Is Saakshi Medtech and Panels (NSE:SAAKSHI) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Saakshi Medtech and Panels Limited (NSE:SAAKSHI) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Saakshi Medtech and Panels's Net Debt?

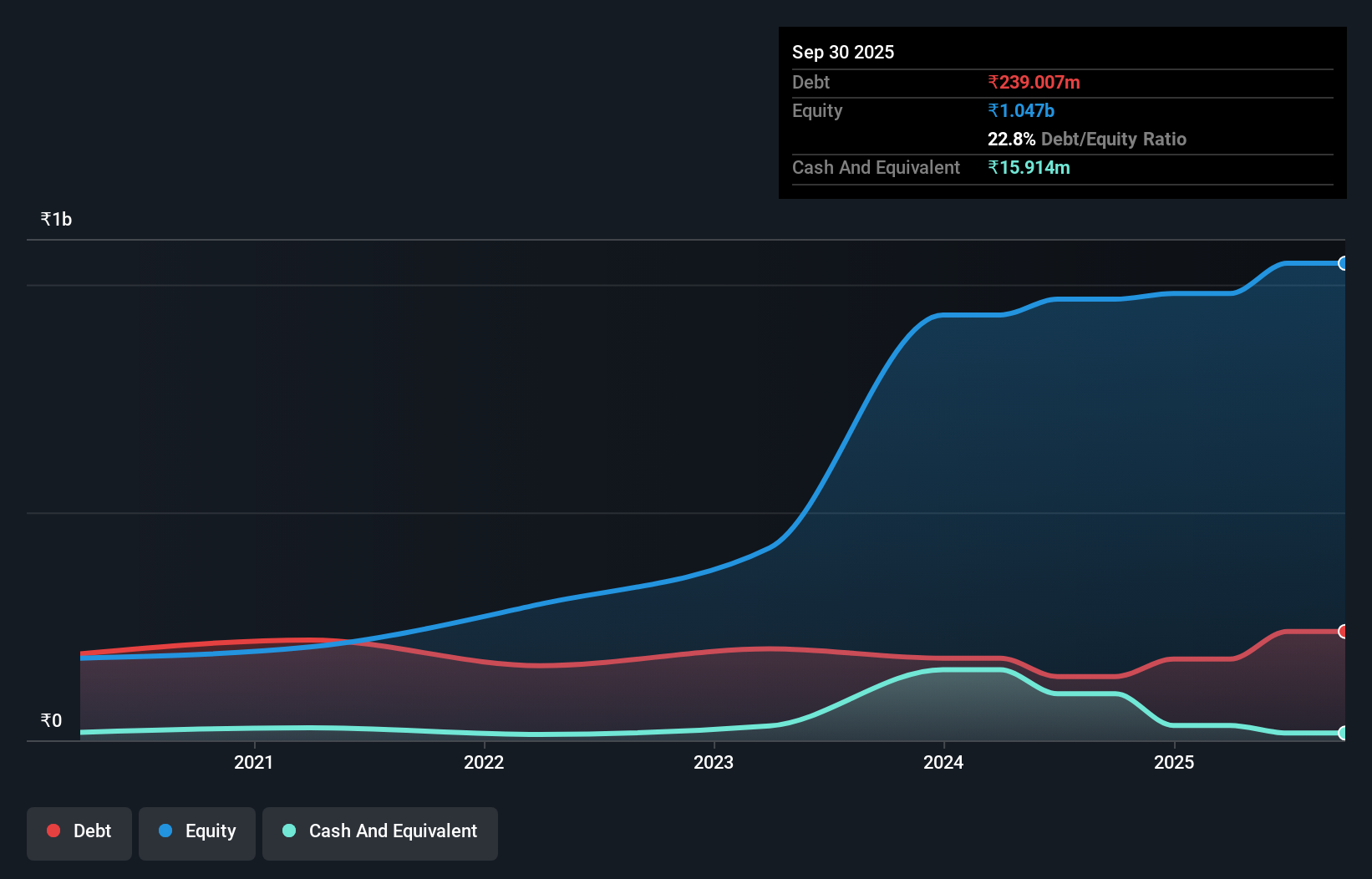

You can click the graphic below for the historical numbers, but it shows that as of September 2025 Saakshi Medtech and Panels had ₹239.0m of debt, an increase on ₹140.0m, over one year. However, because it has a cash reserve of ₹15.9m, its net debt is less, at about ₹223.1m.

A Look At Saakshi Medtech and Panels' Liabilities

We can see from the most recent balance sheet that Saakshi Medtech and Panels had liabilities of ₹255.7m falling due within a year, and liabilities of ₹173.9m due beyond that. Offsetting these obligations, it had cash of ₹15.9m as well as receivables valued at ₹321.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹92.1m.

Of course, Saakshi Medtech and Panels has a market capitalization of ₹3.47b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

See our latest analysis for Saakshi Medtech and Panels

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Saakshi Medtech and Panels's moderate net debt to EBITDA ratio ( being 1.6), indicates prudence when it comes to debt. And its strong interest cover of 1k times, makes us even more comfortable. But the bad news is that Saakshi Medtech and Panels has seen its EBIT plunge 17% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Saakshi Medtech and Panels will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Saakshi Medtech and Panels saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Neither Saakshi Medtech and Panels's ability to convert EBIT to free cash flow nor its EBIT growth rate gave us confidence in its ability to take on more debt. But its interest cover tells a very different story, and suggests some resilience. Taking the abovementioned factors together we do think Saakshi Medtech and Panels's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Saakshi Medtech and Panels (of which 1 shouldn't be ignored!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal