Reassessing ROHM (TSE:6963) Valuation After a Strong Year-To-Date Rally and Recent Pullback

ROHM (TSE:6963) has quietly pulled back over the past month, even as its year to date and 1 year returns remain strong. That gap between recent weakness and longer term strength deserves a closer look.

See our latest analysis for ROHM.

Over the past year, ROHM’s momentum has shifted gears, with a strong year to date share price return giving way to a 1 month share price pullback. The 1 year total shareholder return still looks impressive versus its flat 5 year record, hinting that expectations and perceived risk around its growth profile are being actively reassessed.

If ROHM’s swing in sentiment has you scanning for other semiconductor names with strong narratives, now is a good time to explore high growth tech and AI stocks as potential next ideas.

With ROHM’s share price rallying year to date yet stalling recently, investors now face a key question: does the current valuation underappreciate its earnings recovery potential, or is the market already pricing in most of the future growth?

Most Popular Narrative Narrative: 0.7% Undervalued

With ROHM last closing at ¥2,207.5 against a narrative fair value of ¥2,222.73, the story leans slightly toward upside while hinging on execution.

Significant cost reduction measures are being implemented, including a plan to decrease annual fixed costs by ¥20 to 30 billion over the next three years and increased outsourcing, which is expected to improve net margins and profitability.

Curious how modest revenue growth, a swing from losses to solid profits and a much higher future earnings multiple can still argue for upside? The narrative spells out the math.

Result: Fair Value of $2,222.73 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, particularly if industrial demand stays weak or SiC power device growth disappoints, which could pressure margins and derail the earnings rebound.

Find out about the key risks to this ROHM narrative.

Another Lens on Value

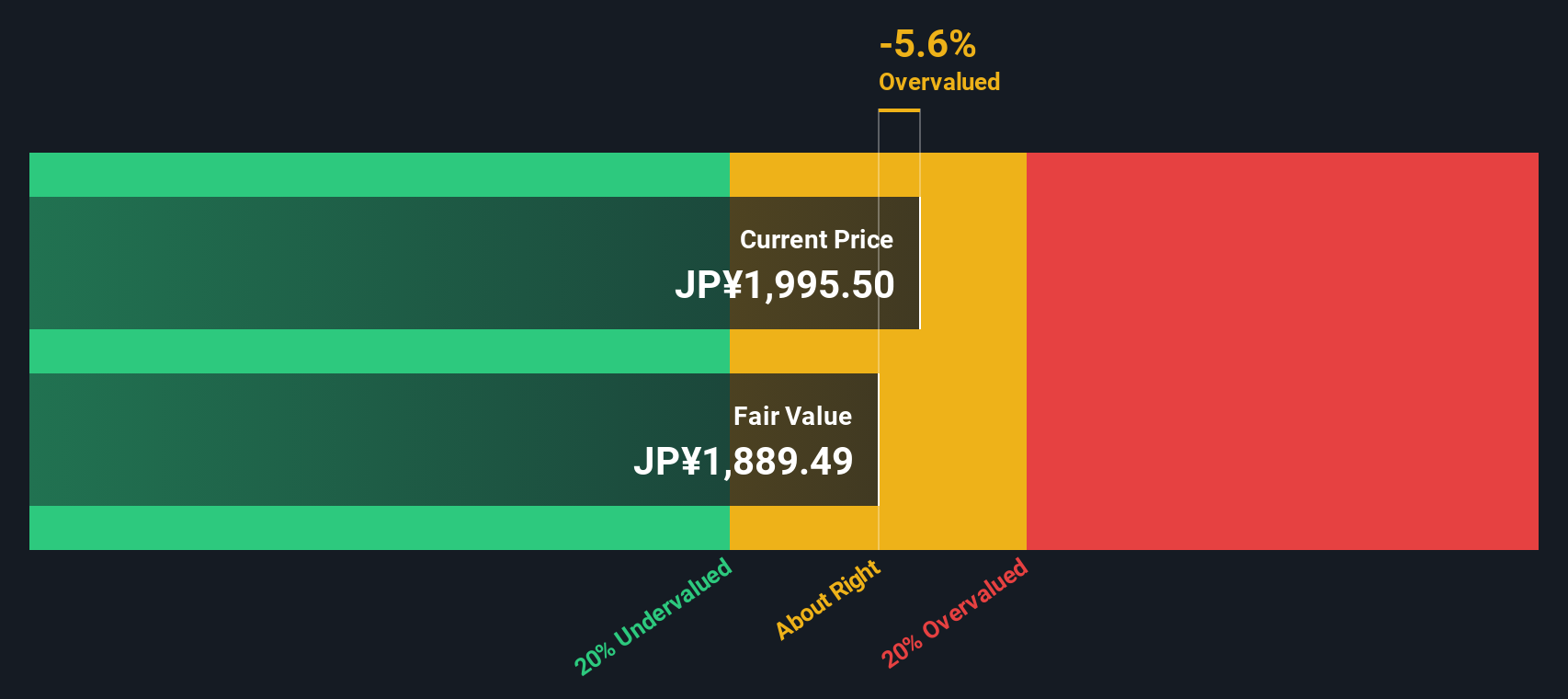

Our DCF model paints a very different picture from the near at the money narrative fair value. From this perspective, ROHM appears materially overvalued today. This suggests that more of the anticipated turnaround may already be reflected in the price than the narrative implies.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ROHM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ROHM Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a full narrative in minutes: Do it your way

A great starting point for your ROHM research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single stock. Use the Simply Wall St Screener to pinpoint fresh opportunities before everyone else starts talking about them.

- Capture mispriced quality by targeting these 909 undervalued stocks based on cash flows that pair solid cash flows with room for sentiment to catch up.

- Ride structural growth trends through these 30 healthcare AI stocks transforming diagnostics, treatment pathways and long term health outcomes.

- Position early in potential market disrupters with these 81 cryptocurrency and blockchain stocks building real businesses around blockchain infrastructure and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal