Evaluating First Horizon’s (FHN) Valuation After Its Recent Share Price Gains

First Horizon (FHN) has quietly delivered solid gains this month, with the stock up around 6% and roughly 14% year to date, as investors reassess regional bank valuations.

See our latest analysis for First Horizon.

That steady climb in First Horizon’s share price, now at $22.72, reflects investors warming back up to regional banks, with a resilient 5 year total shareholder return of over 100 percent underscoring that this is not just a short term bounce.

If First Horizon’s recent move has you rethinking where the next opportunity might come from, it could be worth exploring fast growing stocks with high insider ownership as a way to spot the market’s next quiet outperformers.

With shares trading modestly below analyst targets and a notable intrinsic value discount, the numbers hint at room for upside. But is First Horizon still undervalued or already pricing in its next leg of growth?

Most Popular Narrative: 7.2% Undervalued

With First Horizon last closing at $22.72 versus a narrative fair value near the mid 20s, the valuation case leans modestly in favor of upside.

The analysts have a consensus price target of $24.641 for First Horizon based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $22.0.

Want to see what really underpins that valuation gap? The narrative leans on persistent revenue growth, firmer margins and a future earnings multiple that might surprise you.

Result: Fair Value of $24.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, economic uncertainty and rising credit costs could squeeze margins, challenge loan growth and quickly narrow the current valuation discount investors are eyeing.

Find out about the key risks to this First Horizon narrative.

Another Angle: Valuation Looks Stretched on Earnings

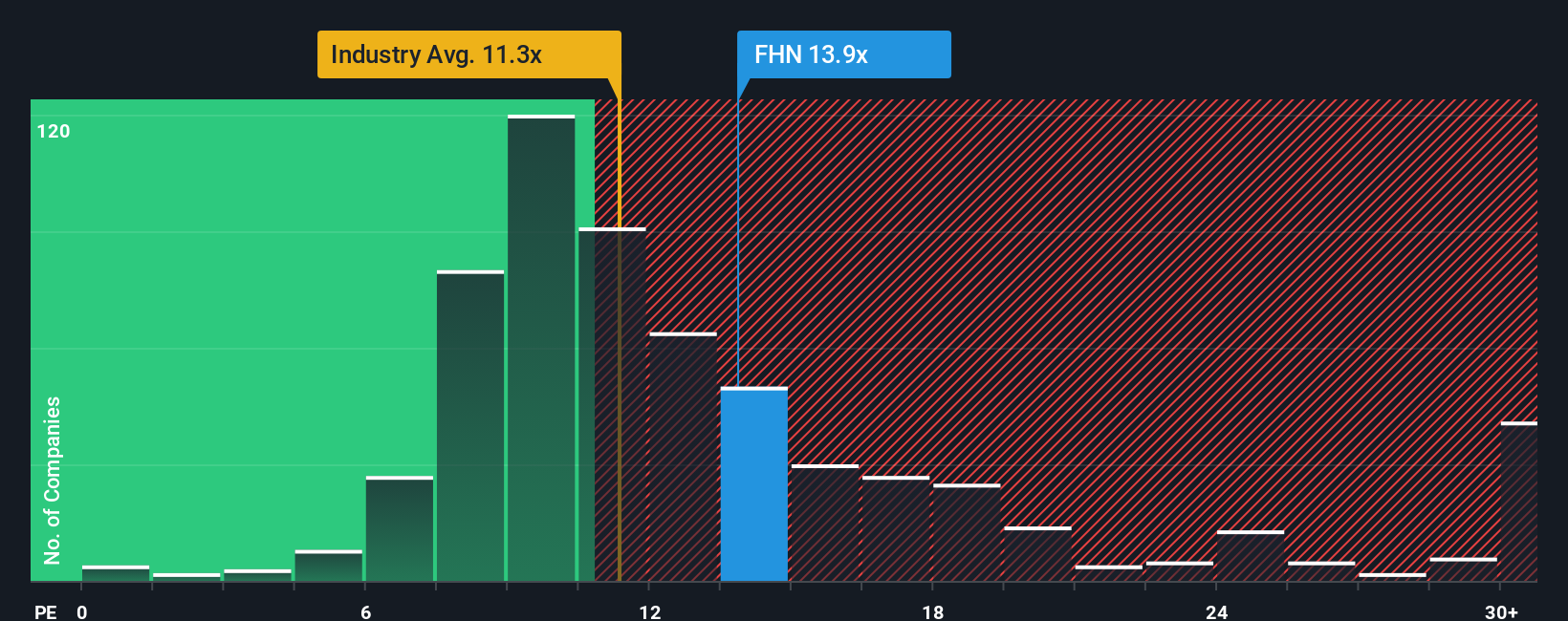

While the narrative points to upside, the earnings lens tells a tougher story. First Horizon trades on a P/E of 13.1x, above the banks industry at 11.5x, peers at 10.7x and even its own fair ratio of 12.6x. This suggests less margin of safety than headline discounts imply.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Horizon Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized view in minutes with Do it your way.

A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next opportunity?

Do not stop at one idea when you can quickly compare many. Use the Simply Wall Street Screener to uncover fresh, data backed opportunities tailored to your strategy.

- Capture early stage momentum by scanning these 3573 penny stocks with strong financials that already show real financial strength instead of just speculative hype.

- Power up your growth watchlist by targeting these 25 AI penny stocks at the heart of machine learning, automation and next generation software.

- Identify value focused prospects by filtering for these 915 undervalued stocks based on cash flows where market prices still trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal