Is Dolby Laboratories a 2025 Value Opportunity After Recent Atmos and Vision Expansion?

- Wondering if Dolby Laboratories is quietly turning into a value opportunity while the market looks the other way? Let us unpack whether the current price really reflects the strength of the underlying business.

- The stock is trading around $66.29 and, despite a solid franchise, it is down 1.1% over the last week, roughly flat over 30 days, and still off 14.8% year to date and 16.1% over the last year.

- Recent headlines have focused on Dolby's continued push into next generation audio and visual standards across streaming, cinema, and device ecosystems, reinforcing its licensing driven model. At the same time, partnerships with major content platforms and device makers keep expanding the Dolby Atmos and Dolby Vision footprint, even as the share price drifts.

- Against that backdrop, Dolby scores a strong 5/6 on our valuation checks. This suggests the stock screens as undervalued on most metrics. Next we will walk through the main valuation approaches investors typically rely on, before finishing with a more holistic way to think about what Dolby is really worth.

Find out why Dolby Laboratories's -16.1% return over the last year is lagging behind its peers.

Approach 1: Dolby Laboratories Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

For Dolby Laboratories, the latest twelve month Free Cash Flow is about $435.7 Million. Analysts and internal forecasts see this rising steadily, with Simply Wall St using a 2 Stage Free Cash Flow to Equity model to project around $731.1 Million of FCF by 2035, based on a mix of analyst estimates for the next few years and then extrapolated growth thereafter.

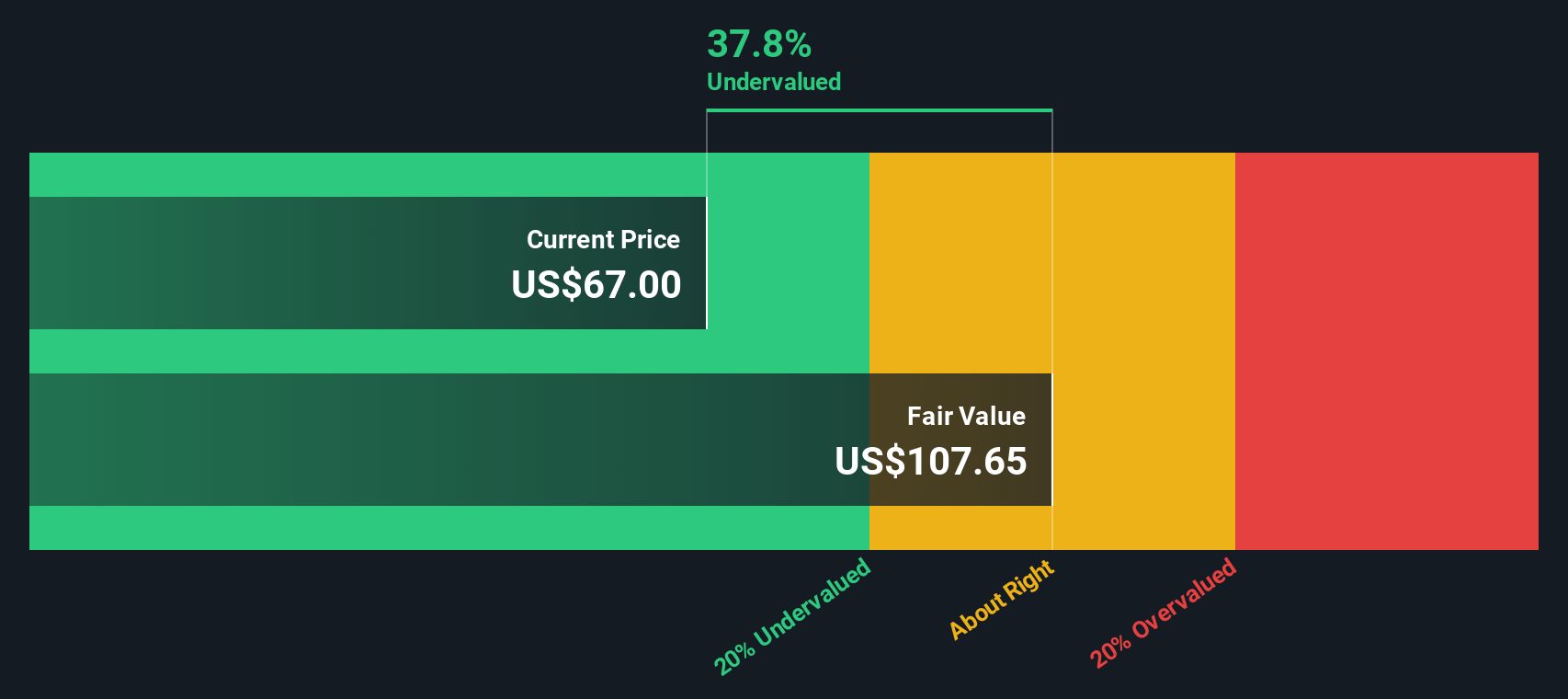

When all those future cash flows are discounted back, the model arrives at an intrinsic value of roughly $108.30 per share. Compared with the recent share price of about $66.29, the DCF implies the stock is trading at a 38.8% discount to its estimated fair value. This suggests there could be meaningful upside if the cash flow path occurs as modeled.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dolby Laboratories is undervalued by 38.8%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Dolby Laboratories Price vs Earnings

For a profitable, established business like Dolby, the Price to Earnings ratio is a useful yardstick because it links what investors pay today directly to the company’s current earnings power. In general, companies with faster, more predictable growth and lower risk deserve a higher PE, while slower growing or riskier firms should trade on a lower multiple.

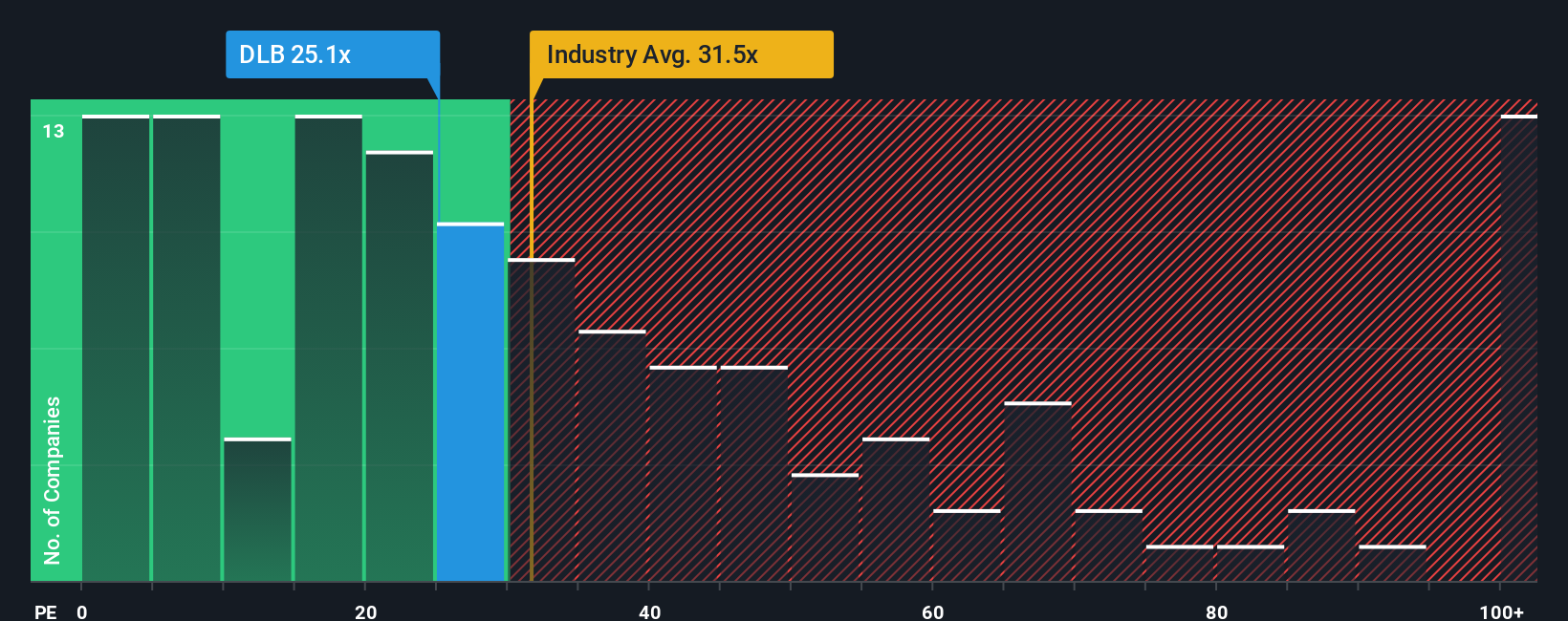

Dolby currently trades on a PE of about 24.83x. That sits below the broader Software industry average of around 31.70x and well under the peer group average of roughly 60.28x, which on the surface makes the stock look inexpensive compared to many listed software names.

Simply Wall St also calculates a Fair Ratio of 27.29x, which is the PE you might reasonably expect for Dolby given its specific mix of earnings growth, margins, size, industry dynamics, and risk profile. This Fair Ratio is more informative than a simple peer or industry comparison because it is tailored to Dolby’s fundamentals rather than broad averages that can be skewed by outliers. With the shares on 24.83x versus a Fair Ratio of 27.29x, the multiple analysis indicates that the stock is trading at a discount to what its fundamentals would justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dolby Laboratories Narrative

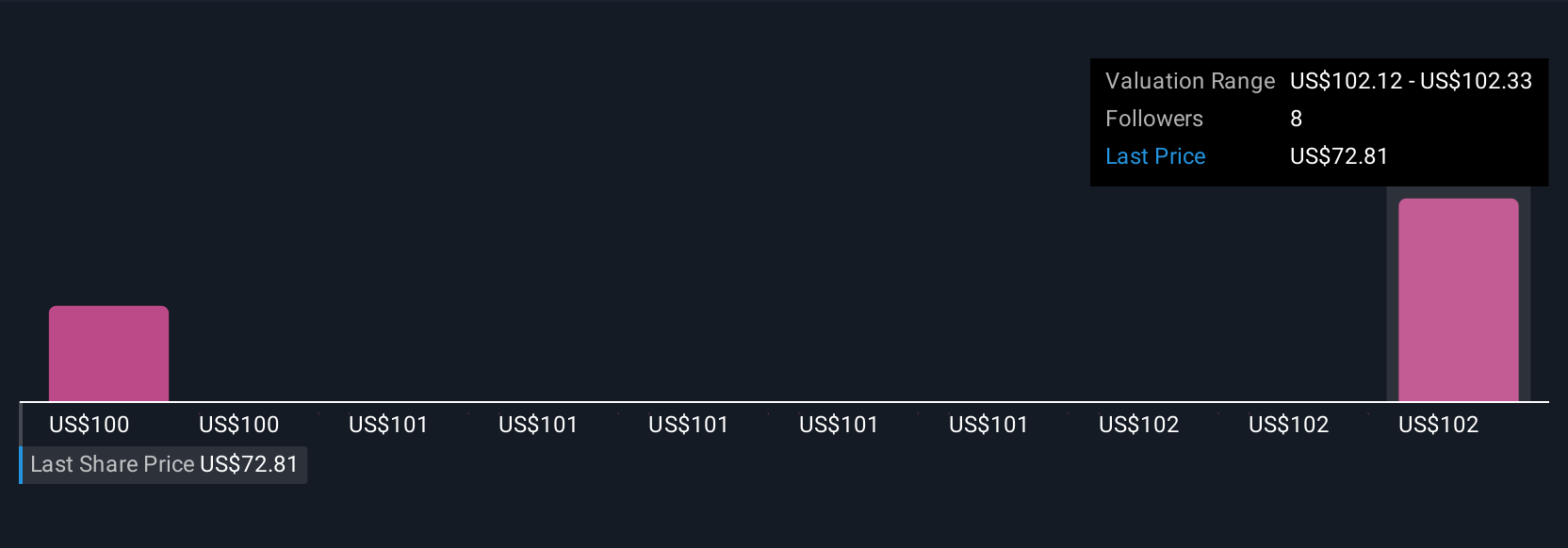

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you write the story behind your numbers, link your view of Dolby’s future revenue, earnings, and margins to a financial forecast, and then arrive at your own fair value that you can easily compare to the current share price. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to capture their perspective on a company, quantify it with assumptions, and see in real time whether their fair value suggests it is a buy, a hold, or a sell. Because Narratives are dynamically updated when new information like earnings, news, or guidance is released, your investment thesis does not stay static; it evolves as Dolby’s situation changes. For example, one Dolby Narrative might assume premium adoption of Atmos and Vision continues, margins expand, and justify a fair value closer to the recent bullish target of about $114. In contrast, a more cautious Narrative might focus on commoditization, macro risk, and weaker device demand, supporting a fair value nearer the lower end around $74.

Do you think there's more to the story for Dolby Laboratories? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal