How Stronger Guidance and Buybacks Could Shape Workday’s (WDAY) AI-Driven Margin Story

- Workday, Inc. recently reported past third-quarter results showing revenue of US$2,432 million and net income of US$252 million, alongside updated guidance calling for fourth-quarter subscription revenue of US$2,355 million and full-year subscription revenue of US$8,828 million, plus the completion of multiple share repurchase tranches totaling 6,668,234 shares for about US$1.59 billion.

- Separately, Tabulera announced a new partnership integrating its benefits reconciliation platform with Workday Human Capital Management, enhancing automation, reducing billing errors, and potentially increasing the appeal of Workday’s ecosystem for HR and payroll clients.

- Now we’ll examine how Workday’s stronger subscription revenue guidance and completed buybacks may influence its AI-focused, margin-improvement investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Workday Investment Narrative Recap

To own Workday, you need to believe its cloud HCM and finance platform, increasingly infused with AI, can keep winning large, sticky enterprise customers despite intense competition. The latest Q3 beat, firmer subscription revenue guidance and active buybacks support the near term focus on profitable growth, while the biggest ongoing risk remains that heavy AI and M&A investment does not translate into the margin gains many shareholders are watching for. On balance, the new information does not radically change that near term setup.

The fresh subscription revenue guidance for Q4 and the full year matters most here, because it directly ties into Workday’s key catalyst: broad adoption of its AI enabled HR and finance products that support higher average contract values. The Tabulera integration fits around that story by making Workday’s HCM stack more useful day to day, but it is the confirmed subscription revenue trajectory that most clearly relates to how the recent AI and efficiency narrative is tracking.

Yet, while Workday leans into AI driven growth, investors should also be aware that rising R&D and acquisition spend could...

Read the full narrative on Workday (it's free!)

Workday’s narrative projects $12.9 billion in revenue and $1.8 billion in earnings by 2028. This requires 13.0% yearly revenue growth and an earnings increase of about $1.2 billion from $583.0 million today.

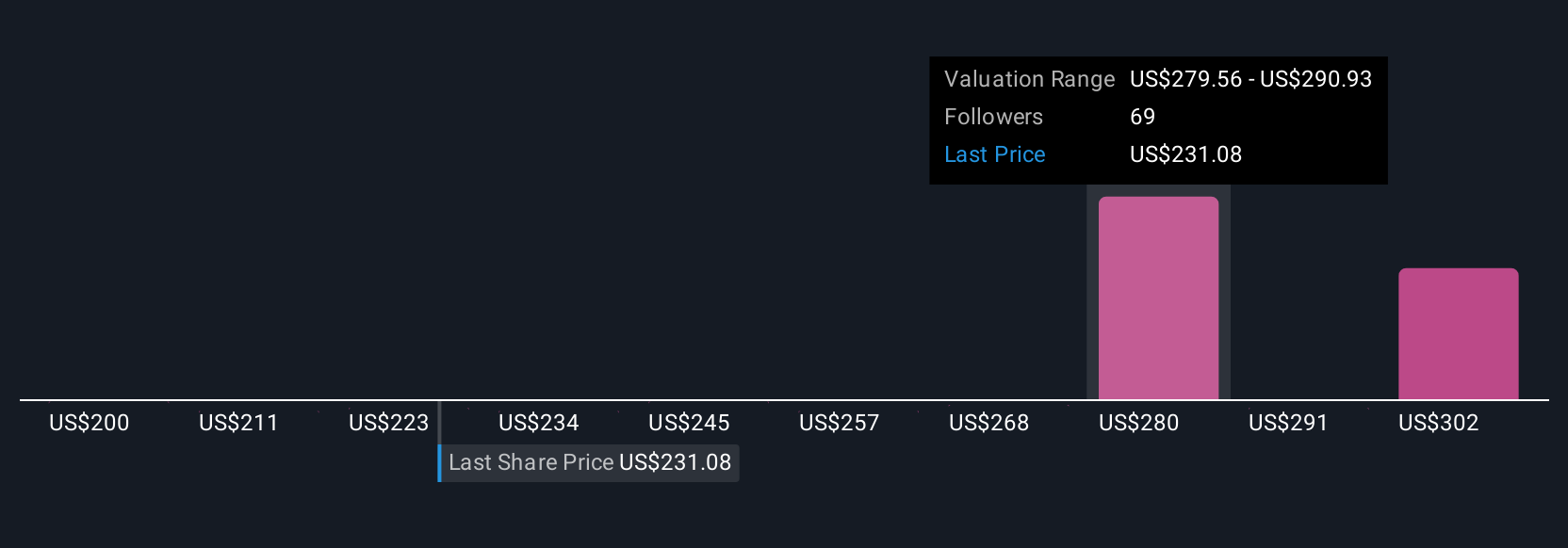

Uncover how Workday's forecasts yield a $277.28 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Twelve Simply Wall St Community valuations for Workday span roughly US$233 to US$348 per share, underscoring how far apart individual expectations can sit. Against that backdrop, the company’s heavy AI and M&A spending, which may or may not yield the margin expansion many expect, gives you a concrete lens to compare these different views and explore several alternative takes on the story.

Explore 12 other fair value estimates on Workday - why the stock might be worth as much as 62% more than the current price!

Build Your Own Workday Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Workday research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workday's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal