Guidewire Software (GWRE): Revisiting Valuation After Recent Pullback and Strong Multi‑Year Shareholder Returns

Guidewire Software (GWRE) has pulled back about 4% over the past month and nearly 19% in the past 3 months, even as its revenue and earnings continue to grow at a double digit clip.

See our latest analysis for Guidewire Software.

Even after the recent pullback, Guidewire’s share price is still well ahead for the year, with a positive year to date share price return and a particularly strong three year total shareholder return that suggests long term momentum remains intact, even if near term enthusiasm is cooling.

If Guidewire’s move has you thinking about where software and automation could reshape other markets, it is a good time to explore high growth tech and AI stocks for more ideas.

With double digit growth and a sizable gap to analyst targets, investors now face a pivotal question: Is Guidewire still trading below its true potential, or is the market already pricing in years of future expansion?

Most Popular Narrative: 21.5% Undervalued

With the narrative fair value sitting meaningfully above the last close of $210.55, the valuation case leans heavily on an aggressive long term growth runway.

The industry's transition to cloud-based systems, particularly in the property and casualty insurance sector, is steadily accelerating, which should facilitate future revenue growth as more customers migrate to the Guidewire Cloud Platform.

Strong performance in annual recurring revenue (ARR) and new customer acquisitions, including global expansion into markets like Brazil and Belgium, indicate potential for sustained revenue growth.

To understand how this narrative supports a richer valuation than today, with faster growth, higher margins, and a demanding earnings multiple incorporated, review the full narrative to see which specific revenue, profit, and valuation assumptions are contributing most to the outcome.

Result: Fair Value of $268.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in cloud migrations or prolonged macro uncertainty across key insurance markets could easily derail the growth and margin gains that are included in this outlook.

Find out about the key risks to this Guidewire Software narrative.

Another Take on Valuation

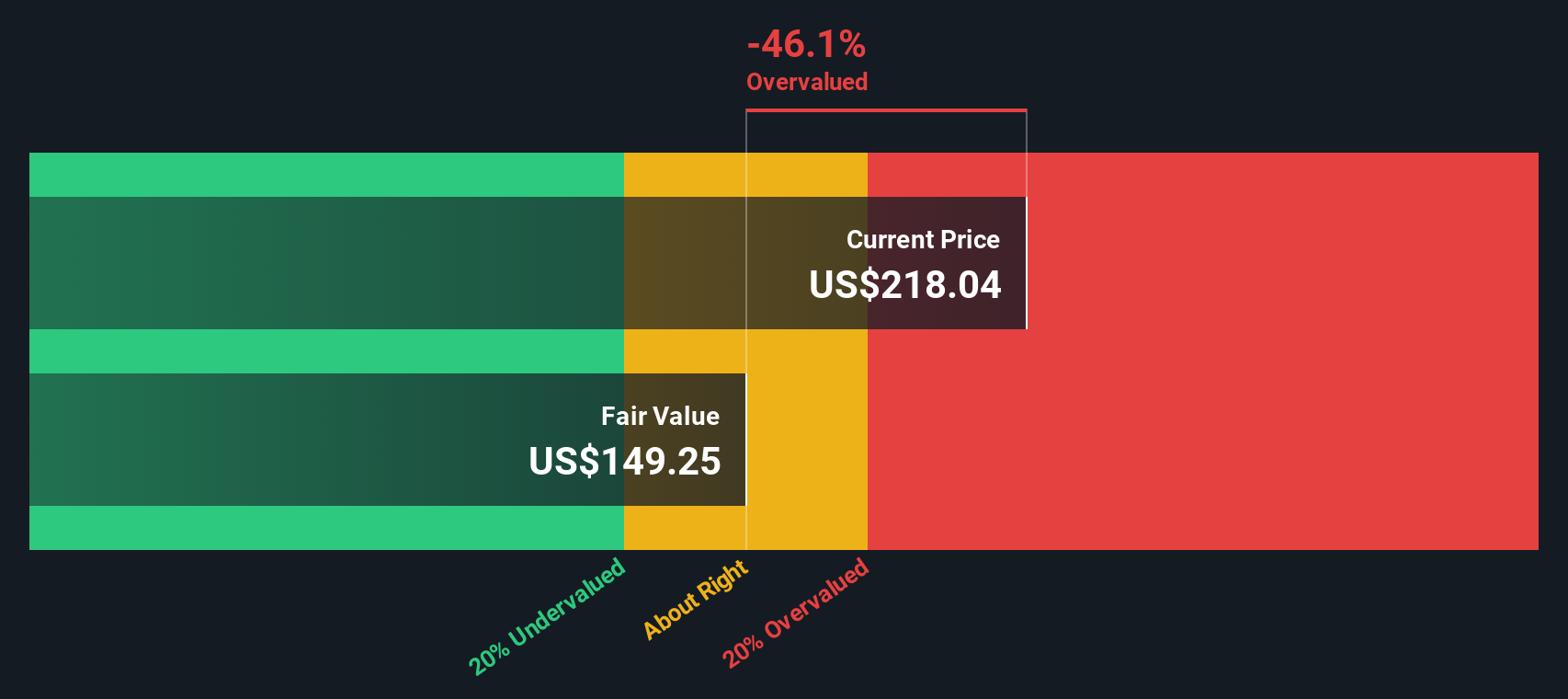

Our SWS DCF model points the other way, suggesting Guidewire is overvalued at $210.55 versus a fair value of $182.54. If cash flow assumptions prove too optimistic, today’s price could already be baking in more than the business can realistically deliver.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Guidewire Software Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Guidewire Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall Street Screener to quickly spot fresh opportunities beyond Guidewire so you are not leaving potential returns and smarter decisions on the table.

- Capitalize on mispriced opportunities by targeting companies trading below their estimated worth through these 906 undervalued stocks based on cash flows before the broader market catches on.

- Ride powerful secular trends by focusing on innovation and automation with these 26 AI penny stocks that could reshape entire industries over the next decade.

- Strengthen your income strategy by selecting reliable payers via these 15 dividend stocks with yields > 3% and aim to lock in yields that support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal