3 Promising Penny Stocks With Market Caps Below $200M

As the Dow Jones and S&P 500 approach record highs, investors are keeping a close eye on market movements and potential interest rate cuts by the Federal Reserve. Investing in penny stocks—though a somewhat outdated term—remains relevant as these stocks often represent smaller or newer companies that can offer unique growth opportunities. By focusing on those with strong financials, investors may uncover hidden gems poised for long-term success amidst current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $249.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.83 | $383.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.88 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8807 | $148.36M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.215 | $541.81M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.96 | $1.25B | ✅ 3 ⚠️ 1 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.61 | $362.82M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8377 | $5.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.06 | $91.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Destination XL Group (DXLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Destination XL Group, Inc. operates as a specialty retailer focusing on big and tall men's clothing and footwear in the United States, with a market cap of $51.73 million.

Operations: The company generates revenue primarily from its retail segment, which accounted for $447.74 million.

Market Cap: $51.73M

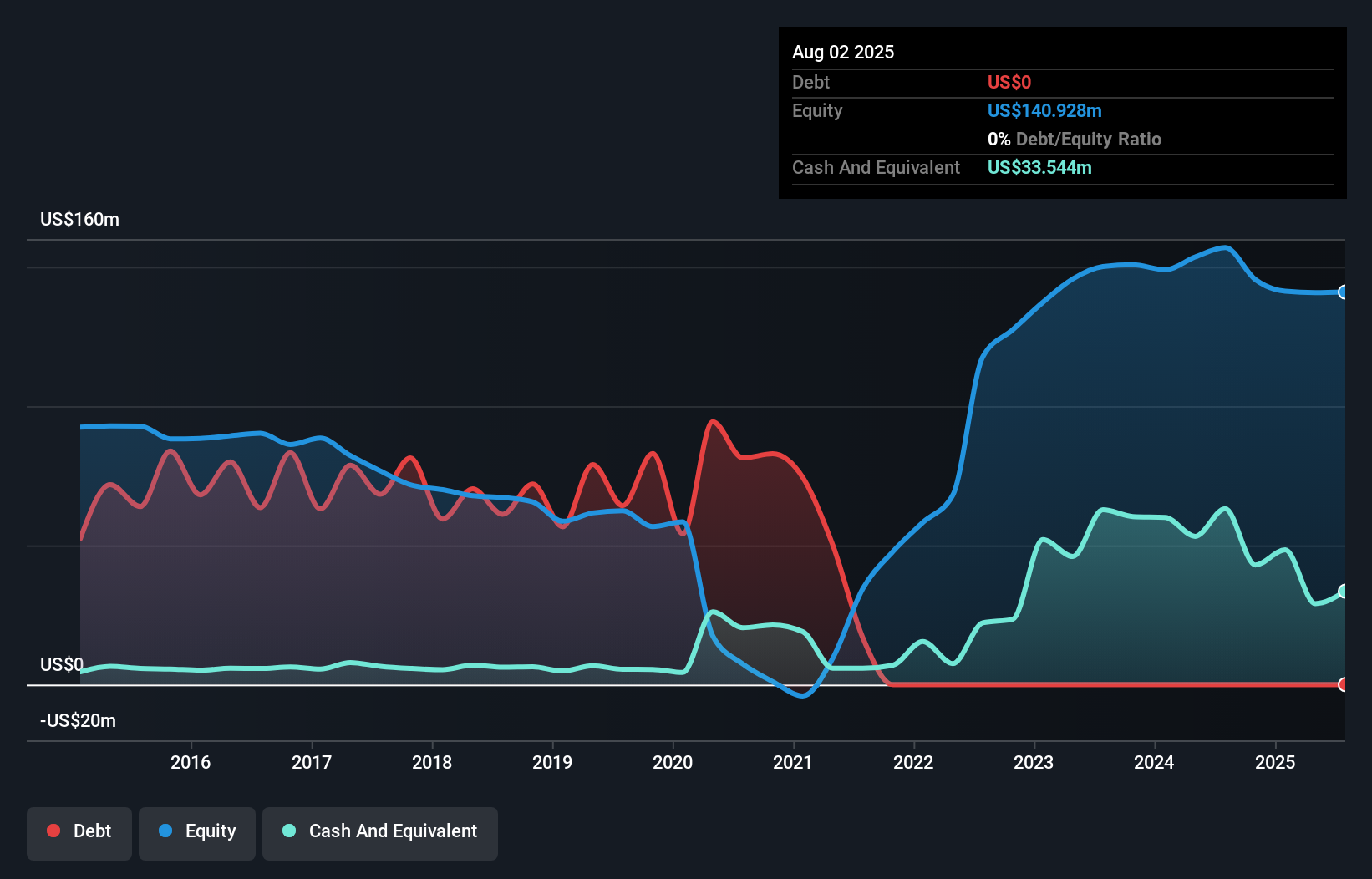

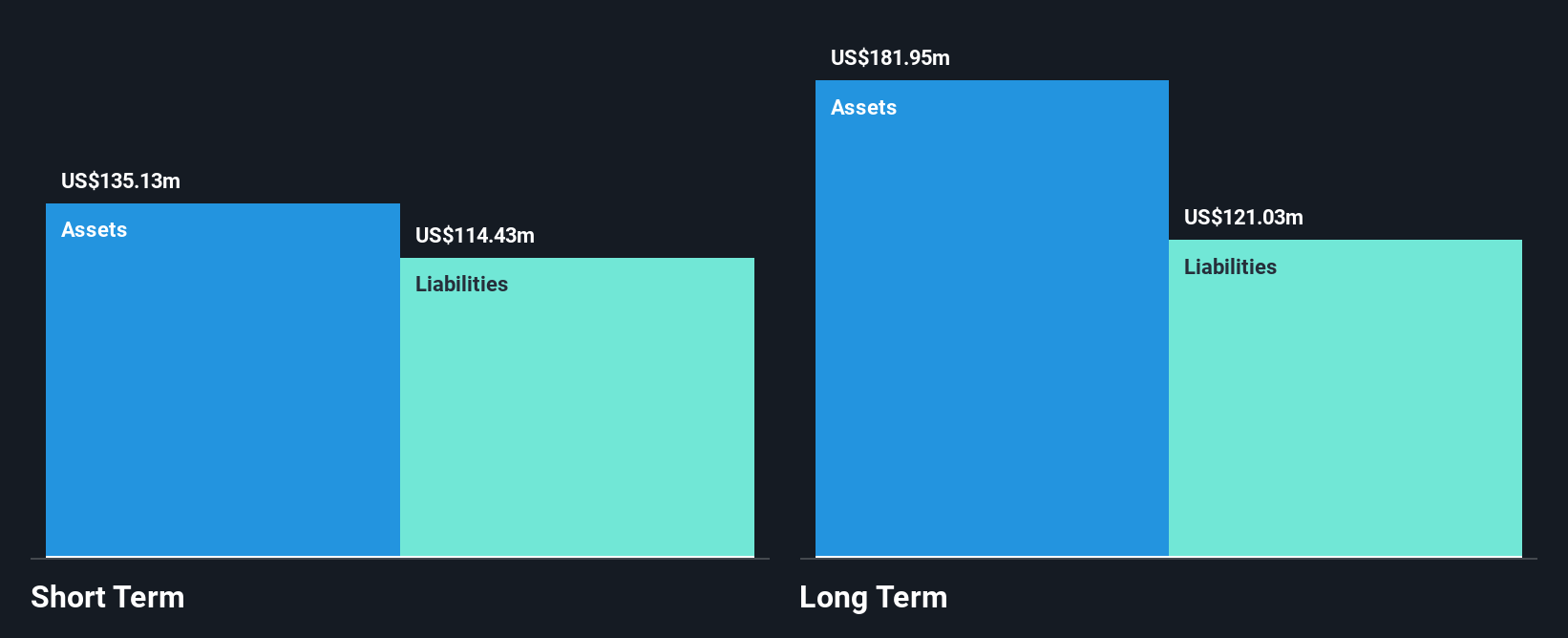

Destination XL Group, Inc., a specialty retailer for big and tall men's clothing, operates with a market cap of US$51.73 million. Despite being currently unprofitable, the company has shown progress by reducing losses over the past five years and is debt-free, alleviating concerns about interest payments. The management team is seasoned with an average tenure of 7.8 years, contributing to stability amidst financial challenges. Recent innovations like the FiTMAP® Scanning Technology aim to enhance customer experience and potentially drive future revenue growth. However, short-term assets do not cover long-term liabilities (US$122.6M vs US$186.3M).

- Click to explore a detailed breakdown of our findings in Destination XL Group's financial health report.

- Assess Destination XL Group's future earnings estimates with our detailed growth reports.

Tilly's (TLYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tilly's, Inc. is a specialty retailer in the United States offering casual apparel, footwear, accessories, and hardgoods for young men and women as well as boys and girls, with a market cap of $54.85 million.

Operations: The company generates revenue primarily from its retail apparel segment, totaling $549.60 million.

Market Cap: $54.85M

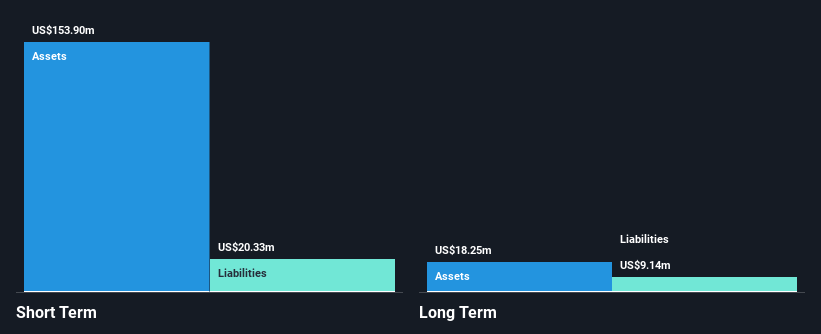

Tilly's, Inc., with a market cap of US$54.85 million, remains unprofitable but has narrowed its losses over the past year. The company reported third-quarter sales of US$139.59 million and a net loss of US$1.41 million, showing improvement from the previous year's figures. Tilly's is debt-free, which reduces financial risk related to interest payments and enhances liquidity management as short-term assets exceed both short- and long-term liabilities. Despite high volatility in share price and negative return on equity, Tilly's trades at good value compared to industry peers and benefits from an experienced management team averaging 10.7 years in tenure.

- Navigate through the intricacies of Tilly's with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Tilly's future.

Valens Semiconductor (VLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valens Semiconductor Ltd., along with its subsidiaries, develops semiconductor products for the audio-video and automotive sectors, with a market cap of $161.74 million.

Operations: Valens Semiconductor generates revenue from two main segments: Automotive, contributing $18.41 million, and Cross Industry Business (CIB), which accounts for $49.48 million.

Market Cap: $161.74M

Valens Semiconductor, with a market cap of US$161.74 million, is unprofitable but has reduced its losses over the past five years. The company generates revenue from automotive and cross-industry business segments, totaling US$51.22 million for the first nine months of 2025. Valens' strategic alliances, such as those with Imavix and Samsung, highlight its focus on advancing MIPI A-PHY standards in machine vision and automotive sectors. Despite leadership changes with Yoram Salinger as CEO, Valens maintains a solid cash runway exceeding three years without debt obligations while trading at good value relative to peers.

- Click here and access our complete financial health analysis report to understand the dynamics of Valens Semiconductor.

- Learn about Valens Semiconductor's future growth trajectory here.

Seize The Opportunity

- Take a closer look at our US Penny Stocks list of 345 companies by clicking here.

- Interested In Other Possibilities? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal