How Investors May Respond To First Industrial Realty Trust (FR) Activist Campaign To Close NAV Discount

- On December 4, 2025, activist investor Land & Buildings Investment Management issued a presentation arguing that First Industrial Realty Trust’s warehouse portfolio is undervalued versus private market benchmarks and public peers, and urged the company to take all necessary steps to close its discount to net asset value, including considering strategic alternatives.

- The activist contends that First Industrial has around 30% upside to its net asset value, spotlighting a potential gap between the REIT’s underlying industrial real estate quality and how public markets currently assess that portfolio.

- We’ll now examine how Land & Buildings’ push to unlock this perceived value gap could reshape First Industrial’s investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

First Industrial Realty Trust Investment Narrative Recap

To own First Industrial Realty Trust, you need to believe in the long term appeal of its warehouse portfolio and the durability of industrial demand, alongside a steady dividend. The Land & Buildings campaign focuses squarely on the share price discount to underlying real estate value, but it does not fundamentally change the core near term catalyst of execution on leasing and development, nor the key risk around balance sheet flexibility and funding in a capital intensive business.

The most relevant recent announcement here is the October 29 dividend declaration of US$0.445 per share, which maintained the materially higher payout set earlier in 2025. That consistency signals management’s confidence in current cash flows, but also ties into the activist debate about capital allocation, as higher dividends compete with reinvestment in developments that underpin future earnings growth and any effort to close the apparent value gap.

However, investors should also be aware that the company’s debt is not well covered by operating cash flow, which could...

Read the full narrative on First Industrial Realty Trust (it's free!)

First Industrial Realty Trust's narrative projects $866.2 million revenue and $270.0 million earnings by 2028.

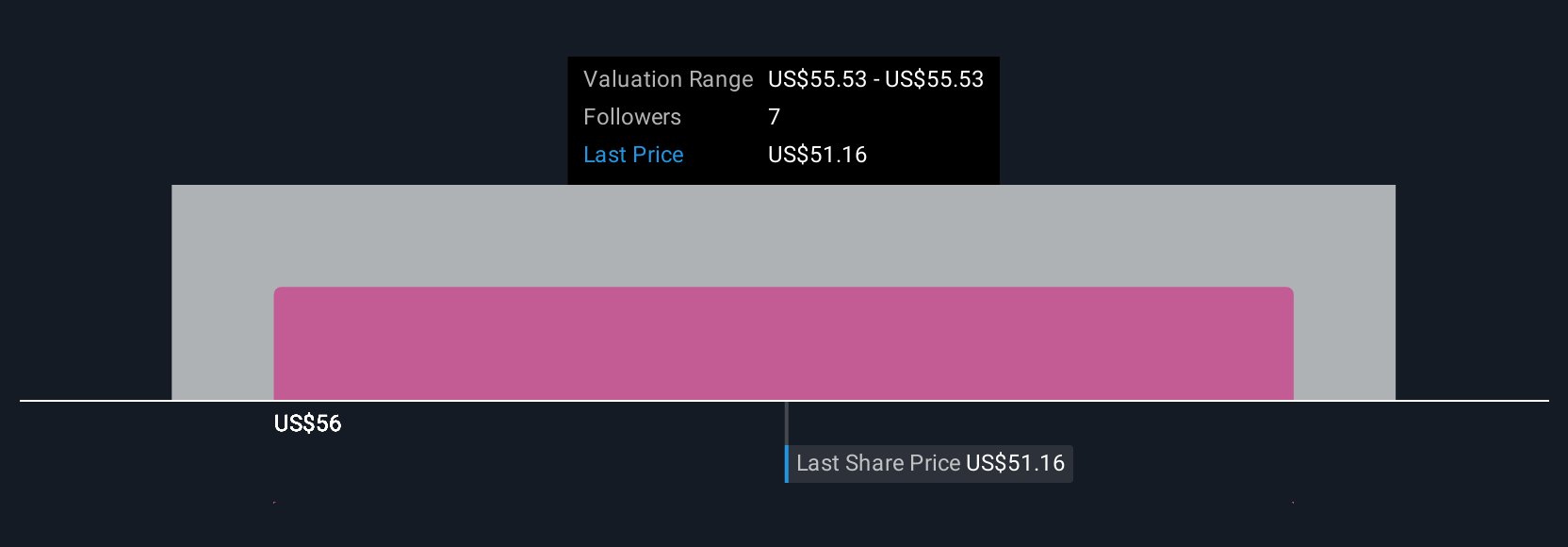

Uncover how First Industrial Realty Trust's forecasts yield a $59.50 fair value, a 5% upside to its current price.

Exploring Other Perspectives

The single fair value estimate of US$59.50 from the Simply Wall St Community shows how one private investor frames First Industrial’s potential. You can compare that with the activist focus on narrowing the discount to underlying real estate value and consider how both might influence the company’s ability to sustain growth and dividends over time.

Explore another fair value estimate on First Industrial Realty Trust - why the stock might be worth just $59.50!

Build Your Own First Industrial Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Industrial Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Industrial Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Industrial Realty Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal