How Investors Are Reacting To MDA Space (TSX:MDA) New Debt Deal And RADARSAT+ Contract Win

- MDA Space Ltd. recently completed the pricing of a C$250 million private placement of 7.00% senior unsecured notes due 2030, while also securing a C$44.7 million Canadian government contract for long lead parts for a RADARSAT Constellation Mission replenishment satellite under the RADARSAT+ Earth observation initiative.

- The Canadian government’s stated intention to have MDA Space build, test, and launch the replenishment satellite, plus its inclusion in a concept study for a next-generation radar system, reinforces the company’s role at the core of Canada’s long-term sovereign Earth observation plans.

- We’ll now consider how the RADARSAT replenishment contract and government intention for a full mission award influence MDA Space’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

MDA Space Investment Narrative Recap

MDA Space’s investment case rests on belief in sustained demand for complex satellites, robotics and Earth observation, supported by its expanded manufacturing footprint. The RADARSAT replenishment work and government intent for a full mission award modestly support near term backlog confidence, while the new C$250 million, 7.00% notes add financial flexibility but also increase leverage, which is already a key risk if large constellation wins slow or are cancelled.

Among recent developments, the EchoStar constellation termination looms largest for the current narrative, given its size relative to MDA Space’s order book and capacity build out. The RADARSAT+ long lead contract and potential full mission award help partially offset sentiment around that cancellation by highlighting enduring government demand for SAR and reinforcing utilisation of MDA Space’s Earth observation and satellite platforms.

However, against the promise of new contracts, investors should also be aware of the risk that MDA’s expanded Montreal capacity could...

Read the full narrative on MDA Space (it's free!)

MDA Space's narrative projects CA$2.6 billion revenue and CA$271.2 million earnings by 2028. This requires 24.5% yearly revenue growth and a CA$156.5 million earnings increase from CA$114.7 million today.

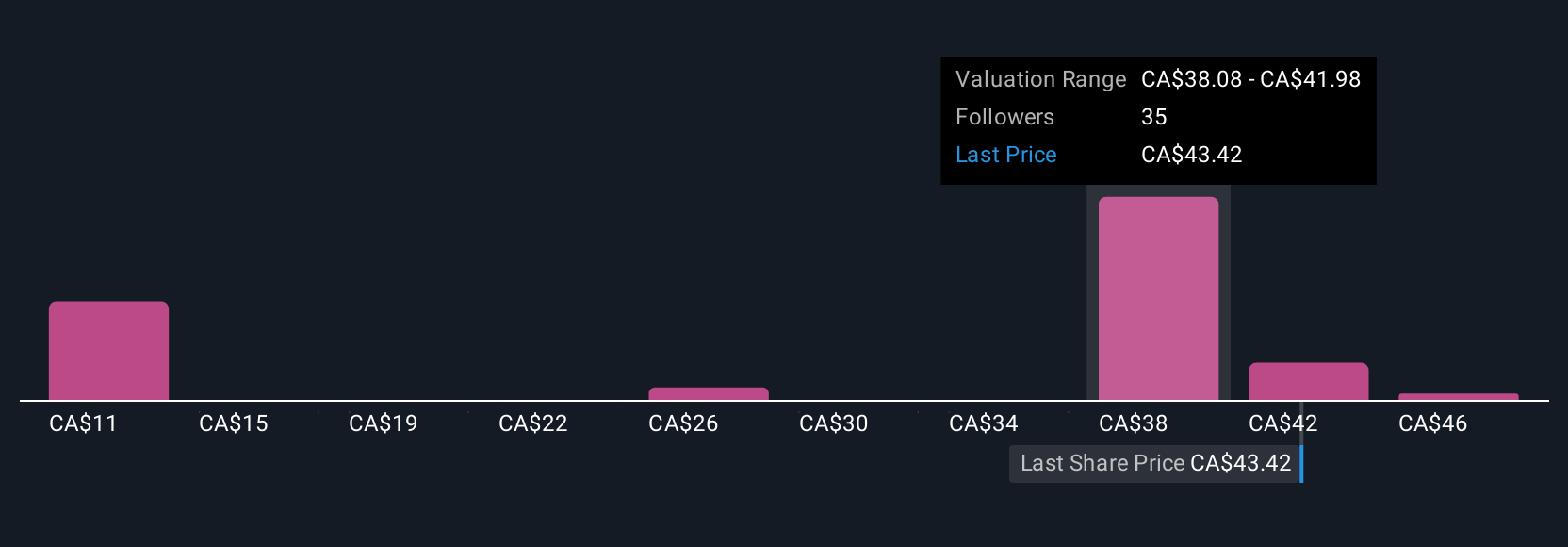

Uncover how MDA Space's forecasts yield a CA$38.79 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Seventeen fair value estimates from the Simply Wall St Community span roughly C$6.43 to C$55, underlining how far apart individual views can be. You can weigh those opinions against the central catalyst that MDA’s growth plan depends on sustained high volume constellation and government contract awards to keep its expanded manufacturing capacity effectively utilised.

Explore 17 other fair value estimates on MDA Space - why the stock might be worth over 2x more than the current price!

Build Your Own MDA Space Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDA Space's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal