Applied Digital (APLD) Is Up 17.7% After Securing US$16 Billion In AI Data Center Contracts

- Applied Digital recently completed the second 50 MW phase at Building 1 of its Polaris Forge 1 AI Factory Campus in North Dakota, bringing the facility to its full 100 MW critical IT load under long-term hyperscale leases.

- Together with a new US$5 billion lease at Polaris Forge 2 and a US$25 million lead investment in chip-cooling specialist Corintis, the company now has roughly US$16 billion of contracted AI data center revenue that reinforces its push into high-density, energy-efficient infrastructure.

- We’ll now examine how this surge in long-term hyperscale leases and AI-focused infrastructure investment could reshape Applied Digital’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Applied Digital Investment Narrative Recap

To own Applied Digital, you need to believe its pivot from crypto-heavy hosting to long-duration AI data center leases can justify today’s premium valuation and heavy build-out. The latest Polaris Forge milestones and US$16 billion contracted revenue strengthen the near term catalyst of securing and executing hyperscale AI leases, but they also magnify the key risk around funding this gigawatt-scale expansion with substantial debt and preferred equity.

The most relevant recent announcement here is Applied Digital’s planned US$2.35 billion senior secured notes offering and access to up to US$5 billion in preferred equity from Macquarie, which together underpin the Polaris Forge build-out that supports those long-term AI leases. These funding moves help reduce immediate common equity dilution but raise the stakes if utilization or additional hyperscaler demand falls short of expectations.

Yet behind this rapid AI build out, investors also need to be aware of the growing balance sheet strain and what happens if...

Read the full narrative on Applied Digital (it's free!)

Applied Digital's narrative projects $755.7 million revenue and $102.2 million earnings by 2028. This requires 73.7% yearly revenue growth and a $263.2 million earnings increase from -$161.0 million.

Uncover how Applied Digital's forecasts yield a $43.70 fair value, a 49% upside to its current price.

Exploring Other Perspectives

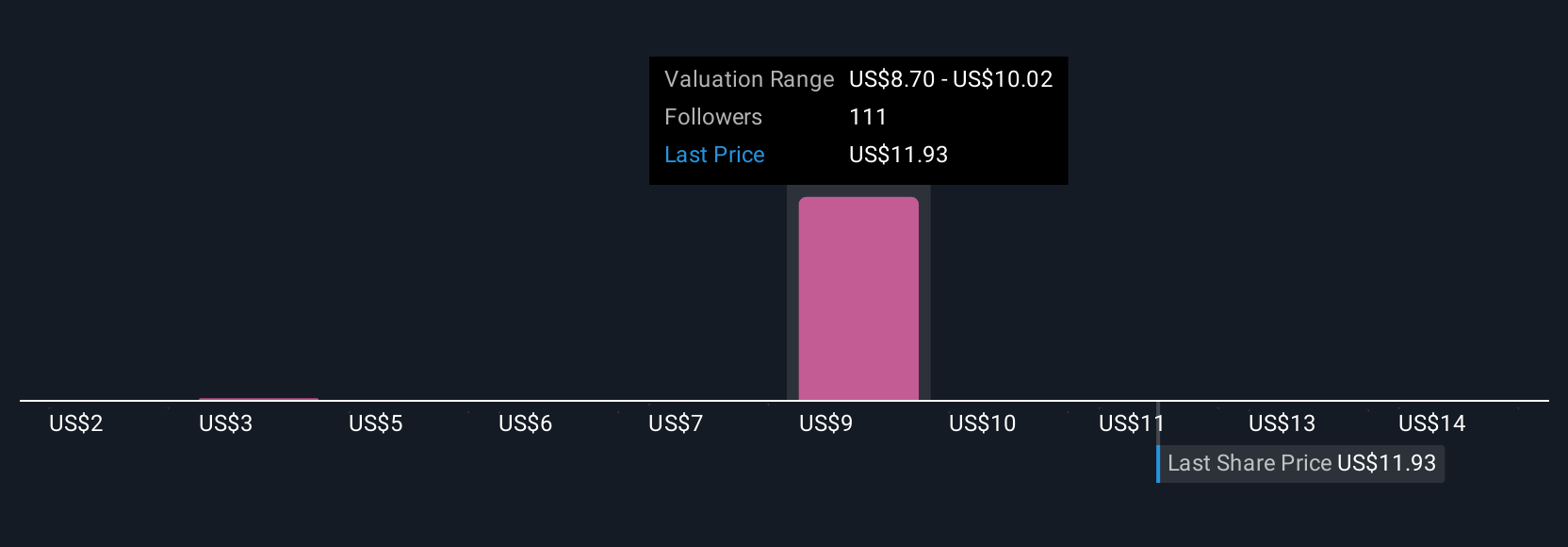

Thirty two members of the Simply Wall St Community see fair value for Applied Digital anywhere between US$3.68 and US$43.70, underlining very different expectations for long term outcomes. Before you anchor on any one view, remember that the same aggressive AI campus expansion that underpins those bullish targets also relies on rising leverage and successful execution at gigawatt scale, so it can be helpful to compare several of these perspectives side by side.

Explore 32 other fair value estimates on Applied Digital - why the stock might be worth less than half the current price!

Build Your Own Applied Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Applied Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Digital's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal