Why monday.com (MNDY) Is Up 9.1% After SailGP Partnership And New Buyback Authorization

- In late November 2025, the Bonds Flying Roos announced multi-year partnerships with monday.com as Official Global Work Management Partner and Blueberry as Official Online Trading Partner, debuting the new branding at the Abu Dhabi SailGP Grand Final.

- The monday.com partnership moves beyond marketing exposure by using its AI-powered platform to coordinate the team’s complex global operations, showcasing the software’s capabilities in a demanding, real‑world environment.

- Now we’ll explore how monday.com’s three-year Bonds Flying Roos partnership and sizeable buyback authorization shape its existing investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

monday.com Investment Narrative Recap

To own monday.com, you need to believe its AI-first platform can keep winning deeper, stickier adoption across larger customers while turning that growth into sustained profitability. The Bonds Flying Roos partnership is helpful brand proof of concept, but it does not materially change the near term focus on improving enterprise expansion and managing heavy sales and R&D spend, which remain the key catalyst and risk.

The recent US$870 million share repurchase authorization is the most relevant backdrop to this partnership, as it signals management’s confidence amid a sharp share price pullback and high headline valuation multiples. Against that, ongoing investment intensity in AI products and go to market raises the bar for future execution, especially as monday.com pushes further upmarket and relies less on smaller self serve customers.

Yet behind the new partnerships and buyback, investors should still be aware of the risk that rising R&D and sales spend could...

Read the full narrative on monday.com (it's free!)

monday.com's narrative projects $2.0 billion revenue and $157.5 million earnings by 2028. This requires 22.9% yearly revenue growth and about a $117 million earnings increase from $40.0 million today.

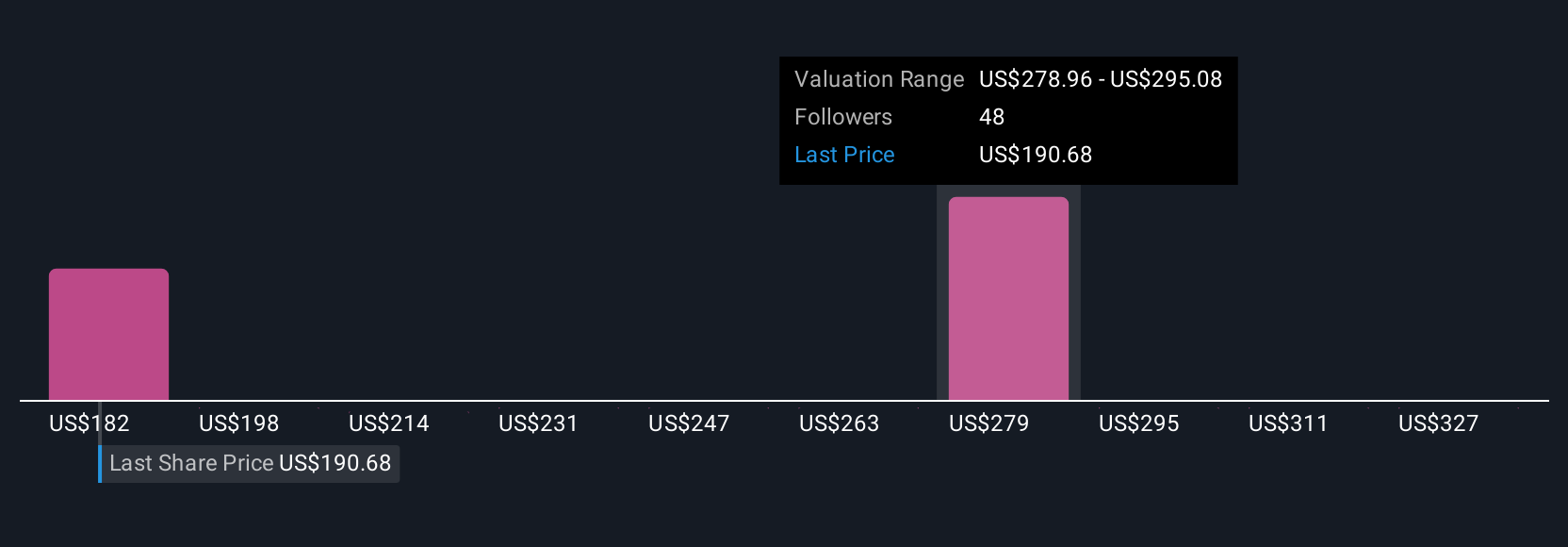

Uncover how monday.com's forecasts yield a $234.58 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span roughly US$170 to US$343 per share, showing how far apart individual views can be. Set that against monday.com’s heavy reliance on paid search for new customers, and it becomes even more important to compare different assumptions about how shifts in online acquisition channels could affect future performance.

Explore 16 other fair value estimates on monday.com - why the stock might be worth just $170.20!

Build Your Own monday.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your monday.com research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free monday.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate monday.com's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal