After Leaping 35% GoFintech Quantum Innovation Limited (HKG:290) Shares Are Not Flying Under The Radar

GoFintech Quantum Innovation Limited (HKG:290) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The annual gain comes to 184% following the latest surge, making investors sit up and take notice.

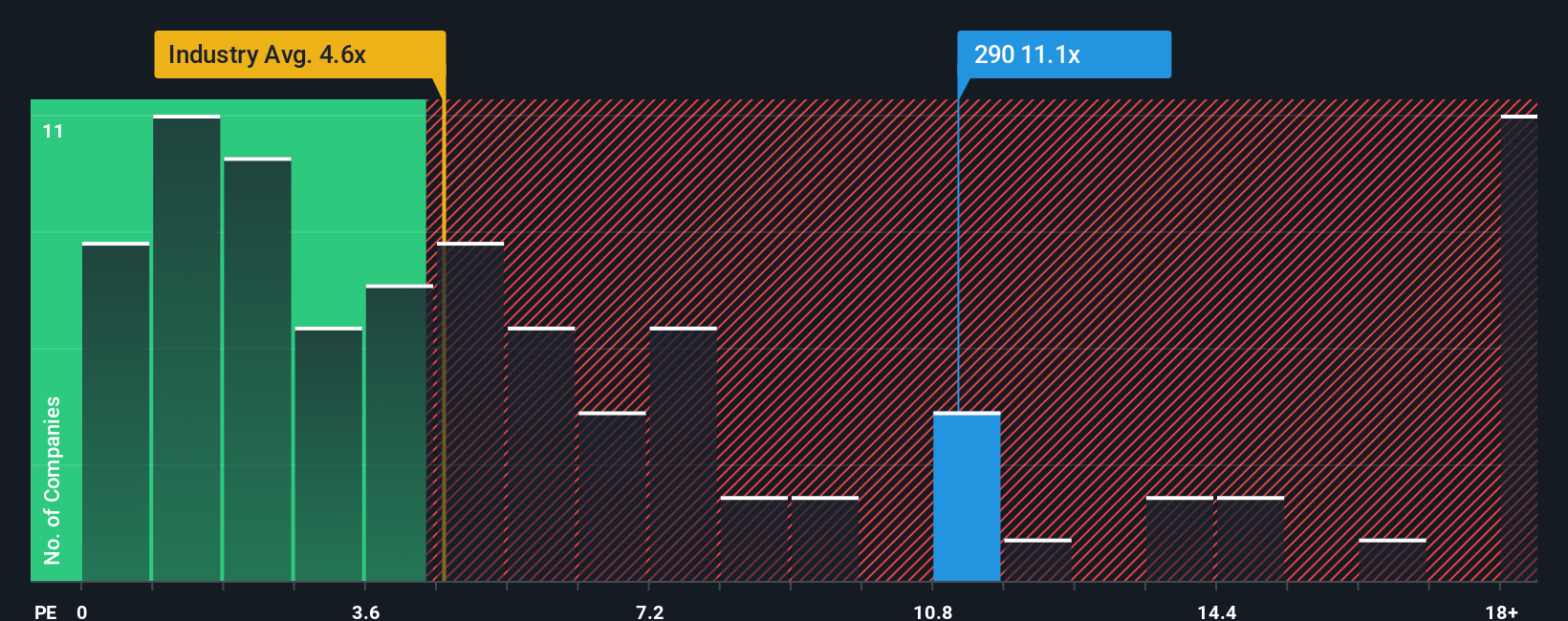

After such a large jump in price, GoFintech Quantum Innovation may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 11.1x, since almost half of all companies in the Capital Markets industry in Hong Kong have P/S ratios under 4.6x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for GoFintech Quantum Innovation

What Does GoFintech Quantum Innovation's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, GoFintech Quantum Innovation has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on GoFintech Quantum Innovation's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For GoFintech Quantum Innovation?

In order to justify its P/S ratio, GoFintech Quantum Innovation would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 16%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why GoFintech Quantum Innovation's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From GoFintech Quantum Innovation's P/S?

Shares in GoFintech Quantum Innovation have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that GoFintech Quantum Innovation can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for GoFintech Quantum Innovation that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal