Tecsys (TSX:TCS) Margin Rebound Supports Bullish Narratives Despite Premium Valuation

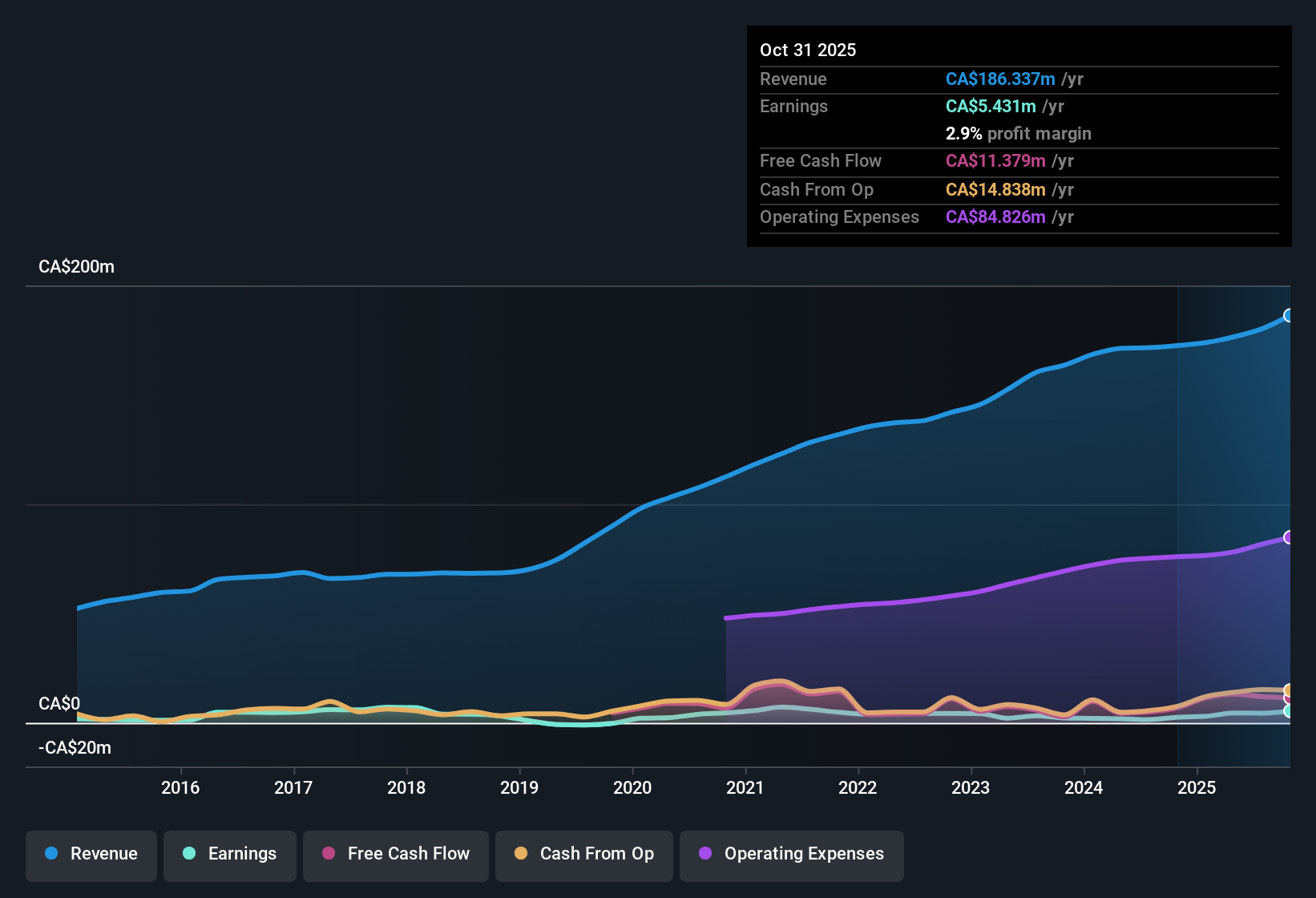

Tecsys (TSX:TCS) just posted its Q2 2026 numbers, with quarterly revenue of about CA$46.0 million and basic EPS of CA$0.05, set against a trailing twelve month revenue base of roughly CA$180.1 million and EPS of CA$0.30 that reflects a 199.7% year over year earnings jump. The company has seen revenue move from CA$171.2 million to CA$180.1 million over the past few reported trailing periods, while quarterly revenue has stepped from CA$42.4 million in Q2 2025 to about CA$46.0 million. This lays the groundwork for a narrative in which improving margins sit at the center of the story investors are watching.

See our full analysis for Tecsys.With the latest figures on the table, the next step is to compare these results with the most common narratives around Tecsys, highlighting where the data confirms the story and where it starts to move in a different direction.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Climbs to 2.5%

- On a trailing twelve month basis, Tecsys generated CA$4.4 million of net income on CA$180.1 million of revenue, equating to a 2.5% net profit margin compared with 0.9% a year earlier.

- What stands out for a bullish view is that net income has risen from CA$1.5 million to CA$4.4 million over the trailing periods while the margin improved to 2.5%, which supports the idea of higher quality earnings even though revenue growth is more modest.

- Supporters can point to the 199.7% year over year earnings increase alongside this margin move as evidence that the business is converting more of its revenue into profit than in the recent past.

- At the same time, the five year annualized earnings decline of 14.8% reminds investors that this margin profile is still relatively new compared with the longer history.

Revenue Growth Running Near 8%

- Revenue on a trailing twelve month basis has risen from CA$171.2 million to CA$180.1 million, and is forecast to grow about 8% per year, ahead of the Canadian market expectation of roughly 4.6% per year.

- From a bullish angle, the combination of mid single digit to high single digit revenue expansion and much stronger trailing twelve month earnings growth heavily supports the idea that Tecsys is executing well in its supply chain and healthcare focused markets.

- Investors who favor the bullish story can note that quarterly revenue has stepped from CA$42.4 million in Q2 2025 to about CA$46.0 million now while earnings over the same trailing period climbed 199.7%.

- That mix of faster than market revenue growth and improving profitability gives bulls specific figures to track as they judge whether the recent performance can be sustained.

Premium P/E but DCF Upside

- Tecsys trades on a trailing P/E of 110.9x compared with a peer average of 58.3x and a Canadian Software industry average of 49.1x, yet the CA$33.27 share price sits below both an analyst target of CA$46.25 and a DCF fair value of about CA$69.63.

- For a more cautious, valuation focused take, critics highlight that the five year annualized earnings decline of 14.8% sits uncomfortably next to the 110.9x P/E, even though the stock is shown as trading materially below both the DCF fair value and the analyst target.

- Investors weighing the bearish side can reasonably question whether a business whose earnings fell on average 14.8% per year over five years should carry a multiple more than double its software peers.

- On the other hand, the roughly 39% gap to the CA$46.25 analyst target and the larger gap to the CA$69.63 DCF fair value give number driven investors a clear benchmark for potential upside if recent earnings and margin gains persist.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tecsys's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Tecsys' impressive recent margin rebound and earnings spike sit uncomfortably alongside a five year record of shrinking profits and a premium earnings multiple.

If you want more consistent execution than this mixed track record offers, use our stable growth stocks screener (2081 results) to quickly focus on businesses delivering steadier, through cycle growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal