Toronto-Dominion Bank (TSX:TD) Valuation Check After Strong Earnings Jump and Dividend Policy Shift

Toronto-Dominion Bank (TSX:TD) just paired a strong full year earnings jump with a shift to semi annual dividend reviews, backing that up with a CAD 1.08 quarterly payout to common shareholders.

See our latest analysis for Toronto-Dominion Bank.

Those dividend moves land on top of a strong run, with the share price at about CA$122.20 and a year to date share price return of nearly 60 percent, backed by a 1 year total shareholder return above 70 percent. This signals momentum that is still building rather than fading.

If TD’s surge has you rethinking your bank exposure, this could be a smart moment to broaden your search and explore fast growing stocks with high insider ownership.

Yet with earnings surging, dividends rising, and the share price already near analyst targets, investors have to ask: is Toronto Dominion still trading at a discount, or is the market already pricing in most of its future growth?

Most Popular Narrative Narrative: 3.4% Overvalued

With Toronto Dominion trading around CA$122.20 versus a narrative fair value near CA$118.13, the most followed view sees only a small premium, hinging on how its earnings profile evolves under tighter regulation and rising digital investment.

Persistent investment in compliance (notably elevated AML remediation, cyber, and fraud prevention costs) is expected to drive higher structural expenses, weighing on net margins and overall earnings growth well into 2026 and 2027, as regulatory scrutiny and associated operational costs remain elevated.

Curious how this outlook still supports a premium price tag? The narrative leans on a radically different earnings path, margin reset, and future profit multiple. Want to see exactly how those moving parts combine into that fair value? Dive in to unpack the full playbook behind this valuation call.

Result: Fair Value of $118.13 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steady digital execution and disciplined restructuring could support stronger revenue and margin resilience than expected and challenge the mildly overvalued narrative.Find out about the key risks to this Toronto-Dominion Bank narrative.

Another View: Multiples Point to Value, Not Excess

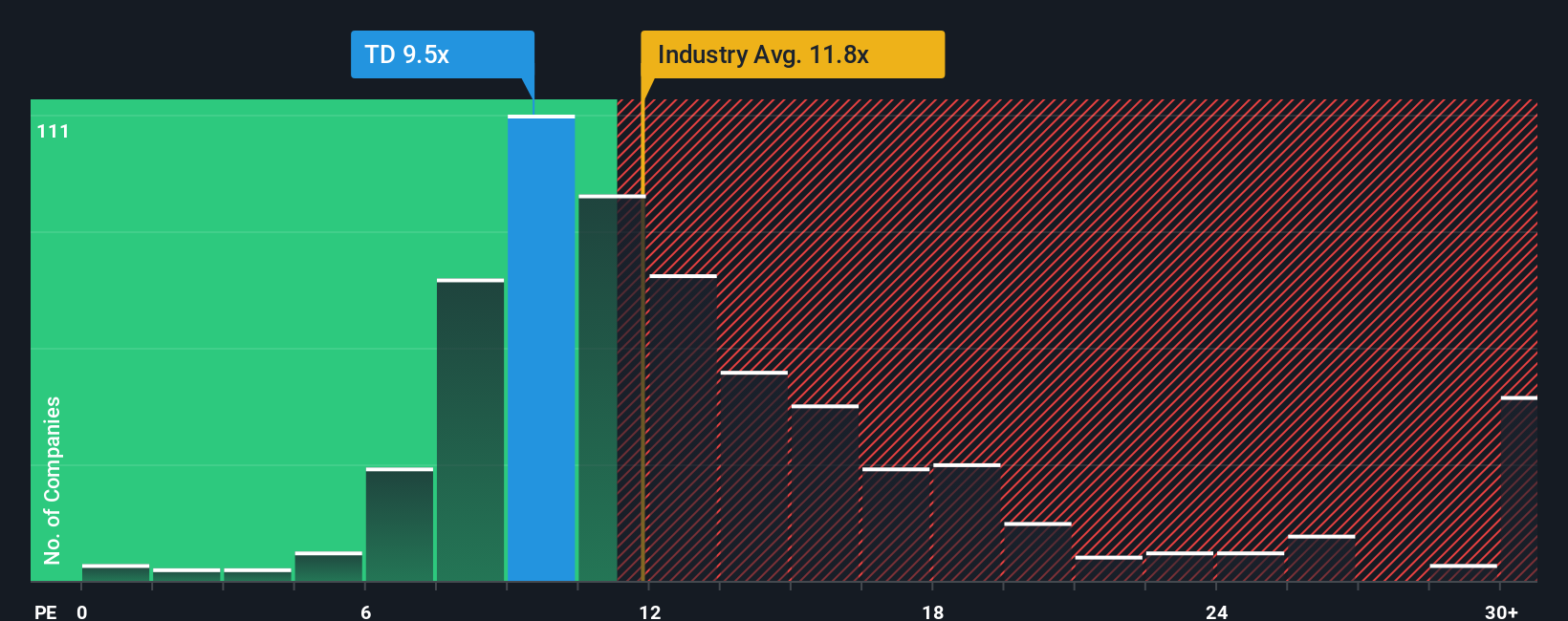

While the most popular narrative pegs TD as slightly overvalued, our valuation using a single earnings multiple paints a different picture. At 10.1 times earnings versus peers at 15.7 times and a fair ratio of 11.3, the gap suggests room for upside rather than downside. This raises the question of whether sentiment is lagging the fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toronto-Dominion Bank Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single bank when the market is full of candidates; use the Simply Wall Street Screener today and strengthen your next move.

- Capture potential income opportunities by reviewing these 15 dividend stocks with yields > 3% that can support long-term returns through consistent cash payouts.

- Explore transformative innovation by targeting these 26 AI penny stocks reshaping entire industries with smarter, scalable technologies.

- Position yourself ahead of possible value rotations by focusing on these 906 undervalued stocks based on cash flows where cash flow strength is not yet fully recognized in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal