4 million revenue and $232.2 million earnings by 2028. This requires 33.5% yearly revenue growth and about a $127.6 million earnings increase from $104.6 million today.

Uncover how Sezzle's forecasts yield a $108.50 fair value, a 59% upside to its current price.

Exploring Other Perspectives

Seventeen fair value estimates from the Simply Wall St Community span roughly US$8.83 to US$267.23 per share, underscoring how differently investors see Sezzle’s upside and downside. When you set that dispersion against Sezzle’s holiday sensitive BNPL catalyst and the parallel risk of higher credit losses, it underlines why exploring several grounded viewpoints can be so important.

Explore 17 other fair value estimates on Sezzle - why the stock might be worth over 3x more than the current price!

Build Your Own Sezzle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sezzle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sezzle's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal