Will history repeat itself? The hot silver market raised concerns about a collapse, but analysts said “this time is different”

The Zhitong Finance App learned that the silver market has led investors on a thrilling journey this year, and the price has almost doubled. However, some analysts worry that silver is leading us to a disappointing end. These bearish sentiments are based on historical experience. After all, after hitting record highs twice in 1980 and 2011, silver then plummeted rapidly.

As a result, there is a sense of tension in the market, which is reflected in the current price fluctuations of silver. Some traders worry we'll see silver sell off as fast as it did after breaking $48 per ounce in 1980 and 2011.

Will history repeat itself? Sprott Money analyst Craig Hemke doesn't think so. He said the situation was different. “The current economic, monetary, and physical conditions are completely different from 1980 and 2011.”

Hemke didn't expect Baiyin to return to the “grandfather path” of the 80s or the “father's path” in 2011. He thinks the current pattern is more like the trajectory of “Uncle Gold” over the past few years.

Learn from history

So what happened in 1980 and 2011?

In both cases, silver quickly surged above $48 before falling back to the ground at a faster rate.

In 1980, the price of silver rose from $10 to $48 an ounce in just four months. Two months later, it went back to $10.

Beginning at the end of 2010, silver rebounded again, hitting $48 within eight months. But again, it quickly regained its gains and fell to $26 in just a few months.

This time it really looks different. Silver hit $48 on October 3 and closed above $50 for the first time the following week. It briefly consolidated around $48, tested this level several times, and then took off again in recent weeks.

The fact that silver was able to hold above $48 for so long made this round of gains different from 1980 and 2011.

Some market participants claim that silver has formed a double peak this year (a bearish sign). However, Hemke pointed out that to confirm the double peak, the silver price would need to fall below $46. “Until then, two spikes at the same level only represented a trading range and consolidation — that's all.”

Aim for gold

Hemke believes that the price pattern being displayed is more similar to gold's breakthrough market in 2023 and 2024, rather than the silver bull market in 1980 and 2011.

The market may recall that in December 2023, gold finally broke through the strong resistance level of $2,000 per ounce and surged to $2,100, then experienced a sharp reversal. After just 17 days, gold once again reached $2,100 and then sold off again. Over the next few months, gold traded sideways in the $2,000 per ounce range until March 2024, when it broke through again and soared.

When gold rebounded from $2,100 twice in a few weeks, many experts claimed it was a double top and a fake breakout. As Hemke points out, these experts have been proven wrong. It was just a period of consolidation and range trading.

“The price of gold has not peaked; it has only bottomed out within the consolidation range. The real breakthrough came 90 days later, in early March 2024.”

Hemke believes that silver also has similar technical characteristics. He wrote in late September:

“I expect the price trend of silver in the next few weeks to some extent replicate the gold trend from the end of December 2023 to the beginning of 2024. First, it rebounded to an all-time high of $48-50, then a sharp reversal. There will be several failed attempts to break through before the final and official breakout occurs. Let's use the gold chart at the end of 2023 as an analogy for our silver trend.”

Looking ahead, we are likely to see further consolidation and a period of sideways trading. But Hemke believes that the real breakthrough for silver is still in the future.

“It's not 1980, it's not 2011. The price of silver will not collapse, nor has it just formed a double peak. On the contrary, just like gold two years ago, the price of silver is bottoming out near and above its old historical high, and the real breakthrough will not be until early 2026.”

Hemke said next year's breakthrough is likely to push silver to a new all-time high.

“The price of gold has doubled since it broke through in March 2024, and a similar increase in silver will see its price reach $100 per ounce in mid to late 2027.”

Lack of silver

Fundamental factors underpin Hemke's technical analysis. The supply and demand dynamics continue to highlight the extreme bullishness for silver.

Many analysts claim that silver moved from London to New York this spring due to tariff concerns, laying the foundation for a record rise in silver in October. As demand picks up (particularly in India), traders scramble to find usable silver. The rapid transfer of silver from New York to London eased the tense situation at the time, but it did not resolve the fundamental issue.

The problem isn't that London doesn't have enough silver; the problem is that, in general, there isn't enough silver. This isn't a problem that can be solved by moving silver from one warehouse to another. The crux is that demand has been outstripping supply for several years in a row.

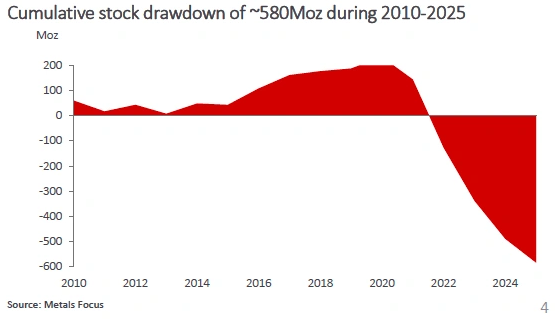

According to Metals Focus, silver is moving towards a structural market deficit for the fifth year in a row. Metals Focus predicts demand will exceed supply of 95 million ounces this year. This will bring the five-year cumulative market deficit to 820 million ounces, which is equivalent to the average mine production for a full year.

Since 2010, the silver market has accumulated a supply deficit of more than 580 million ounces.

To make up for the supply deficit, silver users will have to pull from existing ground inventory. This is likely to require a higher price. The Federal Reserve's shift to a loose monetary policy and interest rate cuts may also support Silver in the coming year.

Combining technical and fundamental aspects, there is no reason to turn bearish on silver despite the 1980 and 2011 precedents.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal