Can MP Materials Rally Continue After 277% Surge Despite Lofty Valuation Metrics?

- If you are wondering whether MP Materials is still attractive after its huge run up, you are not alone. This is exactly the kind of stock where valuation really matters.

- The share price has climbed 2.7% over the last week, 12.6% over the last month, and 277.1% year to date, with a 208.8% gain over the past year and triple digit returns over 3 and 5 years.

- Those moves have been fueled by growing investor focus on rare earths as a strategic resource and MP Materials position in the US supply chain. Policy headlines around critical minerals and long term demand for electric vehicles and clean energy technology have also kept sentiment elevated.

- Despite the excitement, MP Materials only scores 1/6 on our valuation checks. This means we will need to dig into different valuation methods and then finish by looking at a smarter way to think about what this price really implies for the company’s future.

MP Materials scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

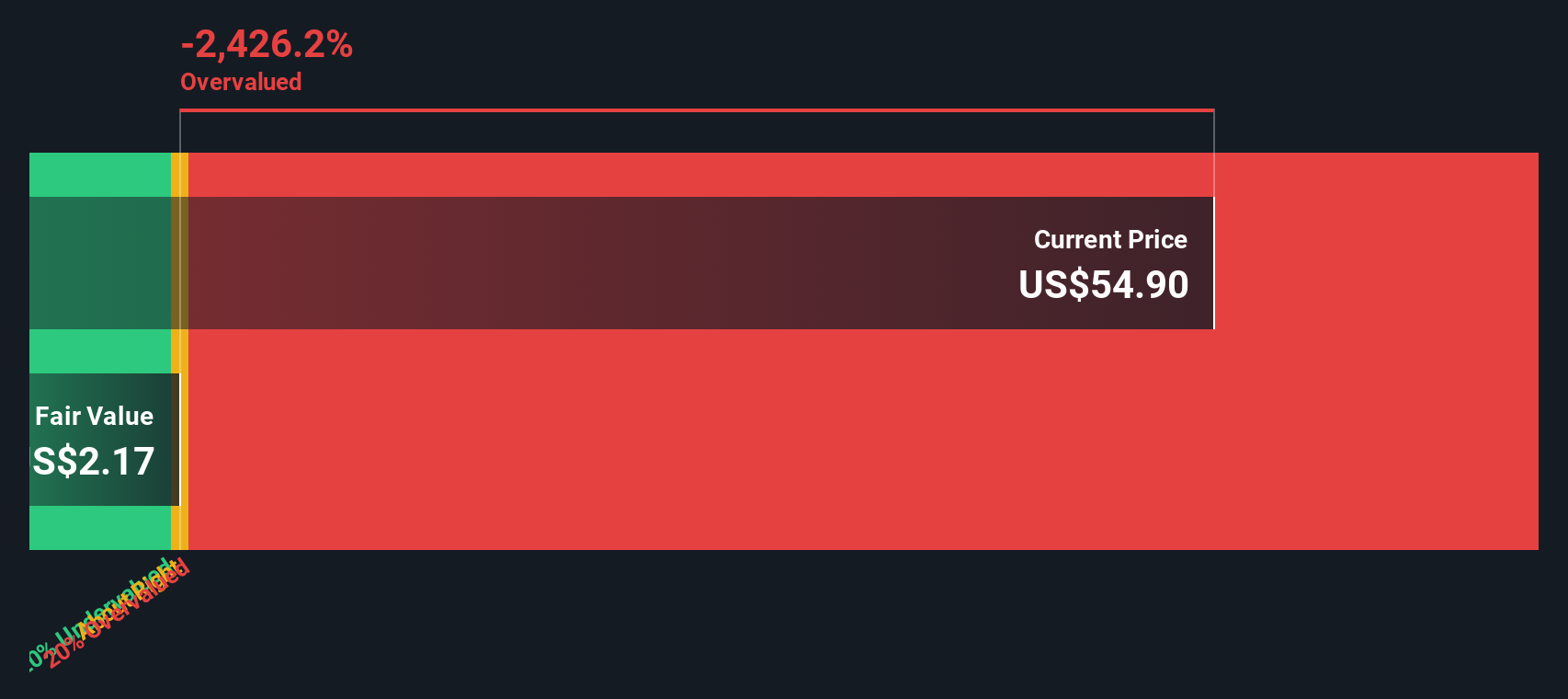

Approach 1: MP Materials Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, using an appropriate rate to reflect risk and the time value of money.

For MP Materials, the DCF is based on a 2 Stage Free Cash Flow to Equity approach using free cash flows. The latest twelve month free cash flow is deeply negative at about $294.5 Million, reflecting heavy investment and weak current cash generation. Analyst estimates and Simply Wall St extrapolations then forecast a sharp improvement, with free cash flow projected to turn positive and rise to around $243.5 Million in 2035.

When all these future cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $16.34 per share. With the DCF indicating the stock is trading about 278.1% above this fair value estimate, MP Materials screens as significantly overvalued on this cash flow basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MP Materials may be overvalued by 278.1%. Discover 911 undervalued stocks or create your own screener to find better value opportunities.

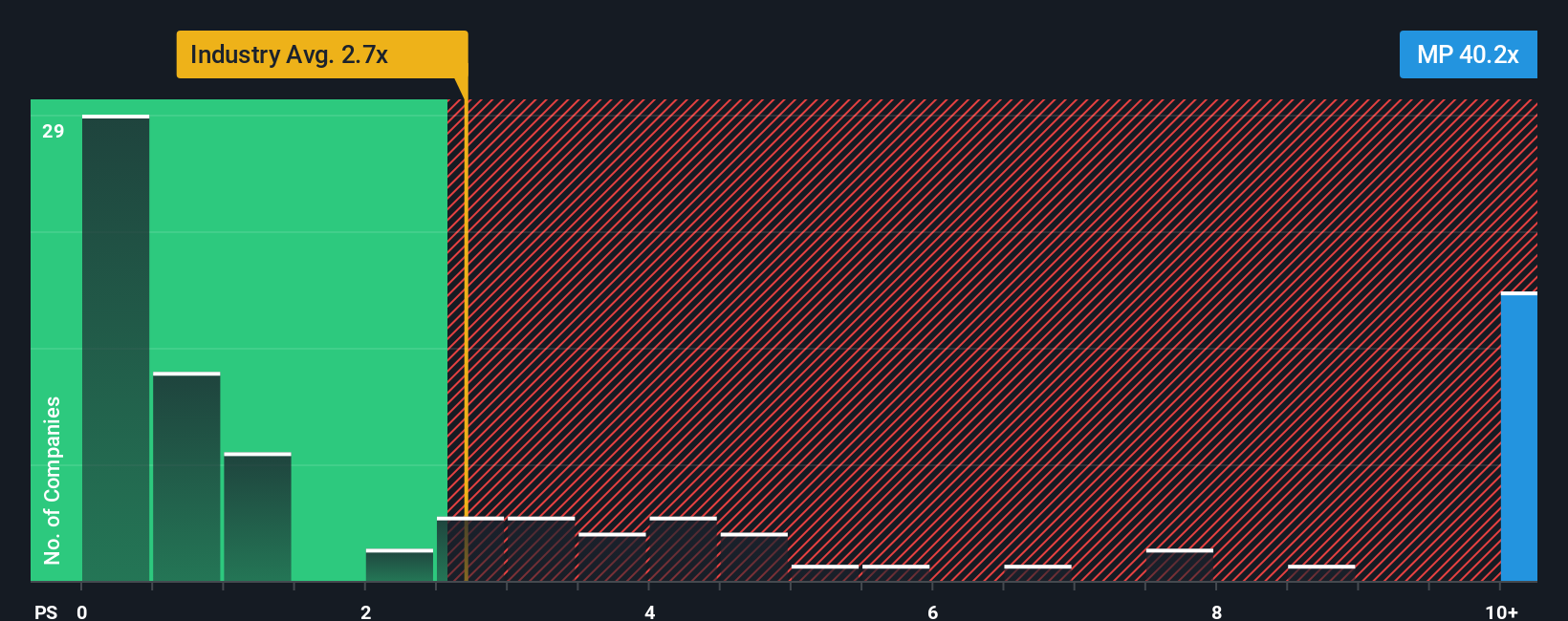

Approach 2: MP Materials Price vs Sales

For many growth focused or early stage companies where earnings are limited or volatile, the price to sales ratio is often a more useful yardstick because revenue tends to be more stable and less affected by accounting choices. Investors are usually willing to pay a higher multiple of sales when they expect stronger growth and see lower risk, while slower growth or higher uncertainty should translate into a more modest, or even discounted, multiple.

MP Materials currently trades on a price to sales ratio of about 47.1x, which is dramatically above both the Metals and Mining industry average of around 2.1x and the peer group average of roughly 0.8x. To go a step further, Simply Wall St calculates a proprietary Fair Ratio of 2.63x for MP Materials, which is the price to sales multiple the company would typically warrant after accounting for its growth prospects, profitability profile, industry, market cap and specific risks.

This Fair Ratio is more informative than a simple comparison with peers because it blends in company specific drivers such as earnings growth, risk and margins, instead of assuming all miners deserve the same multiple. With the current 47.1x price to sales ratio sitting far above the 2.63x Fair Ratio, the stock appears significantly overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

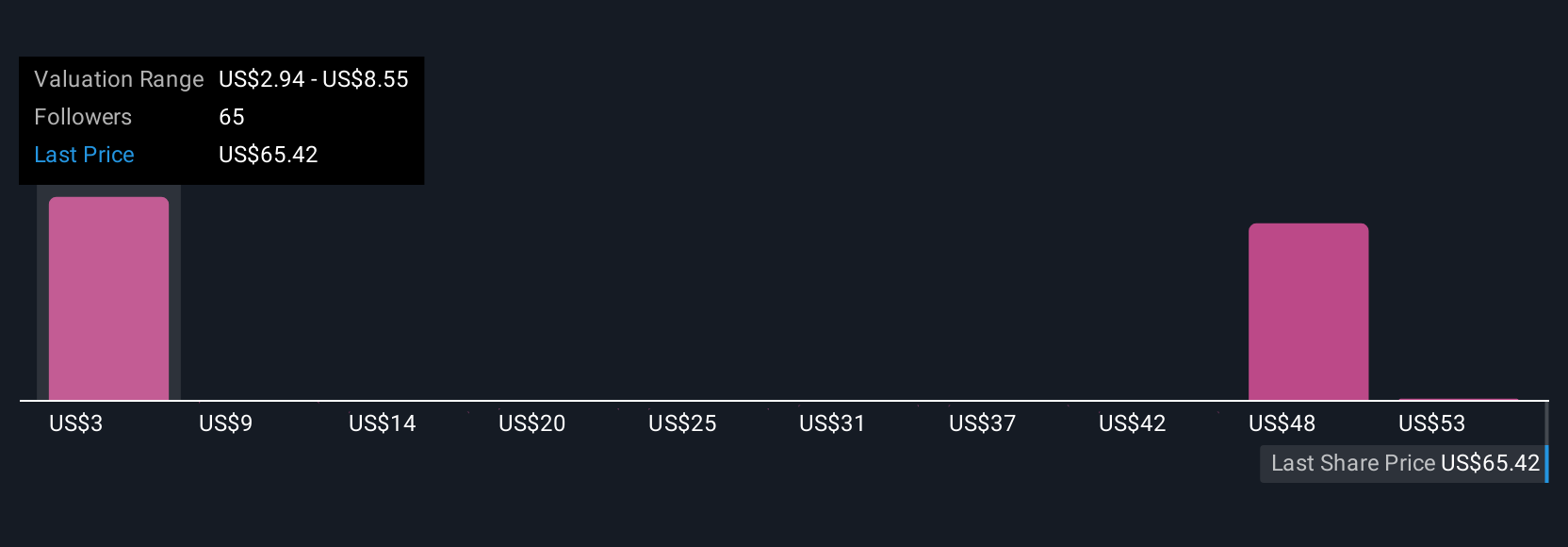

Upgrade Your Decision Making: Choose your MP Materials Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page. It lets you tell a clear story about MP Materials by linking your view of its strategy, contracts, risks and competitive position to explicit forecasts for revenue, earnings and margins, and then to a fair value that you can compare to today’s share price to decide whether to buy, hold or sell. The platform continuously refreshes your Narrative when new news or earnings arrive, and allows very different perspectives to coexist. For example, one investor might think the joint ventures, buyback and downstream expansion justify a fair value near $85. Another, more cautious investor might focus on execution and concentration risks and pin fair value closer to $65. This gives you a dynamic, side by side view of how different stories lead to different numbers for the same stock.

Do you think there's more to the story for MP Materials? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal