Arista Networks (ANET): Assessing Valuation After a 16% Pullback in the Share Price

Arista Networks (ANET) has had a choppy stretch lately, with the stock roughly flat over the past week but down sharply over the past month, inviting a closer look at whether the pullback matches the fundamentals.

See our latest analysis for Arista Networks.

That 16.3% 1 month share price pullback looks more like a breather within a strong multi year run, with Arista still boasting a 5 year total shareholder return above 600 percent. This suggests that long term momentum remains firmly intact.

If Arista’s move has you thinking about where growth in networking and cloud might go next, it could be worth scanning high growth tech and AI stocks for other potential standouts.

With robust double digit revenue growth, hefty margins, and a share price still trading well below the average analyst target, the real question now is whether Arista remains undervalued or if markets already price in its next leg of growth.

Most Popular Narrative Narrative: 21.7% Undervalued

With the most popular narrative putting fair value around $164 versus the last close at $128.55, the story leans heavily on sustained AI driven networking demand.

The migration of AI networking from proprietary standards (InfiniBand, NVLink) to open Ethernet solutions is expanding Arista's addressable market, expected to drive sustained multi year revenue growth as hyperscalers and enterprises favor open, scalable architectures for both back end and front end AI clusters.

Want to see what powers that upside view? The narrative focuses on ambitious revenue compounding, resilient margins, and a rich future earnings multiple. Curious which assumptions really move the dial?

Result: Fair Value of $164.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on a few hyperscalers and intensifying competition from Cisco and NVIDIA could quickly pressure Arista’s margins and high growth expectations.

Find out about the key risks to this Arista Networks narrative.

Another Angle on Valuation

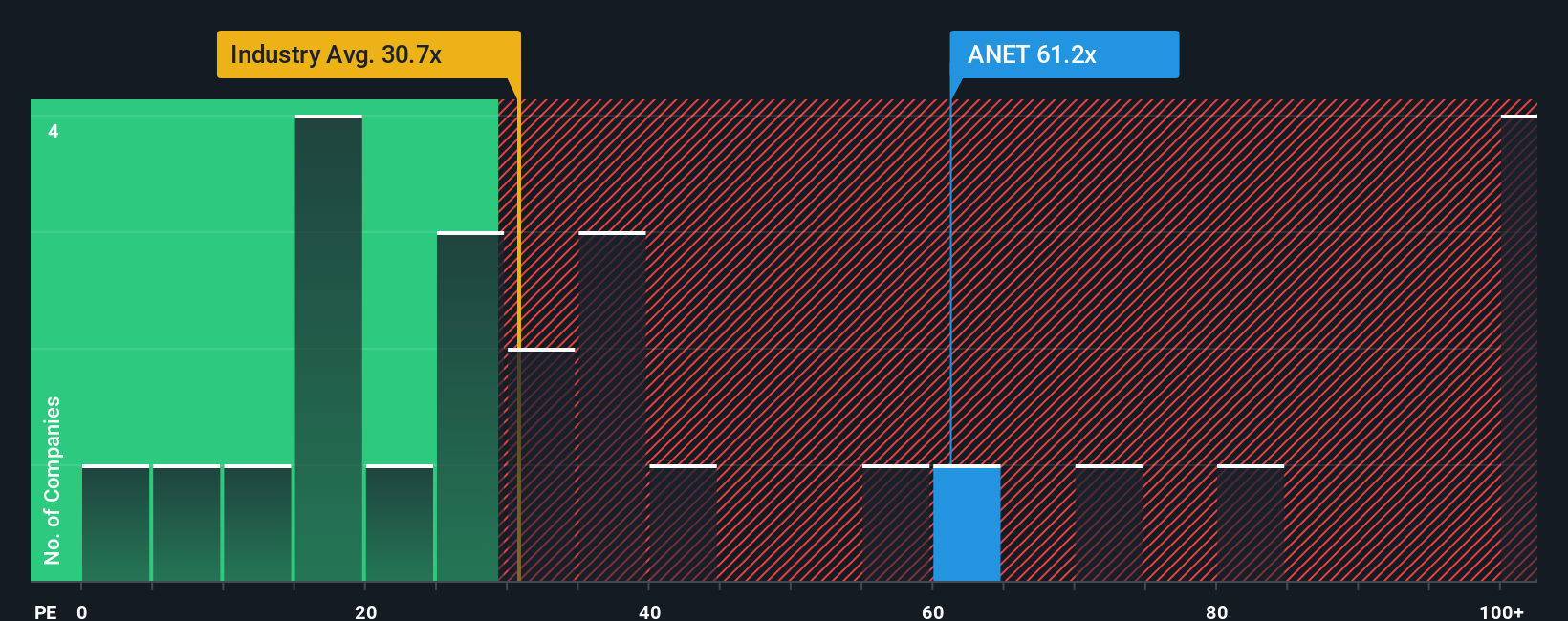

On earnings, Arista looks expensive. Its P E of 48.2 times stands well above both the US Communications sector at 31.5 times and peers at 30.7 times, and even its own 39 times fair ratio, suggesting limited room for disappointment if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arista Networks Narrative

If you are not fully convinced by this perspective, or prefer digging into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Arista when the market is full of potential. Use the Simply Wall Street Screener now so fresh opportunities never slip past you.

- Capture potential multi baggers early by scanning these 3572 penny stocks with strong financials that already show stronger balance sheets and earnings quality than typical speculative names.

- Capitalize on the AI wave by targeting these 26 AI penny stocks positioned at the intersection of data, automation, and scalable software driven demand.

- Lock in quality at a discount by filtering for these 909 undervalued stocks based on cash flows where cash flows suggest upside that the broader market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal