3 Growth Companies Insiders Are Betting On

As the Dow Jones and S&P 500 approach record highs, investors are closely monitoring insider activities in growth companies, especially given the current economic indicators suggesting potential interest rate cuts by the Federal Reserve. In this environment, stocks with high insider ownership can be appealing as they often signal confidence from those most familiar with a company's prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Here Group (HERE) | 36.1% | 38.8% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's review some notable picks from our screened stocks.

Aeluma (ALMU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aeluma, Inc. develops optoelectronic and electronic devices for sensing, communication, and computing applications in the United States with a market cap of $272.78 million.

Operations: Aeluma, Inc. focuses on creating advanced devices for applications in sensing, communication, and computing within the U.S. market.

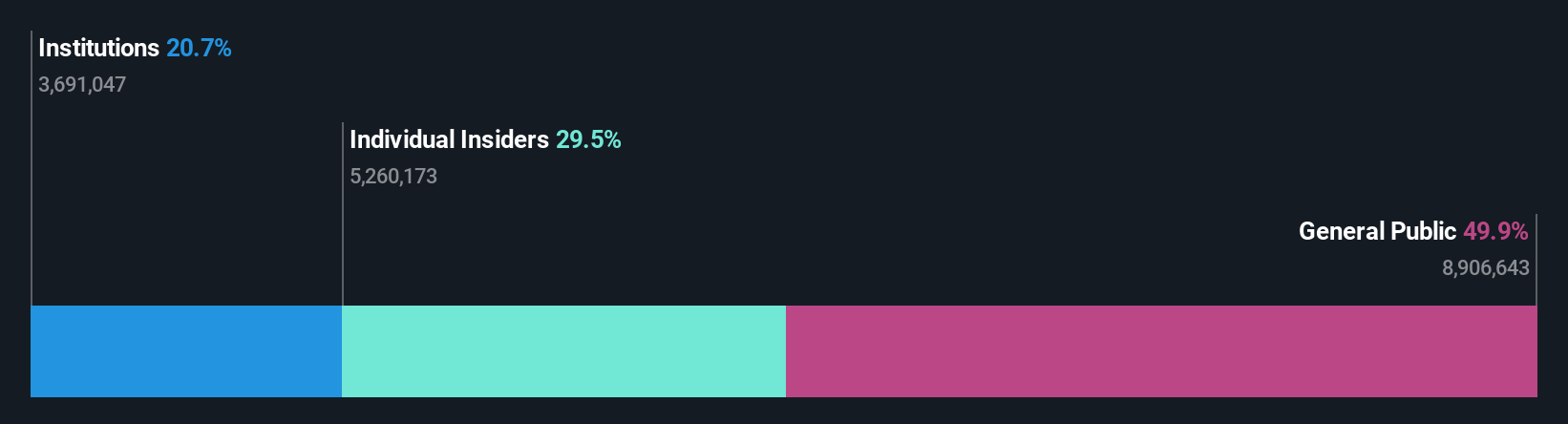

Insider Ownership: 29.5%

Earnings Growth Forecast: 60.1% p.a.

Aeluma, Inc. demonstrates significant growth potential with forecasted revenue growth of 67.1% annually, outpacing the US market average. Despite high share price volatility and recent substantial shareholder dilution, the company is expected to become profitable within three years. Recent earnings show increased sales but also a widening net loss, highlighting financial challenges. Insider activity has been mixed with more shares sold than bought recently, yet no substantial insider buying was recorded in the past quarter.

- Take a closer look at Aeluma's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Aeluma's share price might be too optimistic.

MediaAlpha (MAX)

Simply Wall St Growth Rating: ★★★★☆☆

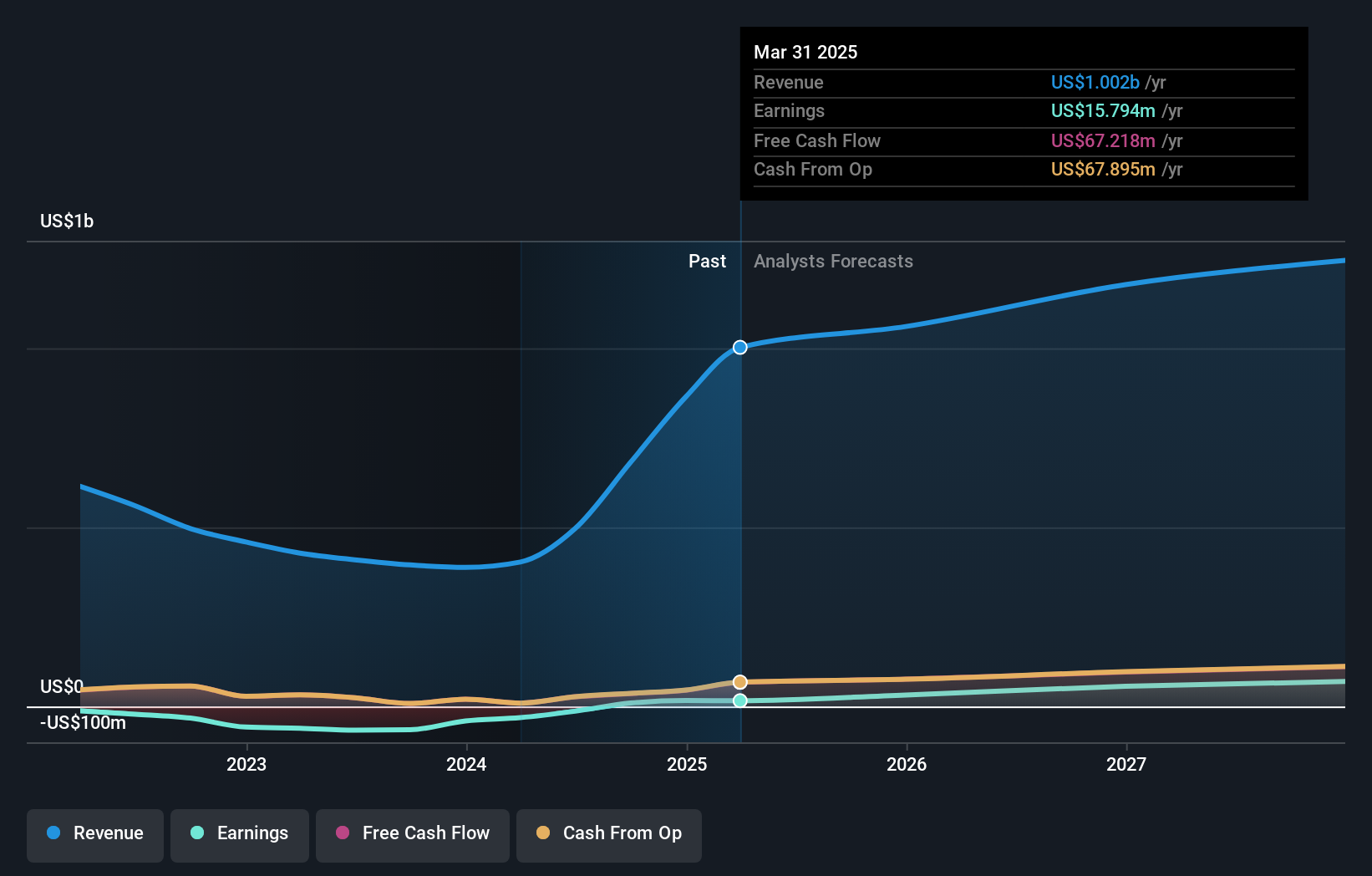

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States with a market cap of approximately $829 million.

Operations: The company generates revenue of $1.12 billion from its Internet Information Providers segment.

Insider Ownership: 21.9%

Earnings Growth Forecast: 51.6% p.a.

MediaAlpha exhibits characteristics of a growth company with substantial insider ownership, despite facing challenges like negative shareholder equity and slower revenue growth compared to the US market. The company's earnings are forecasted to grow significantly at 51.58% annually, with profitability expected in three years. Recent developments include a share repurchase program worth up to US$50 million and key board changes, such as appointing Ramon Jones, which could strategically enhance leadership in digital transformation initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of MediaAlpha.

- Upon reviewing our latest valuation report, MediaAlpha's share price might be too pessimistic.

Waterdrop (WDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in the People’s Republic of China, connecting users with insurance products, and has a market cap of approximately $683.54 million.

Operations: Waterdrop Inc.'s revenue is primarily derived from providing online insurance brokerage services in the People’s Republic of China, facilitating connections between users and insurance products underwritten by various companies.

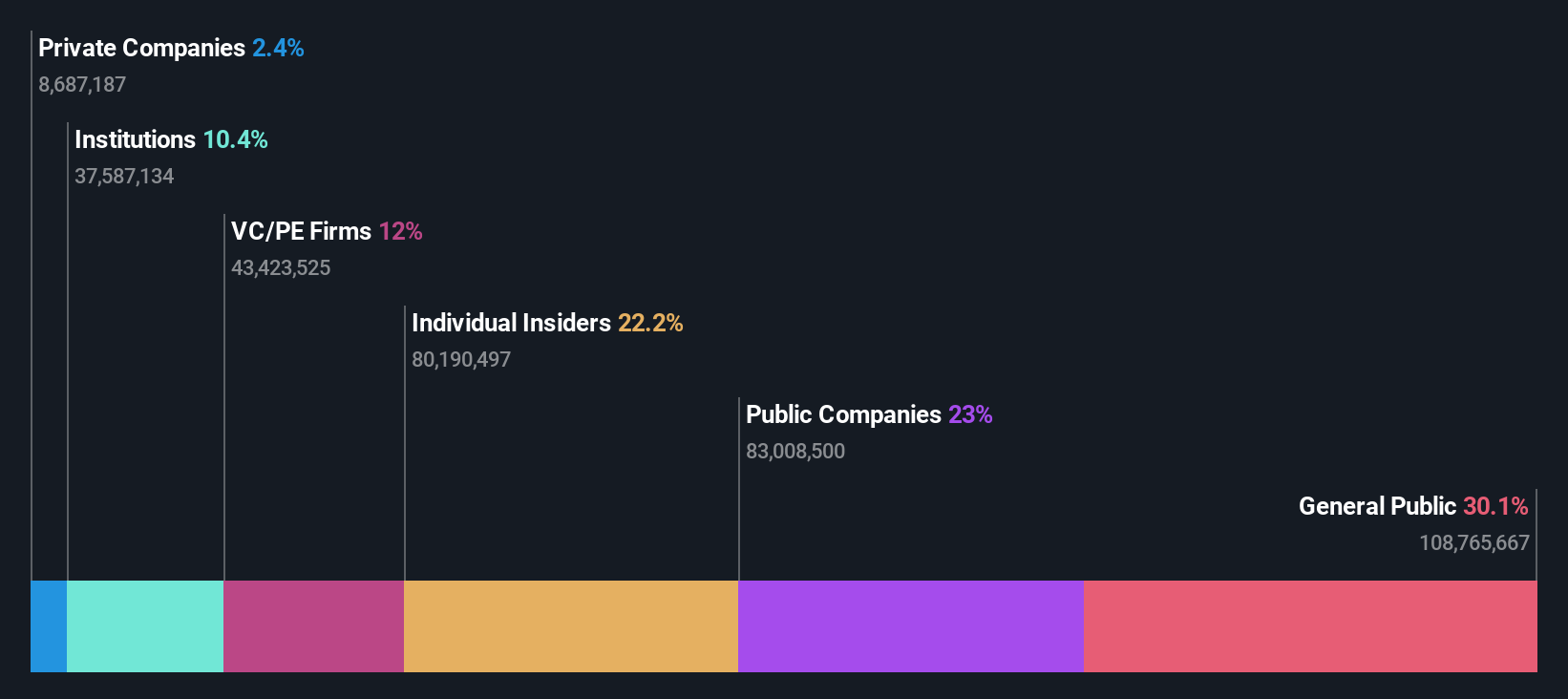

Insider Ownership: 22.2%

Earnings Growth Forecast: 24.2% p.a.

Waterdrop demonstrates strong growth potential with earnings increasing by 68.8% last year and projected to grow at 24.2% annually, outpacing the US market. Despite a low forecasted Return on Equity of 10.7%, it trades below estimated fair value and favorably against peers. Recent buybacks totaling US$9.9 million indicate confidence in its valuation, while revenue is set to grow faster than the market at 12.4% annually, although not exceeding 20%.

- Click to explore a detailed breakdown of our findings in Waterdrop's earnings growth report.

- According our valuation report, there's an indication that Waterdrop's share price might be on the cheaper side.

Seize The Opportunity

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 198 more companies for you to explore.Click here to unveil our expertly curated list of 201 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal