Ramaco Resources (METC): Assessing Valuation After Special Call on U.S. Critical Minerals and Brook Mine Strategy

Ramaco Resources (METC) has scheduled a special call to discuss developments in U.S. critical minerals and its Brook Mine project, a move that hints at meaningful strategic updates for the company’s long term growth mix.

See our latest analysis for Ramaco Resources.

Investors seem to be reassessing Ramaco’s growth story, with the recent U.S. critical minerals push coming after a sharp setback in its 30 day share price return of minus 36.52 percent. Even so, the year to date share price return of 57.61 percent and standout five year total shareholder return of 578.49 percent still point to powerful long term momentum.

If this shift in sentiment has you thinking more broadly about opportunities in cyclical and resource linked names, it could be a good moment to explore fast growing stocks with high insider ownership.

With shares still well below analyst targets but long term returns firmly positive, the real question now is whether Ramaco is trading at a discount to its next growth leg, or if the market already sees what comes next?

Most Popular Narrative: 56.9% Undervalued

With the most followed narrative putting fair value far above the last close of $16.88, the focus shifts to what justifies that gap.

Federal policy shifts prioritizing domestic supply chain resilience and national security for critical minerals, as evidenced by multi agency U.S. government engagement and discussions around price supports/offtake agreements, could further accelerate Ramaco's rare earth scale up and de risk future revenue streams.

Curious how coal losses today could morph into a high margin rare earth platform tomorrow? The narrative leans on bold revenue, margin, and earnings step changes, plus a future valuation multiple more often reserved for market darlings. Want to see exactly how those moving parts stack up into that aggressive upside case?

Result: Fair Value of $39.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on timely government support and successful Brook Mine execution. Delays, cost overruns, or weaker rare earth pricing could quickly erode confidence.

Find out about the key risks to this Ramaco Resources narrative.

Another Lens on Valuation

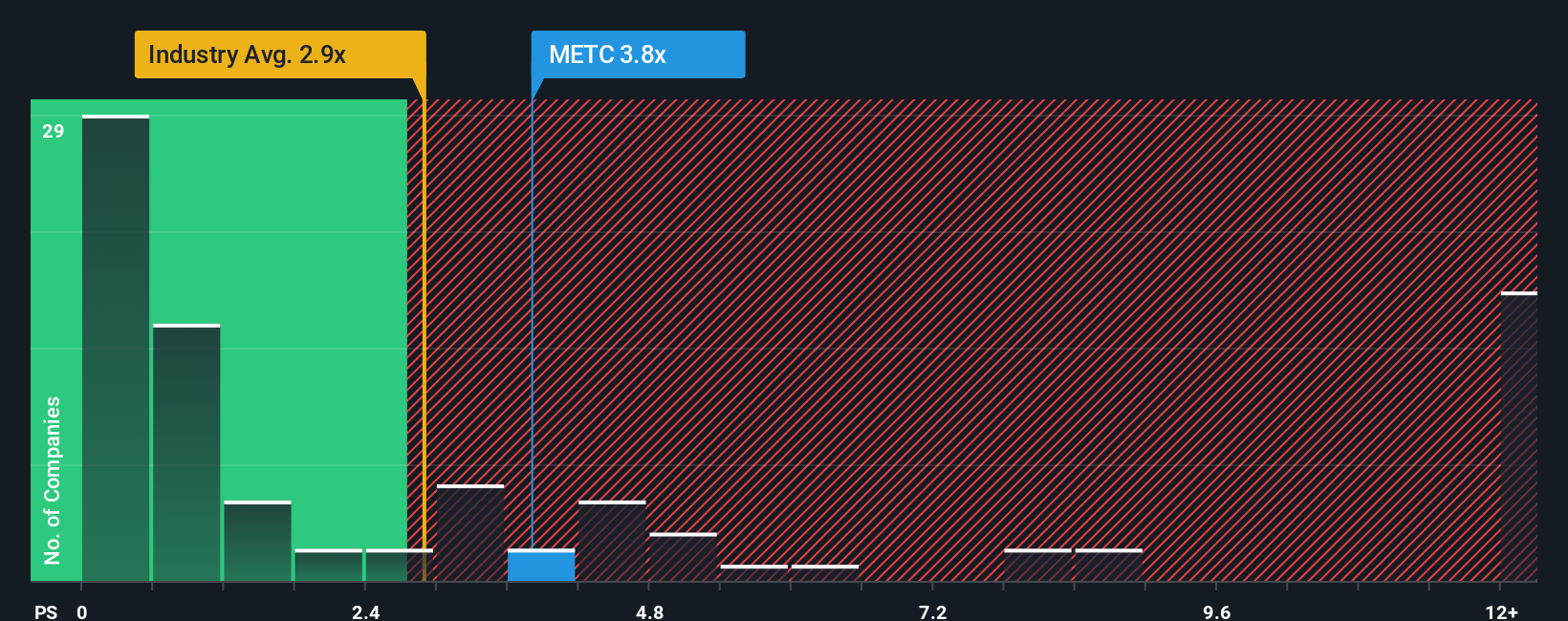

Price to sales paints a more cautious picture. Ramaco trades at 1.9 times sales, in line with the U.S. metals and mining group at 1.9 times, but above its fair ratio of 1.0 times, which hints that expectations may already be rich if execution slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ramaco Resources Narrative

If this perspective does not quite match your own view, you can quickly dig into the numbers yourself and build a fresh narrative in under three minutes, Do it your way.

A great starting point for your Ramaco Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by running a focused search with the Simply Wall St Screener and lining up tomorrow’s potential winners today.

- Capture income potential by scanning for these 14 dividend stocks with yields > 3% that can support a reliable, long term payout stream.

- Ride structural shifts in healthcare by zeroing in on these 30 healthcare AI stocks transforming diagnostics, treatment, and medical efficiency.

- Position ahead of the next market re rating by targeting these 915 undervalued stocks based on cash flows that may be priced below their long term cash flow power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal