Does REA Group’s AI and Data Push With OpenAI, Neighbourlytics and Ray White Reshape the Bull Case (ASX:REA)?

- In recent months, REA Group has partnered with OpenAI, launched its realAssist AI companion and expanded natural-language search on realestate.com.au, while also acquiring Neighbourlytics and signing a network-wide data and Pro tools deal with Ray White.

- Together, these moves show REA Group intensifying its push to turn rich property, community and agent data into differentiated AI-powered services across the real estate ecosystem.

- We’ll now examine how REA Group’s OpenAI-powered realAssist launch and broader AI data push interact with its existing investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

REA Group Investment Narrative Recap

To own REA Group, you generally need to believe its core Australian property marketplace can keep monetising deep data and high engagement despite competition, regulatory attention and reliance on the listings cycle. The recent OpenAI and data partnerships enhance the product story, but the key short term swing factor still appears to be how quickly listing volumes and premium product uptake stabilise after the recent share price weakness, while competition from Domain and CoStar remains a central risk.

The expanded Ray White Pro and data deal looks especially relevant here, because it puts REA’s AI and intelligence products directly into the workflows of more than 550 offices. For investors watching near term catalysts, this type of broad-based adoption may matter for assessing how much pricing power and upsell capacity REA can sustain if listings stay patchy and competitors lean harder on discounts or bundled offerings.

Yet against the appeal of richer AI tools, investors should be aware that intensifying competition from Domain and CoStar could...

Read the full narrative on REA Group (it's free!)

REA Group's narrative projects A$2.3 billion revenue and A$905.3 million earnings by 2028. This requires 7.1% yearly revenue growth and about A$227 million earnings increase from A$677.9 million today.

Uncover how REA Group's forecasts yield a A$243.58 fair value, a 28% upside to its current price.

Exploring Other Perspectives

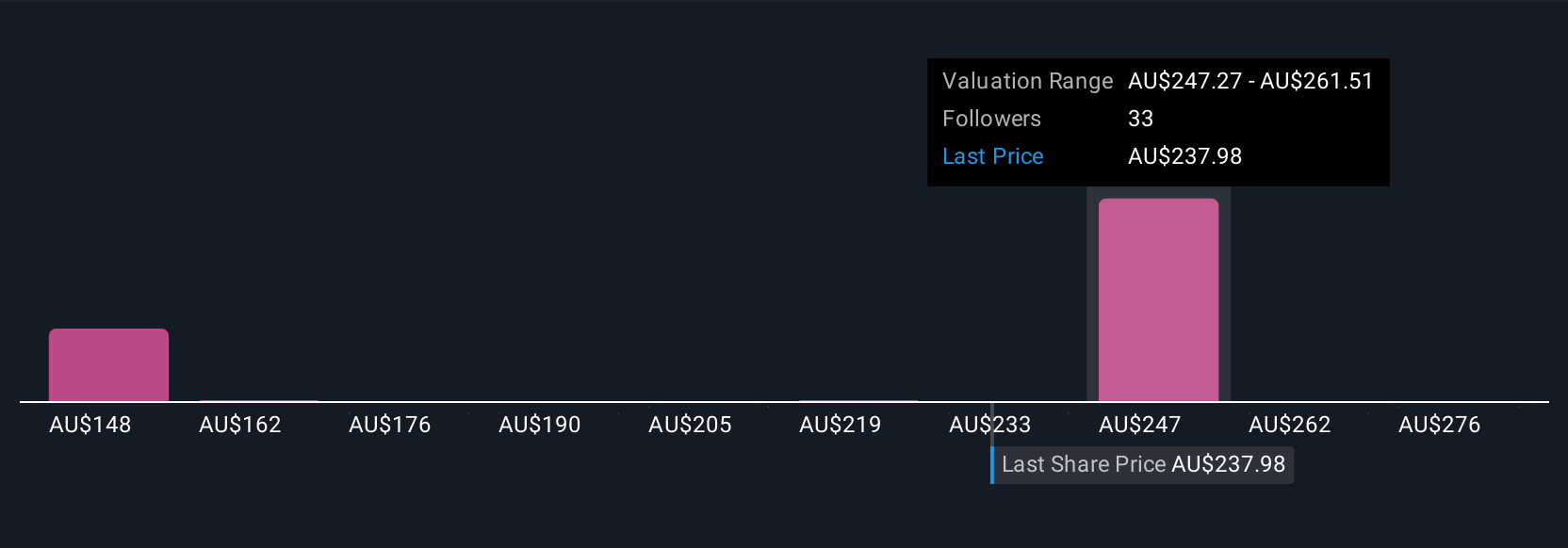

Seven Simply Wall St Community members now value REA Group between A$156 and A$300 per share, showing how far apart individual views can be. When you set those opinions against the risk that rising competition could pressure REA’s pricing power and margins, it underlines why many investors choose to compare several perspectives before forming a view.

Explore 7 other fair value estimates on REA Group - why the stock might be worth as much as 58% more than the current price!

Build Your Own REA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your REA Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free REA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate REA Group's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal