A Look at Hewlett Packard Enterprise’s Valuation Following Its Discover Barcelona 2025 AI and Cloud Announcements

Hewlett Packard Enterprise (HPE) stock is back on traders radar after the company used Discover Barcelona 2025 to roll out its AMD Helios AI racks, expanded GreenLake cloud tools, and new European AI factory labs.

See our latest analysis for Hewlett Packard Enterprise.

All of this AI and GreenLake news lands as HPE’s 1 day share price return of 1.55 percent and 7 day share price return of 3.39 percent tentatively reverse a 30 day share price pullback of 9.14 percent. A 5 year total shareholder return above 100 percent suggests the longer term momentum story remains very much intact.

If HPE’s AI push has your attention, it might be worth seeing what else is out there in next generation infrastructure. Explore high growth tech and AI stocks for more ideas riding similar tailwinds.

With earnings growth accelerating, revenue up nearly 10 percent annually, and the stock still trading at a sizable discount to both intrinsic value estimates and analyst targets, is HPE quietly undervalued, or is the market already discounting years of AI driven growth?

Most Popular Narrative Narrative: 16% Undervalued

With Hewlett Packard Enterprise last closing at $22.26 against a narrative fair value of $26.50, the story leans toward upside if its growth path holds.

Strategic acquisitions and expansion in high-growth technologies, including the integration of Juniper, launches of next-gen Gen12 servers, and AI-driven management platforms, are enhancing HPE's competitive positioning in edge, networking, and AI, laying the groundwork for continued share gains and outsized revenue growth relative to traditional industry averages.

Curious how modest revenue growth, rising margins, and a lower future earnings multiple still point to upside potential? The narrative stitches those ingredients into one ambitious valuation roadmap.

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps integrating Juniper or slower progress shifting away from legacy hardware could quickly erode the margin and growth assumptions behind this upside case.

Find out about the key risks to this Hewlett Packard Enterprise narrative.

Another Angle on Valuation

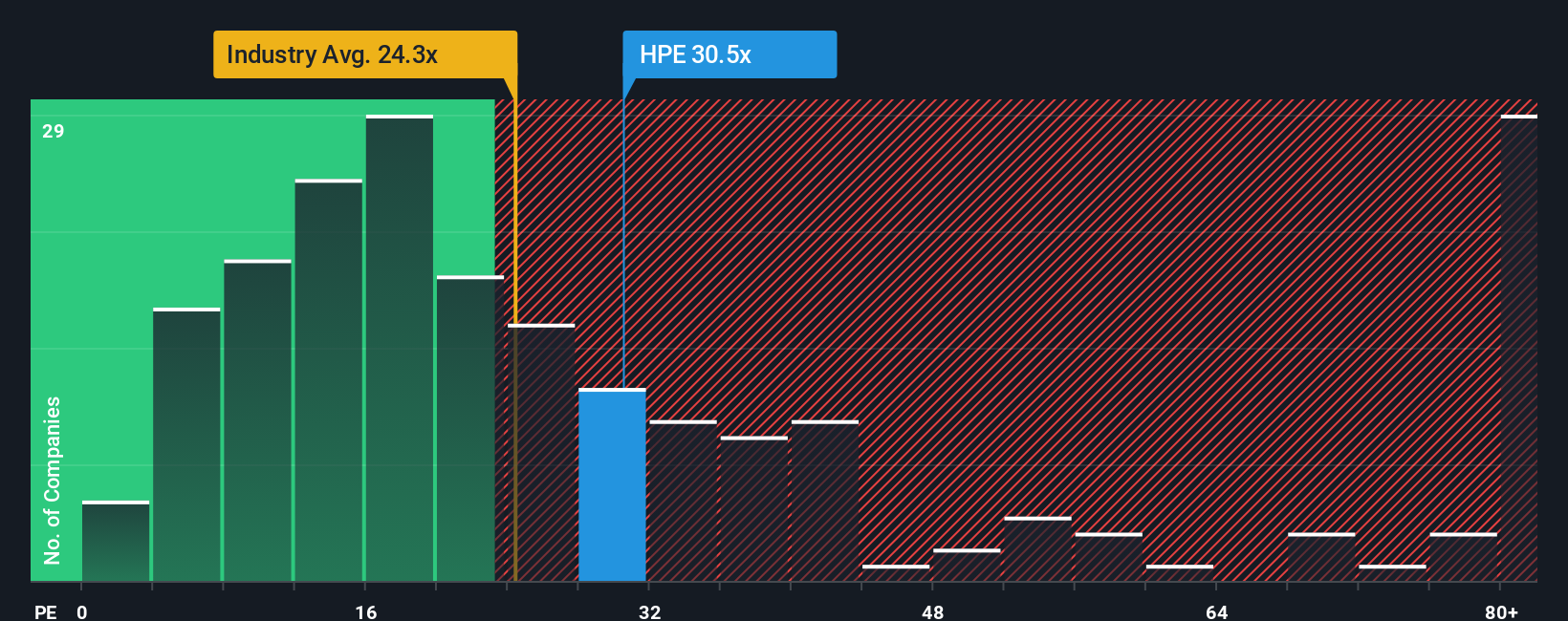

On simple earnings comparisons, HPE looks pricey, trading on a P E of 25.9 times versus 20.5 times for peers and 22.6 times for the wider tech sector. Yet its fair ratio of 39.7 times hints the market may still be underestimating its AI and networking upside. Which signal do you trust more right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hewlett Packard Enterprise Narrative

If this view does not match your own, or you want to stress test the numbers yourself, you can build a custom HPE story in minutes: Do it your way.

A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, review your next potential move by scanning fresh opportunities on Simply Wall St’s Screener so you can explore a wider range of possible returns.

- Assess early-stage potential with these 3573 penny stocks with strong financials that already show stronger balance sheets and fundamentals than the typical speculative name.

- Explore the structural shift toward automation and intelligent software by focusing on these 26 AI penny stocks positioned at the heart of the AI adoption wave.

- Evaluate your portfolio for potential mispriced opportunities using these 910 undervalued stocks based on cash flows that appear inexpensive relative to the cash they are expected to generate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal