Optimism for ezCaretech (KOSDAQ:099750) has grown this past week, despite one-year decline in earnings

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the ezCaretech Co., LTD (KOSDAQ:099750) share price is up 13% in the last year, that falls short of the market return. The longer term returns have not been as good, with the stock price only 1.1% higher than it was three years ago.

Since the stock has added ₩22b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, ezCaretech actually saw its earnings per share drop 2.0%.

The mild decline in EPS may be a result of the fact that the company is more focused on other aspects of the business, right now. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

Unfortunately ezCaretech's fell 5.8% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

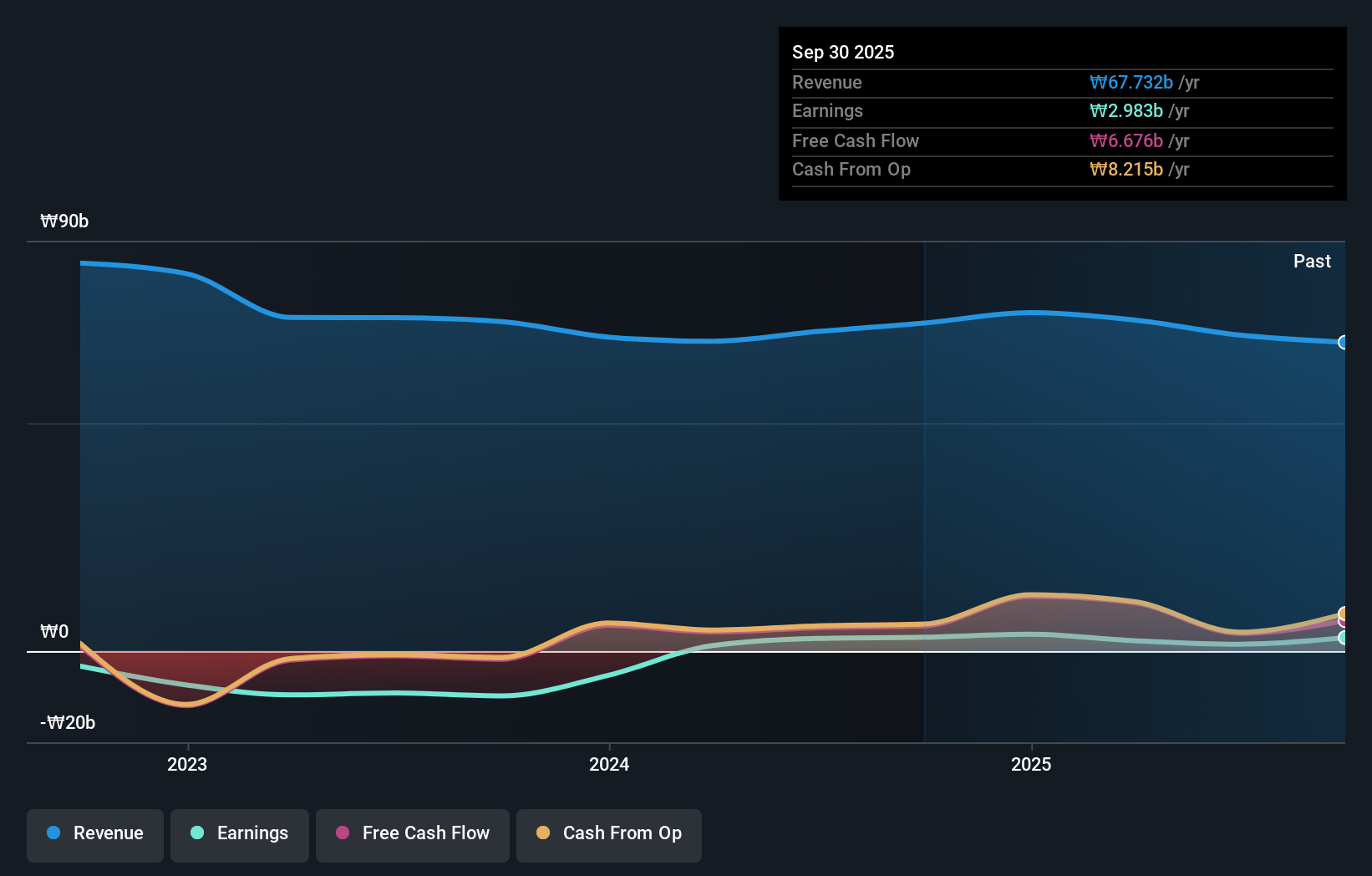

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling ezCaretech stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

ezCaretech shareholders gained a total return of 13% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 0.8% per year over five year. This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - ezCaretech has 1 warning sign we think you should be aware of.

We will like ezCaretech better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal