How Black Stone’s Long-Term Caturus Drilling Pact in Haynesville and Shelby Trough At Black Stone Minerals (BSM) Has Changed Its Investment Story

- In December 2025, Black Stone Minerals, L.P. announced it had entered into a multi-year development agreement with an affiliate of Caturus Energy, covering 220,000 gross acres in the Shelby Trough and Haynesville Expansion to support growing Gulf Coast natural gas demand.

- The deal outlines a structured ramp-up from pilot wells in the first two years to about 12 gross wells annually by year six, potentially unlocking more value from Black Stone’s roughly 40,000 undeveloped net acres in the contract area and any future acquisitions there.

- We’ll now examine how this long-term Shelby Trough and Haynesville drilling program with Caturus could reshape Black Stone Minerals’ investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Black Stone Minerals Investment Narrative Recap

To own Black Stone Minerals, you need to believe in the durability of its royalty model and continued operator appetite to develop its core gas basins. The new Caturus agreement directly addresses the short term risk around slower Shelby Trough and Haynesville activity by putting a clearer drilling schedule in place, although execution and operator follow through remain key questions.

Among recent announcements, the Q3 2025 results stand out in this context, with US$132.47 million of revenue and US$91.73 million of net income helping to fund distributions while new drilling ramps. The Caturus deal sits alongside prior Shelby Trough expansions and earlier operator agreements, reinforcing the idea that future production growth will largely depend on how effectively third party partners develop Black Stone’s concentrated acreage.

But while new drilling commitments may ease volume concerns, investors should still be aware of...

Read the full narrative on Black Stone Minerals (it's free!)

Black Stone Minerals’ narrative projects $530.3 million revenue and $283.0 million earnings by 2028. This requires 8.6% yearly revenue growth and about a $37 million earnings increase from $245.6 million today.

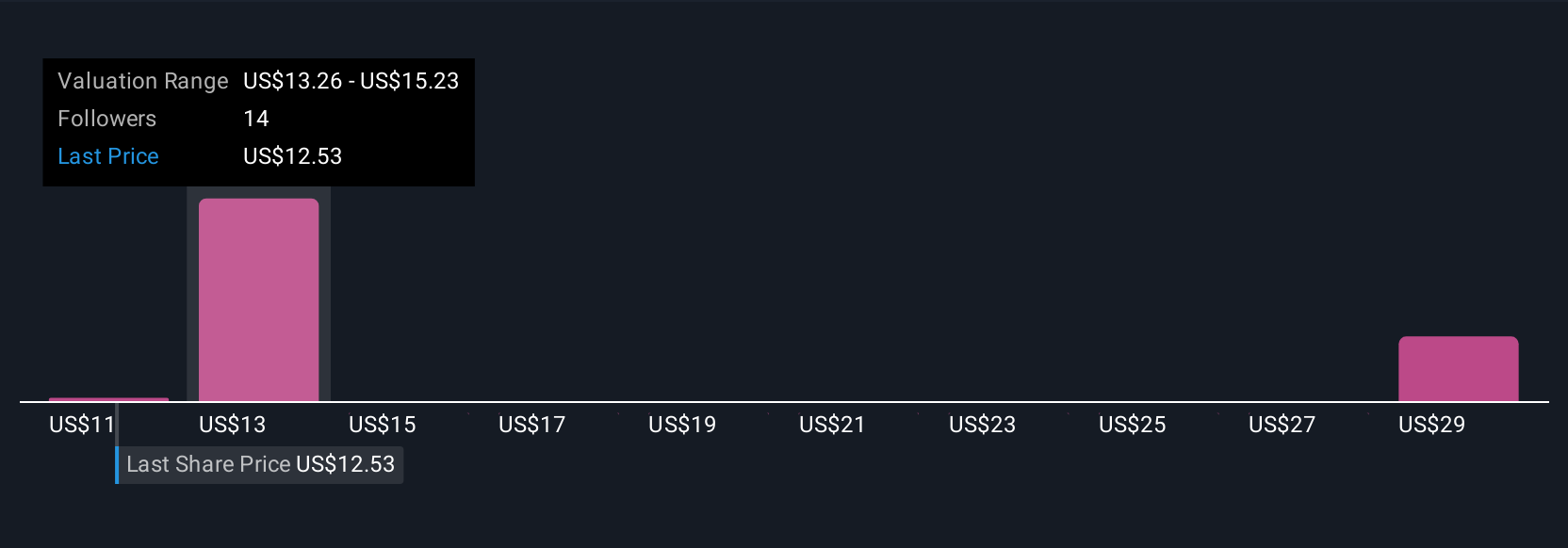

Uncover how Black Stone Minerals' forecasts yield a $13.00 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$11.50 to almost US$19.75, showing how differently investors can size up Black Stone Minerals. Set that against the new multi year Caturus drilling plan in the Shelby Trough, which directly touches both the company’s main growth catalyst and its reliance on third party operators, and you have several angles on future performance worth comparing side by side.

Explore 4 other fair value estimates on Black Stone Minerals - why the stock might be worth 20% less than the current price!

Build Your Own Black Stone Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Stone Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Stone Minerals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal