Gravity SUV Ramp and Record Deliveries Could Be A Game Changer For Lucid Group (LCID)

- Lucid Group recently began production of its luxury Gravity electric SUV, helping drive seven consecutive quarters of delivery growth and a 68% year-over-year revenue increase, while management reiterated a 2025 year-end production goal of around 18,000 units despite earlier forecast cuts.

- This combination of Gravity-led delivery momentum and revenue expansion is prompting investors to reassess how effectively Lucid can scale its operations amid ongoing cost and demand pressures.

- We’ll now explore how Gravity’s early production ramp and record delivery streak could reshape Lucid’s investment narrative and future growth expectations.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Lucid Group Investment Narrative Recap

To own Lucid today, you need to believe Gravity can anchor a larger, higher volume EV business before cash constraints and dilution overwhelm the story. Gravity’s early production ramp and record delivery streak help the near term delivery and revenue catalyst, but they do not yet solve the core risks around persistent losses, heavy cash burn, and reliance on external funding that have weighed on the share price.

Among recent developments, the Uber robotaxi agreement tied to the Gravity platform stands out as most relevant here, because it connects Gravity’s ramp directly to a potential high volume fleet channel. If Lucid can translate its production progress into reliable Gravity supply for that partnership, it could support the company’s growth ambitions even as price cuts, tariffs, and elevated operating costs pressure margins and keep financing risk front of mind.

Yet against this backdrop of Gravity momentum, investors should still be aware of Lucid’s ongoing dependence on fresh capital and the dilution that could...

Read the full narrative on Lucid Group (it's free!)

Lucid Group's narrative projects $5.6 billion revenue and $285.8 million earnings by 2028.

Uncover how Lucid Group's forecasts yield a $18.43 fair value, a 37% upside to its current price.

Exploring Other Perspectives

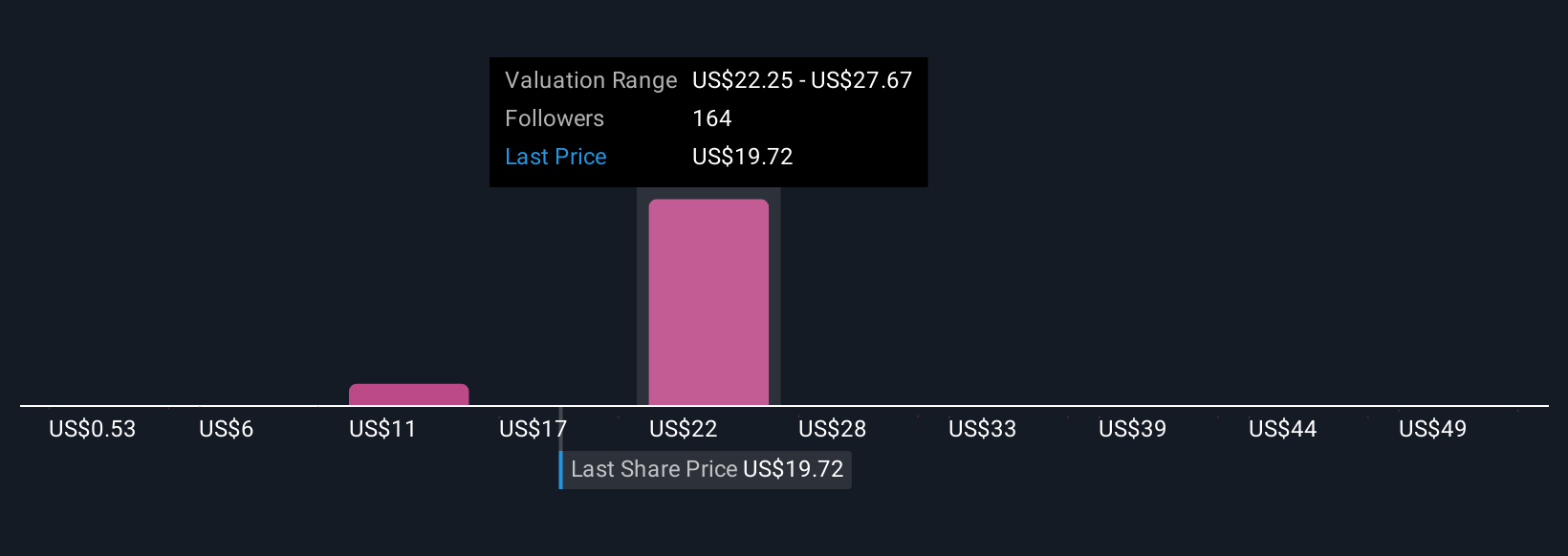

Eighteen fair value estimates from the Simply Wall St Community range from US$0.53 to US$54.82, underlining how far apart expectations can be. When you set that against Lucid’s continued heavy cash burn and funding needs, it becomes even more important to compare several viewpoints before deciding what the Gravity ramp and delivery growth might really mean for the company’s long term prospects.

Explore 18 other fair value estimates on Lucid Group - why the stock might be worth less than half the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lucid Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lucid Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal