Is IDC’s AI Database Leadership Nod Reshaping The Investment Case For Open Text (OTEX)?

- In 2025, OpenText was named a Leader in the IDC MarketScape for Worldwide Analytical Databases, reflecting the strength of its AI-powered OpenText Analytics Database, which supports real-time, petabyte-scale workloads across on-premises, private, and public cloud deployments with a focus on security and control.

- This recognition underscores OpenText’s growing relevance as enterprises modernize data analytics infrastructure and seek large-scale, secure AI analytics platforms to handle expanding data volumes.

- We’ll now examine how OpenText’s leadership in AI-powered analytical databases may influence its existing investment narrative and future positioning.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Open Text Investment Narrative Recap

To own OpenText, you generally need to believe its pivot toward cloud and AI can more than offset pressure from declining legacy maintenance and restructuring noise. The IDC MarketScape recognition reinforces OpenText’s AI positioning, but does not materially change the near term focus on stabilizing slower growth businesses and executing its optimization plan, which remain key catalysts and risks for the story right now.

The recent launch of the OpenText AI Data Platform (AIDP) ties directly into this IDC recognition, since both center on secure, large scale analytics and AI for enterprises. Together they frame a clearer path for how OpenText aims to deepen data and AI integration across its portfolio, which could be important as investors watch for proof that newer cloud and AI offerings can offset weaker areas and justify ongoing investment and restructuring.

However, investors should also be aware of the risk that persistent weakness in key units, particularly cybersecurity, could...

Read the full narrative on Open Text (it's free!)

Open Text's narrative projects $5.4 billion revenue and $862.6 million earnings by 2028.

Uncover how Open Text's forecasts yield a $40.45 fair value, a 21% upside to its current price.

Exploring Other Perspectives

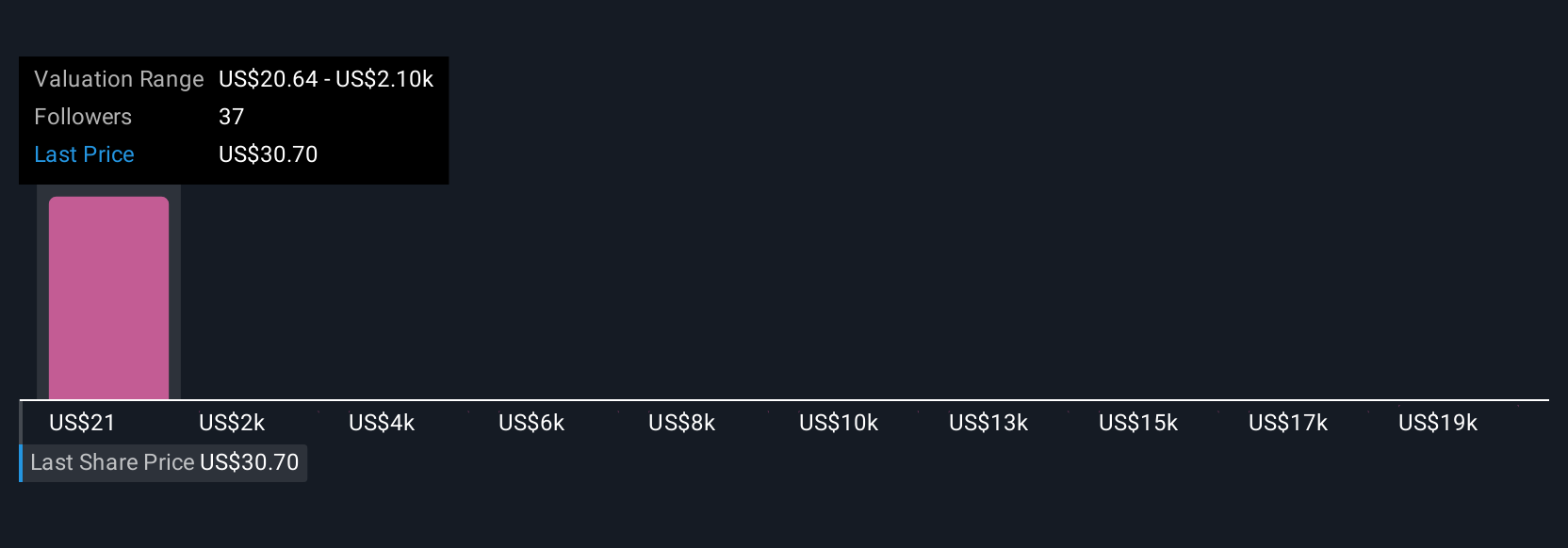

Six members of the Simply Wall St Community currently estimate OpenText’s fair value between US$21.43 and US$68.12, highlighting very different expectations. Against this spread, the company’s push into AI powered analytics stands out as a potential swing factor for future performance, so it can be worth comparing several of these viewpoints side by side.

Explore 6 other fair value estimates on Open Text - why the stock might be worth 36% less than the current price!

Build Your Own Open Text Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Open Text research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Open Text research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Open Text's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal