Cenovus Energy (TSX:CVE) valuation check after new CAD 1.04 billion omnibus shelf registration filing

Cenovus Energy (TSX:CVE) just set up a CAD 1.04 billion omnibus shelf registration, giving management the flexibility to tap markets with debt, equity, or hybrid securities as conditions evolve.

See our latest analysis for Cenovus Energy.

The filing lands against a constructive backdrop, with Cenovus posting a roughly 15% year to date share price return and a 1 year total shareholder return near 24%, suggesting momentum is quietly building as investors reassess its cash generation and balance sheet strength.

If this has you thinking about where else capital disciplined management teams might create upside, it could be worth exploring fast growing stocks with high insider ownership as a way to spot the next wave of conviction backed ideas.

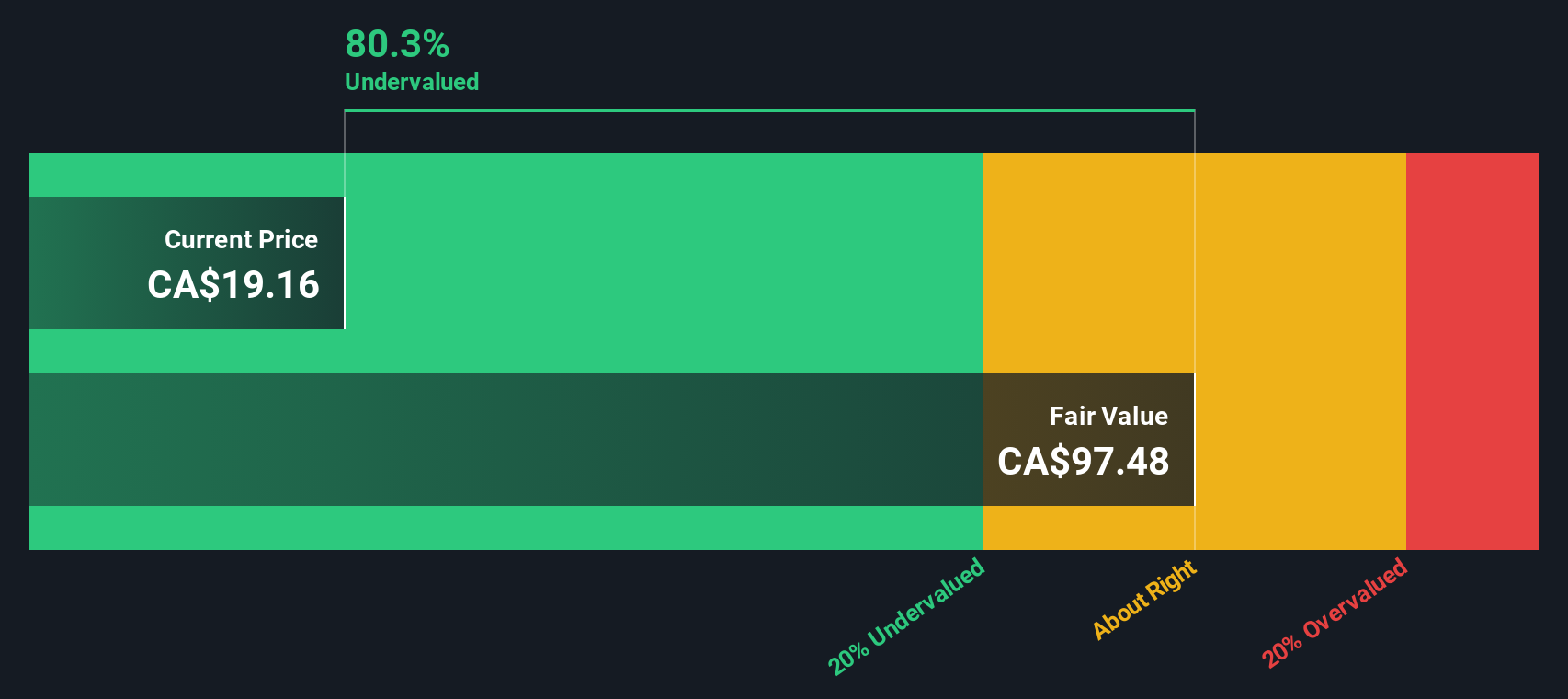

With shares already up strongly and trading at a discount to analyst targets, the real question now is whether Cenovus still trades below its intrinsic value or whether the market is already pricing in the next leg of growth.

Most Popular Narrative: 13.6% Undervalued

With Cenovus closing at CA$25.35 against a narrative fair value near CA$29.35, the spread reflects ambitious assumptions about future efficiency and cash generation.

Successful completion of key growth projects such as Narrows Lake, West White Rose, and the Foster Creek optimization is described as delivering significant new, stable, long-life production with lower steam-oil ratios and reduced capital spending needs moving forward. This is presented as positioning the company for higher free cash flow and earnings as global energy demand remains robust.

Want to see what powers that valuation gap? The narrative leans on rising margins, disciplined capital, and shrinking share count. Curious how those pieces could reshape future earnings?

Result: Narrative Fair Value of $29.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on navigating Canadian regulatory uncertainty and long term oil sands emissions pressures, which could squeeze margins and derail growth expectations.

Find out about the key risks to this Cenovus Energy narrative.

Another Lens on Value

While the narrative fair value pegs Cenovus at a modest 13.6% discount, the SWS DCF model is far more aggressive and suggests intrinsic value near CA$82.60, about 69% above today’s price. Is the market underestimating long term cash flows, or are DCF assumptions running too hot?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cenovus Energy Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Cenovus Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities that match your style, from dependable cash generators to high octane growth stories.

- Capture potential mispricings by zeroing in on these 906 undervalued stocks based on cash flows that the market may be overlooking today.

- Explore the next wave of innovation by targeting these 26 AI penny stocks involved in areas such as automation and intelligent data platforms.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% designed to provide regular shareholder payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal