ASP Isotopes (ASPI): Reassessing Valuation as Paul Mann Prepares to Return as CEO After Earnings Miss

ASP Isotopes (ASPI) is back in focus after founder and Executive Chairman Paul Mann announced he will resume CEO duties in January 2026, following a health related leave, just as investors digest weaker recent earnings.

See our latest analysis for ASP Isotopes.

The leadership clarity seems to be reigniting interest, with a 16.4% 1 day share price return and 12.7% 7 day share price return, even though the 30 day share price return remains negative and longer term total shareholder returns are still strong.

If Mann’s return has you thinking about where leadership and growth stories might go next, it could be worth exploring fast growing stocks with high insider ownership for other potential opportunities.

With shares still well below the 13 dollar analyst price target despite strong multi year returns and rapid revenue growth, investors now face a key question: is ASP Isotopes a buy, or is future growth already priced in?

Price to Book of 10x: Is it justified?

ASPI last closed at 6.67 dollars, and the market is assigning a rich valuation multiple compared to both its industry and closest peers.

The key lens here is the price to book ratio, which compares the company’s market value to the net assets on its balance sheet. For a development stage advanced materials and nuclear fuels business like ASP Isotopes, a high price to book often signals investors are paying up today for the possibility of substantial future earnings that are not yet reflected in current book value.

In this case, ASP Isotopes trades on a price to book of 10 times, while the broader US Chemicals industry averages around 1.3 times and close peers sit nearer 2 times. That gulf suggests investors are heavily front loading expectations for the forecast rapid revenue and earnings growth, making the current valuation look expensive rather than in line with sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 10x (OVERVALUED)

However, investors face real risks if ASP Isotopes fails to convert rapid revenue growth into profitability, or if sentiment cools on high multiple nuclear fuel names.

Find out about the key risks to this ASP Isotopes narrative.

Another View: Our DCF Model

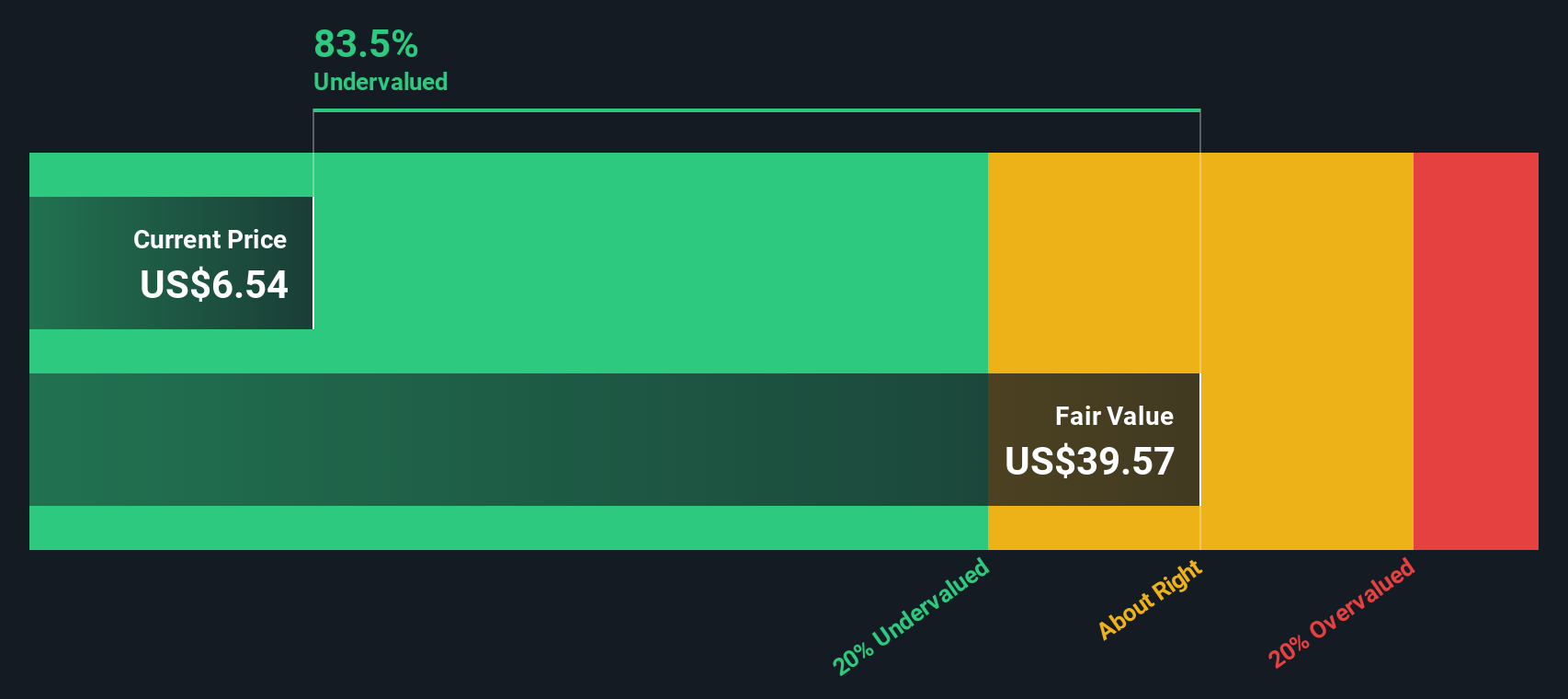

While the 10 times price to book ratio flags ASP Isotopes as expensive, our DCF model goes even further, suggesting fair value nearer 2.26 dollars, meaning the current 6.67 dollar price appears significantly higher than that estimate. This raises the question of whether the market is overestimating future cash flows or whether the models are too cautious.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASP Isotopes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASP Isotopes Narrative

If you are not fully aligned with this view or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes, starting with Do it your way.

A great starting point for your ASP Isotopes research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy and turn research into real action.

- Capitalize on powerful growth trends by targeting these 26 AI penny stocks that could reshape how industries operate and generate long term value.

- Strengthen your portfolio’s income stream by focusing on these 15 dividend stocks with yields > 3% that aim to reward shareholders with consistent cash returns.

- Position yourself early in innovative finance by evaluating these 81 cryptocurrency and blockchain stocks that are building real businesses around blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal