Is U.S. Bancorp (USB) Still Undervalued After Its 18% Profit Jump and Fee Income Strength?

U.S. Bancorp (USB) just posted an 18% profit jump in its latest quarter, with net income climbing to $1.89 billion. This puts its fee businesses and recent stock strength squarely in the spotlight for investors.

See our latest analysis for U.S. Bancorp.

The $51.26 share price has been grinding higher in recent weeks, with a 1 month share price return of 9.67% that builds on a solid 3 year total shareholder return of 37.36%. This suggests momentum is gradually rebuilding as investors recalibrate risk around regional banks.

If U.S. Bancorp’s recent profit beat has you thinking about where else confidence is returning in financials, it could be worth exploring solid balance sheet and fundamentals stocks screener (None results) next.

With profits accelerating, fee income expanding and the share price still trading at a discount to analyst targets and some intrinsic value estimates, is U.S. Bancorp quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 7.9% Undervalued

With U.S. Bancorp last closing at $51.26 against a narrative fair value of $55.63, the story leans toward upside potential grounded in fee strength and margins.

The deliberate strategic expansion in commercial lending (notably C&I and credit cards), as well as the repositioning of the balance sheet towards higher-yielding, multi-service commercial clients, is expected to enhance net interest income and medium-term earnings power, especially as infrastructure investment and urbanization increases credit demand.

Curious how steady revenue gains, shifting profit margins, and a richer earnings multiple all combine into that upside case? The narrative unpacks a multi year earnings climb, a thinner margin profile, and a higher future valuation bar that banks do not often enjoy. Want to see the precise assumptions behind that confidence?

Result: Fair Value of $55.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster moving fintechs and potential credit strain in commercial real estate could blunt fee momentum and pressure the bank’s carefully modeled earnings path.

Find out about the key risks to this U.S. Bancorp narrative.

Another Lens on Valuation

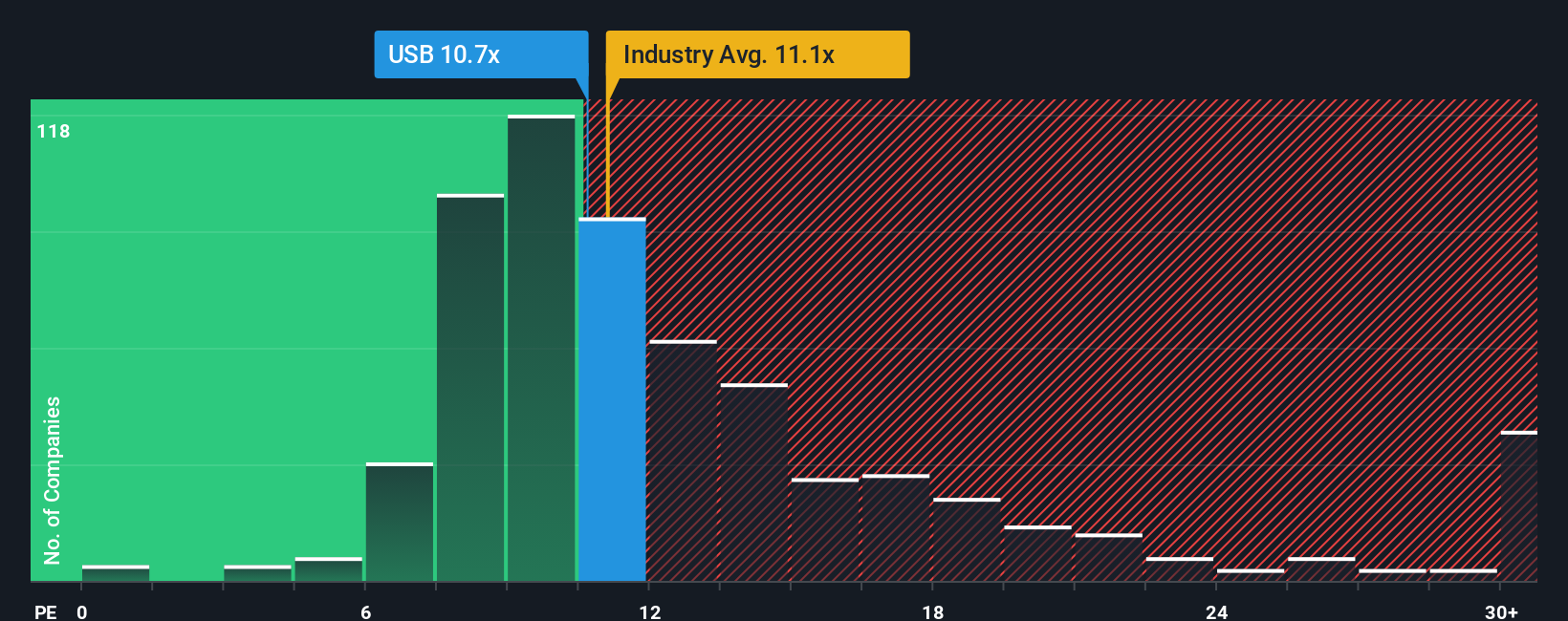

Looking beyond narrative fair value, the current price to earnings ratio of 11.7x looks reasonable next to the US banks industry at 11.7x, but is clearly cheaper than peers on 18.1x and is below a fair ratio of 14.3x, hinting at upside if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U.S. Bancorp Narrative

If you see the numbers differently or want to follow your own trail through the data, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding U.S. Bancorp.

Looking for more investment ideas?

If you stop at one bank stock, you could miss stronger opportunities. Put Simply Wall Street’s screener to work and uncover what the market is overlooking today.

- Capture early growth potential by scanning these 3577 penny stocks with strong financials that combine smaller size with surprisingly resilient fundamentals.

- Ride structural trends in automation and data by targeting these 26 AI penny stocks positioned to benefit from accelerating AI adoption.

- Lock in value before others catch on by tracking these 906 undervalued stocks based on cash flows that our models flag as mispriced on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal