Record Black Friday-Cyber Monday Sales Despite Outage Could Be A Game Changer For Shopify (SHOP)

- Over the recent Black Friday–Cyber Monday weekend, Shopify merchants generated a record US$14.60 billion in sales, up 27% year over year, even as a Cyber Monday outage temporarily disrupted some admin and point‑of‑sale tools before being resolved.

- The surge in sales, including a 39% jump in Shop Pay usage and tens of thousands of merchants hitting their best-ever day, highlights both Shopify’s growing role in global ecommerce and how heavily merchants depend on the platform’s reliability during peak periods.

- We’ll now examine how this record Black Friday–Cyber Monday performance, despite the temporary outage, may shape Shopify’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Shopify Investment Narrative Recap

To own Shopify, you have to believe it can remain a core infrastructure provider for global ecommerce while gradually improving profitability, even at a premium valuation. The record US$14.60 billion Black Friday–Cyber Monday sales reinforce that narrative, but the Cyber Monday outage underscores that short term, platform reliability is a key catalyst and also the most immediate operational risk. For now, the incident appears material mainly as a reminder of how much is at stake during peak demand.

Against this backdrop, Shopify’s Q3 2025 results, with revenue up 32% year over year to US$2,844 million and guidance calling for mid to high 20s revenue growth in Q4, provide additional context for the holiday performance. Together, the strong merchant sales over Black Friday–Cyber Monday and ongoing revenue growth expectations frame a story where investor attention is likely to focus on how reliably Shopify converts heightened gross merchandise volume into sustained, higher margin revenue.

Yet even with record holiday sales, investors should be aware that Shopify’s dependence on uninterrupted uptime during peak periods means...

Read the full narrative on Shopify (it's free!)

Shopify's narrative projects $18.5 billion revenue and $2.7 billion earnings by 2028. This requires 22.6% yearly revenue growth and roughly a $0.4 billion earnings increase from $2.3 billion today.

Uncover how Shopify's forecasts yield a $175.43 fair value, a 8% upside to its current price.

Exploring Other Perspectives

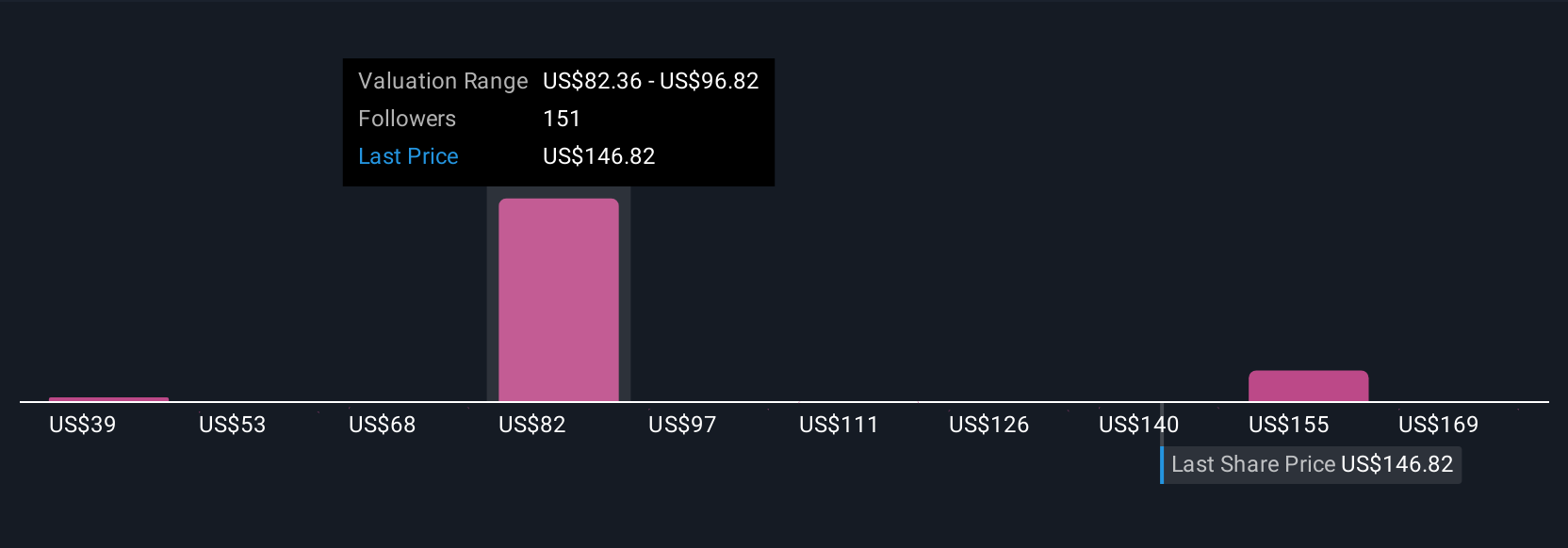

Twenty one members of the Simply Wall St Community value Shopify between US$82 and US$200 per share, with opinions spread right across that range. When you set those expectations against Shopify’s reliance on always on performance during peak events like Black Friday and Cyber Monday, it underlines why many investors are watching execution risk as closely as growth potential.

Explore 21 other fair value estimates on Shopify - why the stock might be worth as much as 23% more than the current price!

Build Your Own Shopify Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shopify research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shopify's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal