Brown-Forman (BF.B) Is Up 5.1% After Q2 Sales And Earnings Decline - Has The Bull Case Changed?

- Brown-Forman Corporation has reported past results for the fiscal second quarter ended October 31, 2025, with sales falling to US$1,036 million and net income to US$224 million, down from US$1,095 million and US$258 million a year earlier.

- The drop in both quarterly and six-month earnings per share, despite product launches like Jack Daniel’s Blackberry gaining traction, is sharpening investor focus on softer trends in core developed markets.

- We’ll now examine how this earnings slowdown, especially the year-over-year decline in sales and net income, reshapes Brown-Forman’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Brown-Forman Investment Narrative Recap

To own Brown-Forman, you need to believe its brands and premium focus can offset pressure in mature spirits markets over time. The latest quarter’s softer sales and earnings confirm that weaker developed-market demand remains the key near term risk, while the most important catalyst is whether innovation and international growth can stabilize overall volumes. This earnings slowdown reinforces, rather than changes, that core investment debate.

Among recent announcements, the 2% dividend increase in November stands out against the backdrop of declining first half earnings, suggesting management still sees the current profit level as supportable. For investors watching near term catalysts, that dividend move sits alongside product launches like Jack Daniel’s Blackberry and New Mix RTDs as the company leans on brand extensions and pricing to offset sluggish developed-market trends.

Yet for all of this, the bigger issue investors should be aware of is how persistent declines in key developed markets could...

Read the full narrative on Brown-Forman (it's free!)

Brown-Forman's narrative projects $4.1 billion revenue and $870.2 million earnings by 2028. This requires 1.5% yearly revenue growth and about a $26 million earnings increase from $844.0 million today.

Uncover how Brown-Forman's forecasts yield a $30.91 fair value, a 3% upside to its current price.

Exploring Other Perspectives

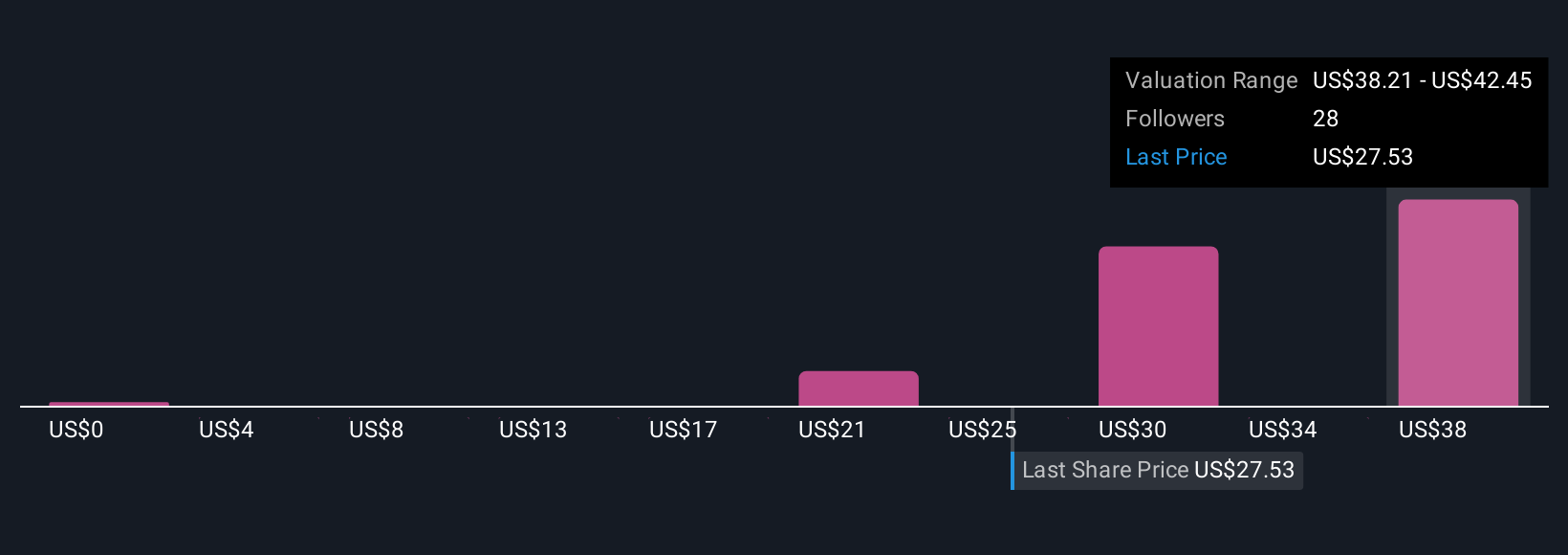

Nine members of the Simply Wall St Community value Brown-Forman between about US$4.22 and US$42.19 per share, highlighting sharply different expectations. When you set those views against the risk of ongoing volume and consumption declines in core developed spirits markets, it becomes even more important to compare several perspectives on what could shape the company’s future performance.

Explore 9 other fair value estimates on Brown-Forman - why the stock might be worth as much as 40% more than the current price!

Build Your Own Brown-Forman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brown-Forman research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brown-Forman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brown-Forman's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal