Fortuna Mining (TSX:FVI): Valuation Check as Séguéla Expansion Study Targets Higher Gold Output

Fortuna Mining (TSX:FVI) just took a concrete step toward scaling up its Séguéla Mine in Côte d’Ivoire, awarding a study contract that could lift processing capacity and push annual gold output above 200,000 ounces.

See our latest analysis for Fortuna Mining.

That growth push has been mirrored in the market, with the share price up 15.61 percent over the past month and a strong 102.28 percent year to date share price return. The three year total shareholder return of 148.69 percent shows momentum has been building rather than fading.

If this kind of production driven story has your attention, it could be a good moment to explore other materials names through fast growing stocks with high insider ownership for more high potential ideas.

With the share price already near analyst targets but our intrinsic estimates still suggesting a modest discount, is Fortuna Mining quietly undervalued here, or are investors already paying up for the next leg of production growth?

Most Popular Narrative Narrative: 4.9% Overvalued

Against a fair value estimate of CA$12.71 and a last close of CA$13.33, the most followed narrative leans slightly cautious on upside from here.

The analysts have a consensus price target of CA$9.917 for Fortuna Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$10.57, and the most bearish reporting a price target of just CA$8.01.

Curious why projected margins leap even as top line shrinks? Wondering which future earnings multiple keeps this valuation hanging together? The full narrative unpacks the tension.

Result: Fair Value of $12.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks at Diamba Sud or prolonged high all in sustaining costs could quickly erode the margin gains that this bullish narrative relies on.

Find out about the key risks to this Fortuna Mining narrative.

Another View: Multiples Paint a Cheaper Picture

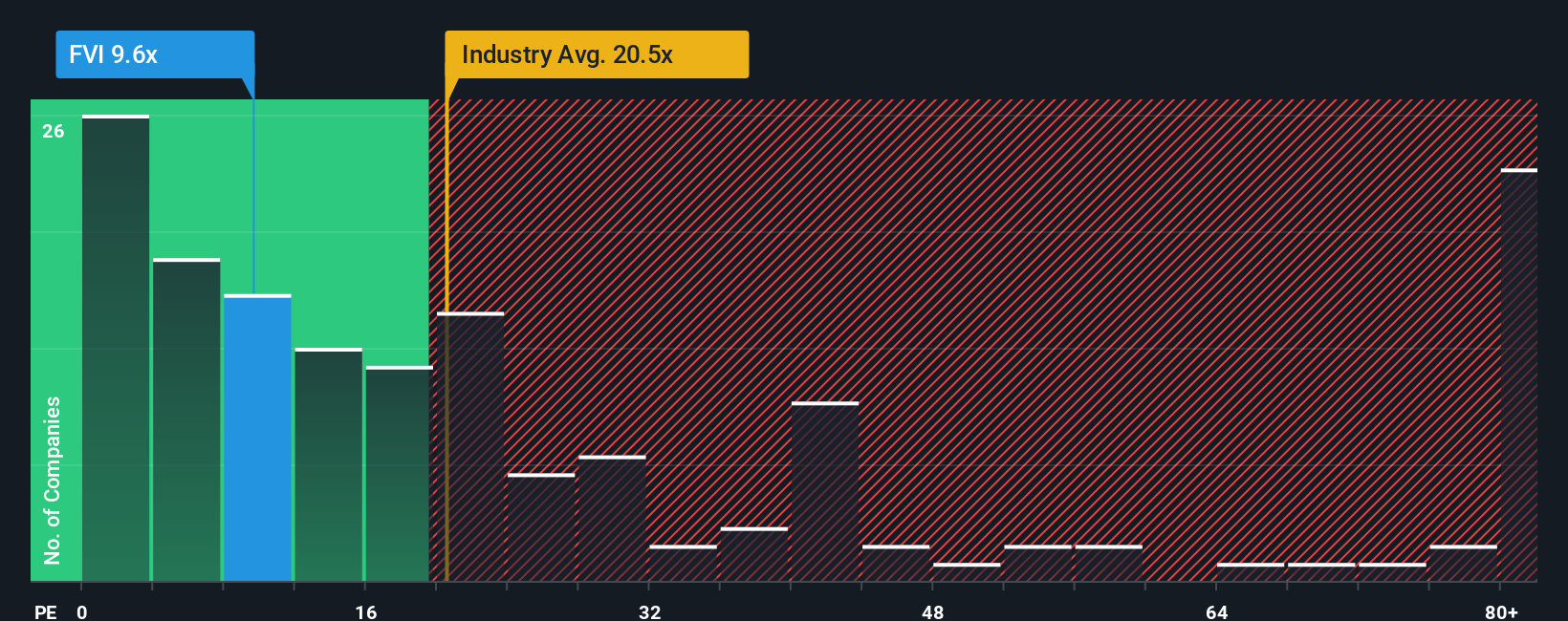

While our intrinsic value work suggests Fortuna screens 4.9 percent overvalued, earnings-based valuation tells a looser story. At 11.2 times earnings versus 20.6 times for the Canadian mining group and a fair ratio of 19.1 times, the gap hints at upside if sentiment normalizes.

Is the market correctly pricing execution and geopolitical risks, or leaving a margin of safety that long term holders might quietly benefit from?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortuna Mining Narrative

If these interpretations do not quite fit your view, dive into the numbers yourself and craft a personalized thesis in minutes, Do it your way.

A great starting point for your Fortuna Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St screener to pinpoint fresh, data backed stock ideas before the market fully catches on.

- Capture potential multibaggers early by targeting these 3573 penny stocks with strong financials that already show real financial strength instead of pure speculation.

- Ride structural shifts in healthcare by focusing on these 30 healthcare AI stocks that blend medical expertise with cutting edge algorithms to reshape patient outcomes.

- Lock in reliable income streams by zeroing in on these 14 dividend stocks with yields > 3% that can help support long term wealth building and smoother portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal