What QUALCOMM (QCOM)'s AI and Automotive Expansion Drive Means For Shareholders

- In recent months, Qualcomm has reported past quarterly results that exceeded expectations while expanding its presence across mobile, automotive, IoT, and AI infrastructure, supported by long-term automotive design wins and new data-center and edge AI platforms.

- These moves, alongside acquisitions such as Alphawave IP Group to boost data-center connectivity and Arduino to deepen its AI edge ecosystem, highlight Qualcomm’s push to become a central enabler of AI at both the cloud and device level.

- We’ll now examine how Qualcomm’s strong quarterly performance and accelerating AI and automotive traction may reshape its existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

QUALCOMM Investment Narrative Recap

To own Qualcomm, you need to believe it can shift from a smartphone-focused supplier to a broader AI and connectivity platform across devices, cars, and infrastructure. The latest results and guidance support that transition in the near term, while unusual options activity and recent share underperformance highlight sentiment risk as the most immediate overhang. The biggest fundamental risk remains whether its new AI and data center bets can scale profitably enough to offset handset cyclicality.

The launch of Qualcomm’s AI200 and AI250 data center platforms, alongside the pending Alphawave IP Group acquisition, is central to that question. Together, they show how Qualcomm is trying to extend its edge in low power, AI inference workloads into the data center, a move that could become an important earnings catalyst if customer adoption matches its strong automotive and IoT design win momentum.

Yet beneath the strong AI narrative, investors should also be aware of the execution and integration risks around Qualcomm’s push into unproven data center markets and...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM’s narrative projects $46.9 billion revenue and $12.2 billion earnings by 2028. This requires 2.7% yearly revenue growth and about a $0.6 billion earnings increase from $11.6 billion today.

Uncover how QUALCOMM's forecasts yield a $191.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

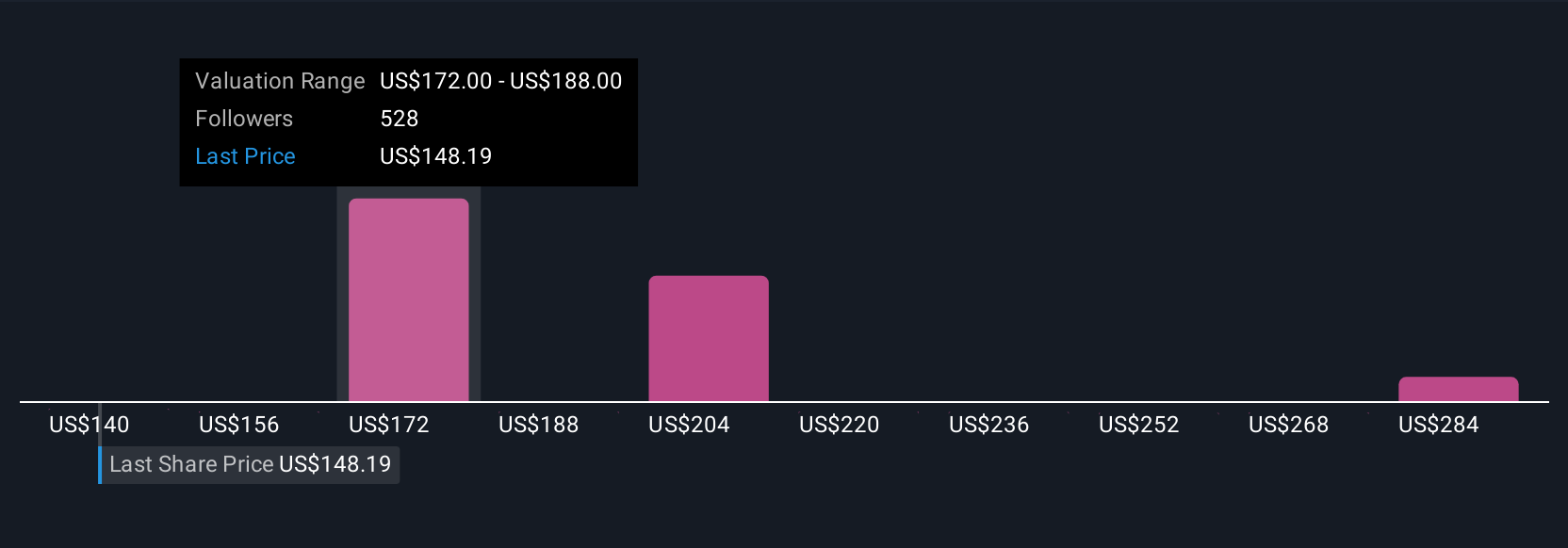

Thirty fair value estimates from the Simply Wall St Community span roughly US$142 to US$300 per share, reflecting very different expectations for Qualcomm’s future. Against that backdrop, Qualcomm’s early stage push into AI data centers could heavily influence whether current earnings growth forecasts ultimately prove conservative or optimistic.

Explore 30 other fair value estimates on QUALCOMM - why the stock might be worth as much as 72% more than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal