Undiscovered Gems in Middle East to Explore This December 2025

As Gulf markets experience gains driven by rising oil prices and anticipation of a potential U.S. Federal Reserve rate cut, the Middle East's investment landscape is garnering increased attention from investors seeking growth opportunities. In this dynamic environment, identifying promising stocks involves looking for companies with robust demand and strategic positioning to capitalize on regional economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Burjeel Holdings (ADX:BURJEEL)

Simply Wall St Value Rating: ★★★★★☆

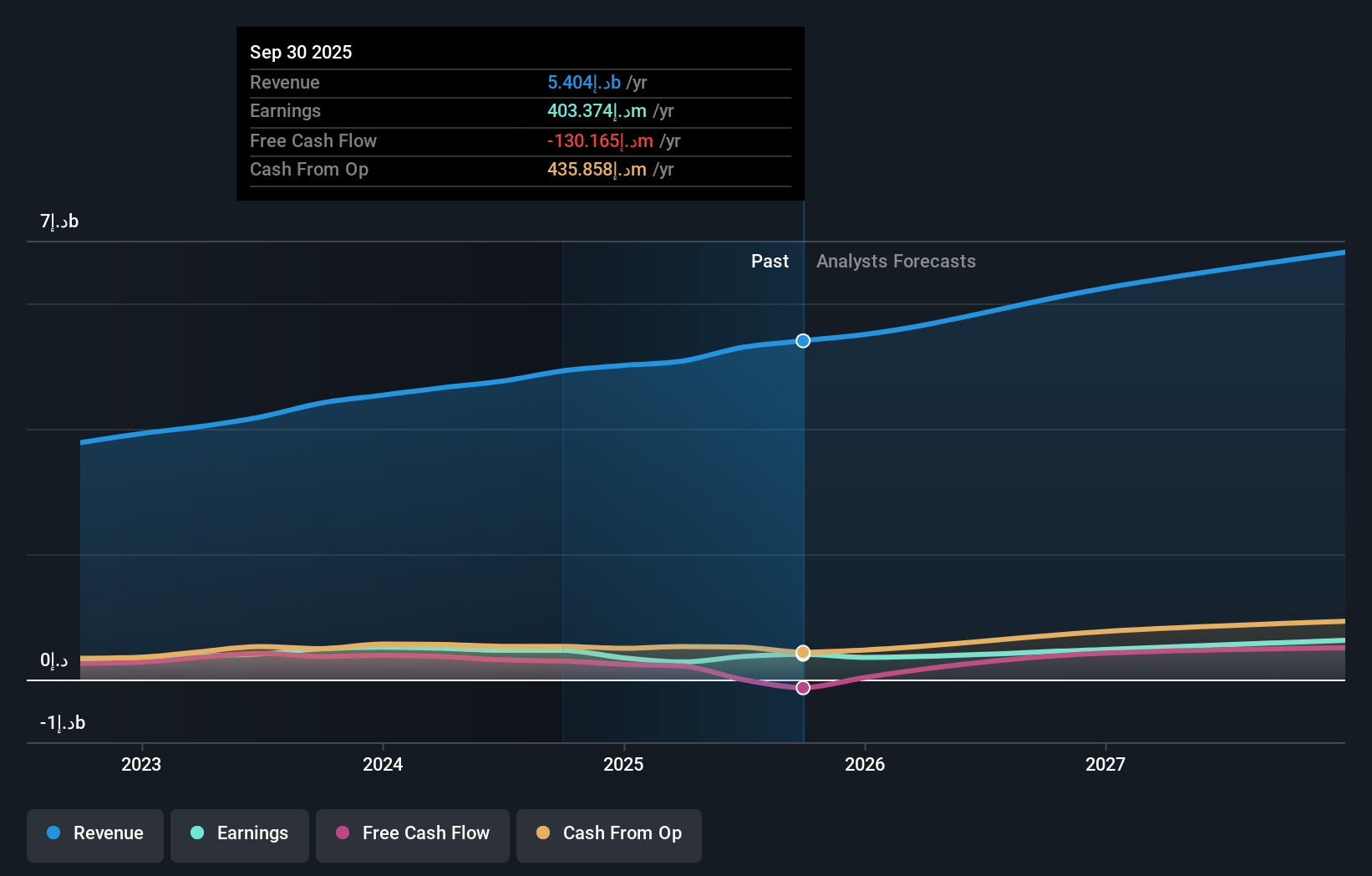

Overview: Burjeel Holdings PLC, along with its subsidiaries, operates multi-specialty hospitals and medical centers across the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia, with a market capitalization of AED7.03 billion.

Operations: The primary revenue streams for Burjeel Holdings are generated from its hospitals, contributing AED4.96 billion, and medical centers, which bring in AED442.61 million. The company also earns from pharmacies with a revenue of AED65.10 million.

Burjeel Holdings, a prominent player in the Middle East healthcare sector, is making strategic moves to expand into high-demand areas like oncology and fertility within the GCC region. The company's net debt to equity ratio stands at 78.7%, which is considered high, yet its interest payments are well covered with an EBIT coverage of 3.5 times. Despite recent negative earnings growth of -13.8% compared to the industry average of 4%, Burjeel's revenue for Q3 2025 rose to AED1.42 billion from AED1.32 billion a year ago, with net income increasing from AED130 million to AED166 million during the same period.

BrainsWay (TASE:BWAY)

Simply Wall St Value Rating: ★★★★★★

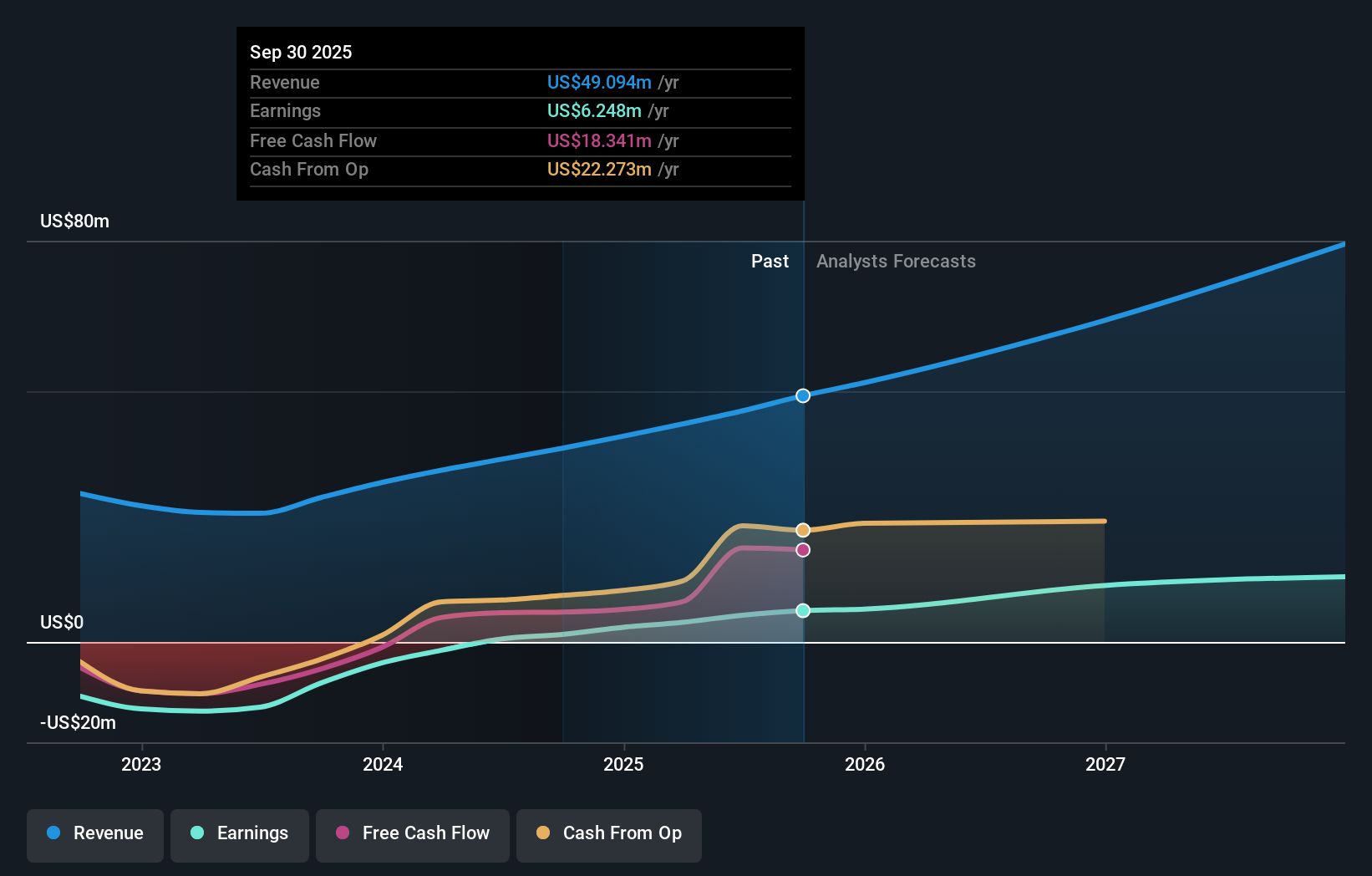

Overview: BrainsWay Ltd. is a company that develops and sells noninvasive neurostimulation treatments for mental health disorders globally, with a market capitalization of ₪1.08 billion.

Operations: BrainsWay generates revenue primarily from the development and commercialization of its Deep TMS System, amounting to $49.09 million.

BrainsWay, a promising player in the medical equipment sector, is making waves with its innovative Deep Transcranial Magnetic Stimulation (Deep TMS) technology. The company's earnings surged by 316% over the past year, outperforming the industry average of 6%. With a debt-free balance sheet and high-quality earnings, BrainsWay offers an attractive value proposition as it trades at 75% below estimated fair value. Recent FDA approvals for expanded treatment protocols and ongoing clinical trials underscore its commitment to advancing mental health treatments. The launch of a multicenter trial for Alcohol Use Disorder highlights BrainsWay's dedication to tackling complex neurological challenges.

- Click here and access our complete health analysis report to understand the dynamics of BrainsWay.

Evaluate BrainsWay's historical performance by accessing our past performance report.

Lapidoth Capital (TASE:LAPD)

Simply Wall St Value Rating: ★★★★★☆

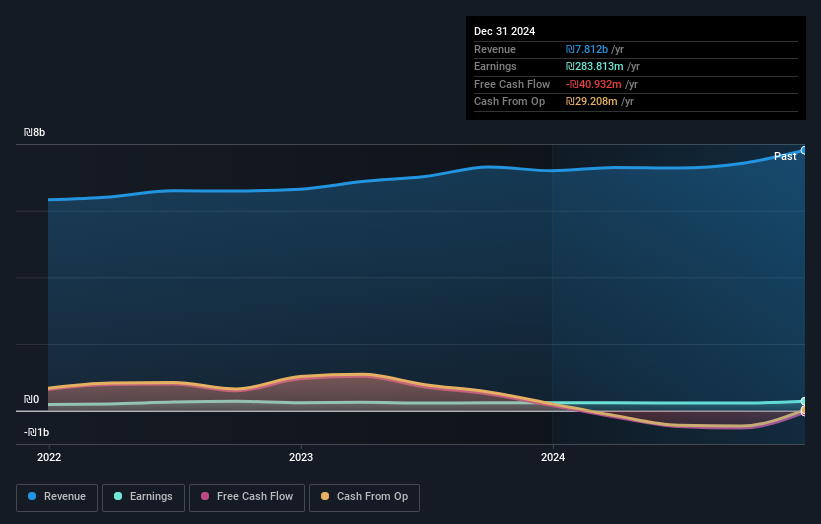

Overview: Lapidoth Capital Ltd, with a market cap of ₪5.65 billion, operates through its subsidiaries to offer drilling and related services across Israel, Romania, the United States, Poland, the rest of Europe, and internationally.

Operations: Lapidoth Capital's revenue primarily stems from its Dania segment, contributing ₪6.58 billion, and Sunny Communications, adding ₪994.25 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Lapidoth Capital, a noteworthy player in the Energy Services sector, has demonstrated impressive financial health with a 21.6% earnings growth over the past year, outpacing the industry average of 8.6%. The company's debt to equity ratio has significantly improved from 192.3% to a more manageable 47.2% over five years, indicating effective debt management strategies. Additionally, Lapidoth's net debt to equity ratio stands at a satisfactory 12.1%. A notable one-off gain of ₪120 million impacted its recent financial results positively. Recently announced plans for share repurchases worth ILS 50 million reflect confidence in its future prospects and stability.

- Dive into the specifics of Lapidoth Capital here with our thorough health report.

Assess Lapidoth Capital's past performance with our detailed historical performance reports.

Summing It All Up

- Unlock our comprehensive list of 184 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal