Super Micro Computer (SMCI) Valuation After Guidance Cut, AI Server Delays and Volatile Investor Sentiment

Super Micro Computer (SMCI) has been on many watchlists after it cut Q1 FY2026 revenue guidance due to delayed AI deliveries, yet reiterated an aggressive full-year growth outlook tied to AI servers.

See our latest analysis for Super Micro Computer.

The guidance cut has capped what was already a volatile stretch, with a 1 month share price return of minus 28.95 percent but a still positive year to date share price return of 12.08 percent. A 3 year total shareholder return above 290 percent shows that longer term momentum has not fully broken.

If Super Micro’s AI story has you rethinking your tech exposure, this could be a good moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With the stock down sharply from its highs yet still targeting rapid AI driven growth, investors face a key question: is SMCI now trading at a discount, or has the market already priced in the next leg of expansion?

Most Popular Narrative: 30.6% Undervalued

With Super Micro Computer last closing at $33.68 against a narrative fair value near $48.53, the story hinges on aggressive AI driven growth and margins.

The accelerating global adoption of AI and analytics continues to drive demand for high-performance, scalable server and data center solutions, positioning Super Micro for strong multi-year revenue growth as enterprises and nations build out AI infrastructure directly supporting projected revenue outperformance.

Curious how ambitious growth, modest margin expansion, and a lower future earnings multiple can still justify a much higher value than today? The full narrative reveals the exact blend of revenue acceleration, profit scaling, and discount assumptions behind that gap.

Result: Fair Value of $48.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few large customers and intensifying AI server competition could quickly erode margins and challenge this upbeat valuation story.

Find out about the key risks to this Super Micro Computer narrative.

Another Angle on Valuation

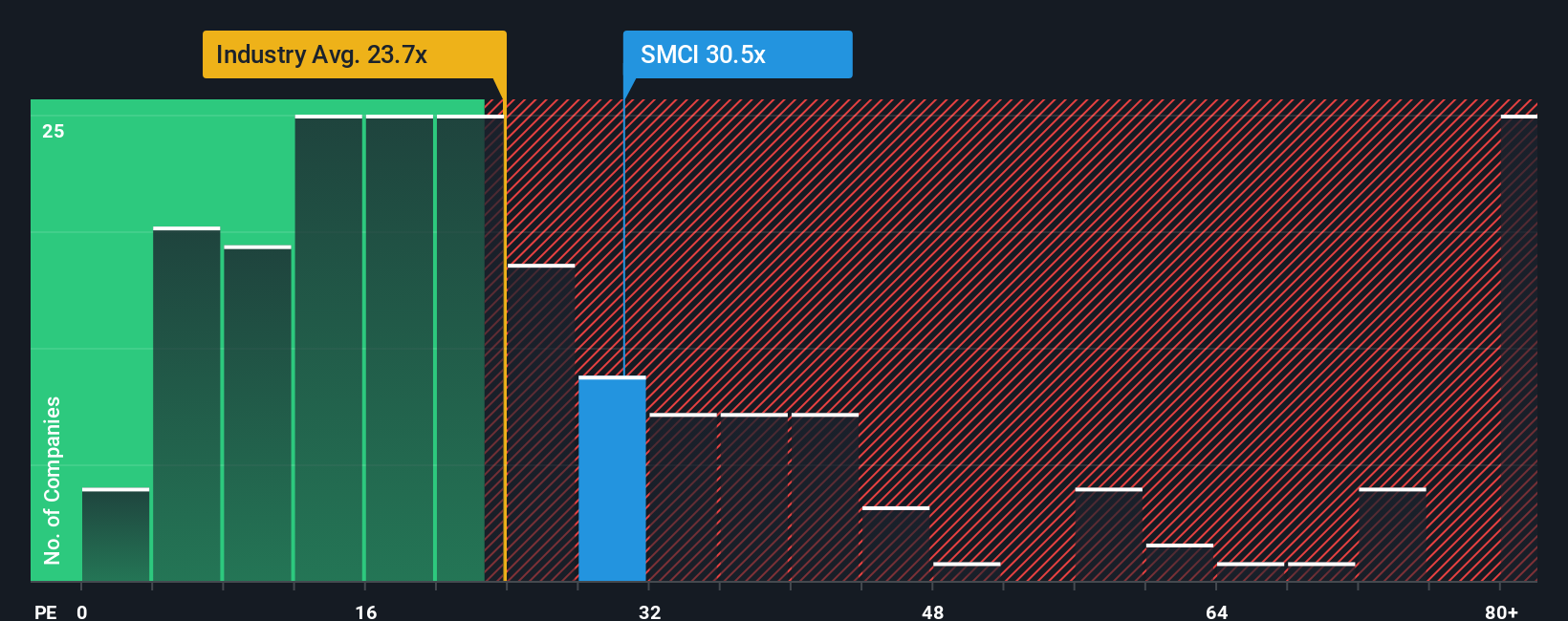

Multiples tell a different story. SMCI trades on a price to earnings ratio of 25.4 times, richer than both the global tech average at 22.6 times and peers at 21.8 times, even though our fair ratio points to 66.3 times. Is the premium today a cushion or a cliff?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Super Micro Computer Narrative

If you see the story differently or want to stress test these assumptions yourself, you can quickly build a custom narrative in under three minutes: Do it your way.

A great starting point for your Super Micro Computer research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, take a moment to explore additional opportunities with the Simply Wall St Screener, so you are not leaving potential returns on the table.

- Seek higher return potential by targeting growth stories at an earlier stage through these 3574 penny stocks with strong financials that still show strong underlying fundamentals.

- Enhance your portfolio’s innovation exposure by focusing on these 25 AI penny stocks positioned within the artificial intelligence ecosystem.

- Identify potential value opportunities by concentrating on these 912 undervalued stocks based on cash flows that the market may be pricing differently from their estimated future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal